U.S. equities ended the day near where they started as investors failed to find a catalyst to lift the benchmark stock index to an all-time high. The dollar sank and Treasuries rose amid a slew of fresh monetary-policy decisions.

The S&P 500 Index closed little changed, within 1% of a record, as gains in software companies offset losses for carmakers. After getting a boost from positive comments on trade by White House economic adviser Larry Kudlow early in the day, equities took a leg down after a report about a U.S. official threatening steeper tariffs against China. The yen, pound and Swiss franc led Group-of-10 currency gains after their respective central banks left borrowing rates unchanged.

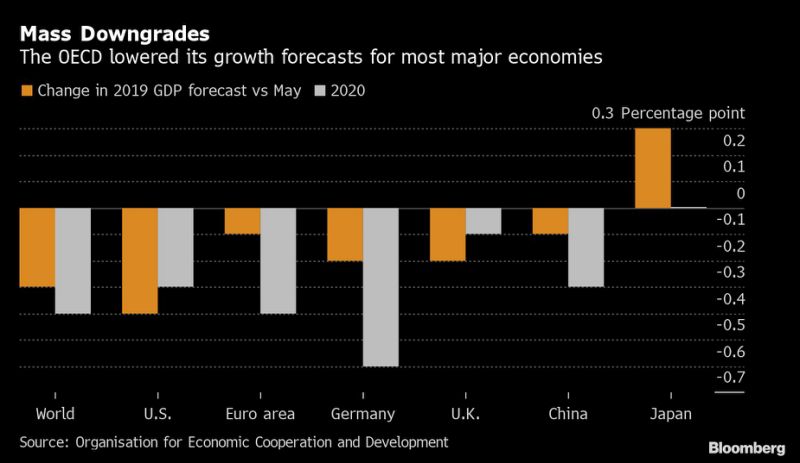

The slate of monetary policy decisions, hot on the heels of the Federal Reserve’s interest-rate cut Wednesday, comes just as the OECD cut its world growth forecast to 2.9% from 3.2% as intensifying trade conflicts take a toll on confidence. Investors continue to focus on the outlook for negotiations between the U.S. and China as trade deputies from both nations meet.

Elsewhere, banks pushed the Europe Stoxx 600 higher. Treasuries advanced while European government bonds slipped. Shares fell in Hong Kong and nudged up in Shanghai. China’s yuan dropped as traders weighed the odds of the People’s Bank of China lowering borrowing costs. Australia’s dollar slumped after the unemployment rate rose.

Oil gained amid contrasting reports about whether Saudi Arabia asked Iraq for crude to supply its domestic refineries.

These are some key events to keep an eye on this week:

Friday is quadruple witching day for U.S. markets. When the quarterly expiration of futures and options on indexes and stocks occurs on the same day, surging volatility and trading can follow.