Let me address one thing up front: There will be no prediction of a market crash in this article.

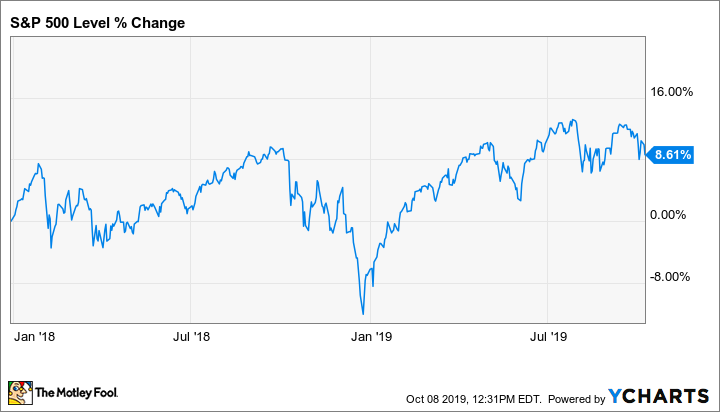

All of the clamorings among market pundits calling for the next recession makes my contrarian instincts kick in. After all, we already had a mild — but nonetheless noteworthy — 20% tumble during the fourth quarter of 2018.

Nevertheless, calling the next economic crisis “difficult to predict” is an understatement. The next bout of mass hysteria could be right around the corner. Adding some defensive plays to your portfolio is never a bad idea — although defensive stocks aren’t completely exempt from economic turmoil.

Three stocks that look poised to keep chugging along no matter what the future holds are Walmart (NYSE:WMT), Nestle (OTC:NSRGY), and Enbridge (NYSE:ENB).

1. Walmart: starting with the most basic of basics

Does it really need any introduction? In spite of years of headlines touting the rise of online retailing led by Amazon, Walmart remains top dog in the industry and a basic staple for hundreds of millions of consumers.

Trailing 12-month sales were $518 billion through the first half of 2019, more than double what Amazon put up (and which includes a lot of other tech-related revenue besides retail).

Walmart has done quite a bit to upgrade its digital chops in recent years and this effort helped the company’s sales reaccelerate to the fastest pace in over a decade. The company has also been busy investing in international markets. It purchased leading Indian e-commerce company Flipkart, for example.

While it certainly helps the investment thesis, this alone isn’t the reason to own Walmart stock if digging in for rough times is your goal.

During times of economic upheaval, everyone still needs to buy necessities: household goods, food, etc. Value is king, and Walmart provides it via its website, app, delivery service, and traditional stores. It wasn’t completely smooth sailing, but investors who bought in before the 2008 financial crisis enjoyed rising revenue, earnings, and share prices. Not a bad way to begin making doomsday portfolio preparations.

2. Nestle: the world’s largest food company

Speaking of basic staples, Nestle is another source of them. Food stocks tend to outperform the broader market during declines — everyone needs to keep eating — and the Swiss company is the biggest in the business. At the midpoint of 2019, trailing 12-month sales were $93 billion and market cap is currently $312 billion.

Perhaps best known for its candy and chocolate brands here in the U.S., Nestle is much more than that. It’s a huge coffee provider, too. Nescafe is the world’s largest coffee brand, and Nestle distributes Starbucks retail products around the globe. It also plays in the packaged food industry, supplies restaurants, makes baby food, health and wellness products, and pet food. The business is a juggernaut, providing virtually every American household with something it needs.

As with Walmart, Nestle struggled during the last recession and revenues took a step back. However, earnings grew as the company managed its expenses and supply mix, and the stock returned a hefty sum by the time the crisis was all said and done. There’s no guarantee things will be a breeze, but Nestle should do just fine, no matter what’s in store for the global economy.

3. Enbridge: keeping North America warm and moving forward

By no means a household name like Walmart and Nestle, Enbridge is nonetheless an integral part of everyday life. The Canadian energy infrastructure company is the largest pipeline and oil and gas delivery stock there is. Its services provide energy for everything from home heating and transportation fuels to refined products used to manufacture plastics.

While energy use tends to decline with lower economic activity, there’s still a floor. Energy consumption is a basic need, so the downside will be limited to more discretionary areas of the economy. Plus, Enbridge isn’t exposed to energy prices the same way an oil and gas producer is; its concern is the transport of energy, not the selling of it. That toll-booth-like model also provides some added stability if things start heading south. A dividend currently yielding 6.5% a year doesn’t hurt, either.

Granted, it’s worth noting that Enbridge has taken on higher debt in recent years to consolidate some of its partnership businesses into outright subsidiaries, creating some extra risk inherent with financial leverage. However, the company generates ample cash, has been using it to reduce that debt, and it expects to fund future projects without outside financing for the foreseeable future. However, the high debt load isn’t an unusual operating model for a business of this kind. Besides, the company has a record of stability in difficult times. Like Walmart and Nestle, Enbridge also did quite well during the last crisis.

Times are uncertain, and worry over another stock market collapse has reached a fever pitch this year. The news is concerning, but it’s no reason to stop investing. These three stocks are proof that money can still be made, even in the worst investing environments.