With the calendar flipped to February, we have moved solidly into the heart of earnings season. And while quarterly earnings updates don’t generally change the story very much for most companies, it does give investors an opportunity to learn a little bit more about how business is going, as well as how a company is being affected by industry and general economic trends.

Furthermore, for companies in transition, each quarterly update is an opportunity to get a more complete picture of the company’s efforts to move in a new direction, right the ship, or otherwise improve the business.

And there are three stocks relatively high on my radar to watch this month. The first one, Chipotle Mexican Grill (NYSE:CMG), certainly qualifies as a company in the midst of a turnaround. The second is renewable-energy producer Brookfield Renewable Partners (NYSE:BEP), which isn’t in a turnaround but is in the process of rotating out some of its less-productive assets and redeploying the proceeds into higher-return assets. Third is Chart Industries (NASDAQ:GTLS), a manufacturer that has spent much of the past few years restructuring its business and dealing with turnover in the executive suite.

For investors looking to maximize their long-term profits, these three companies offer compelling opportunities. Keep reading to learn what I’m looking to learn about them this month.

Can Chipotle reverse its traffic trend?

Based on the stock’s chart over the past year, it’s easy to assume Chipotle has finally turned things around:

The burrito-selling giant’s earnings support the idea that it had a strong turnaround year — at least through the first three reported quarters. Third-quarter sales were up 8.6%, an acceleration from the 8.1% combined growth through the first nine months, while earnings per share were up 12% on improved margins and higher sales. Adjusting for some non-recurring items, earnings would have grown almost 40%.

A big part of the company’s success in 2018 has been the recovery of its same-store sales — also called comps — which measures sales at restaurants that have been open at least 13 months. Comps surged 4.4% in the third quarter, lifting year-to-date comps above 3%.

That’s fantastic. With one minor issue: Chipotle’s recent comps growth has been entirely driven by higher prices and increased add-on item sales, not more orders. Management said comparable transactions actually declined 1.1% in the third quarter. To put it another way, the numbers indicate Chipotle isn’t attracting new customers.

But there’s a ray of sunshine, too. After falling more than 2% in the first half of the year, transaction comps have steadily improved each of the past few quarters, and my expectation is that we should see a reversal of this trend soon — hopefully as soon as in the fourth quarter, which Chipotle will report on Feb. 6.

Flipping the switch back to growth

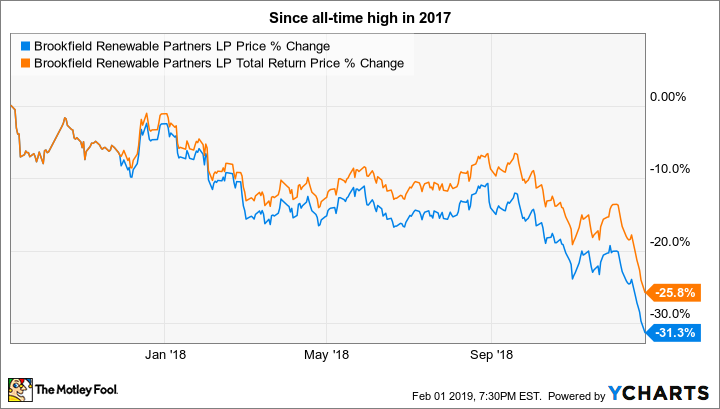

Renewable-energy producer Brookfield Renewable Partners has a wonderful long-term track record of delivering double-digit returns most years. But investors didn’t enjoy that success in 2018; to the contrary, the 26% decline in its unit price was the worst by far it’s done in a decade, and was only the third negative year over that period. Even when factoring in its generous dividend, investors still lost 21% in 2018.

And while it isn’t the case of a business that’s struggling, Brookfield Renewable has undergone some changes over the past year or so that did keep it from delivering the kind of cash flows growth investors had become accustomed to. As a matter of fact, funds from operations (FFO) fell 10% in the second quarter, and its hydroelectric business, which makes up about three-fourths of FFO generation, has generated about 10% less FFO in 2018 than the year before because of reduced rainfall.

At the same time, it’s in the midst of a pretty large “capital recycling” effort, having sold off — or in the process of selling — $850 million in lower-return assets, with plans to opportunistically reinvest that capital into renewable assets with higher returns and better growth profiles. The catch is, those opportunities sometimes take a while to come along, and Brookfield Renewable’s cash flows can take a temporary hit. This is part of what has spooked investors over the past year.

The good news is its solar and wind investments more than made up the weaker hydro results in the third quarter, and my expectation is that investors will see more of the same when the company reports fourth-quarter results on Feb. 8. With shares still down 19% from the all-time high in late 2017 and the dividend yield of 6.7% well above the long-term average of around 5.5%, it still represents an incredible value.

New management, same results

Cryogenic gas processing equipment maker Chart Industries has had one heck of a run over the past few years. Since bottoming out in mid-January 2016, its shares have been anything but ice-cold:

This big surge has mainly been due to a well-executed plan to lower costs, better leverage Chart’s core capabilities, and identify and acquire businesses that make it more competitive. In short, management has done quite a good job of doing what it intended.

What’s most incredible is that Chart has done it under three different CEOs, at least three different CFOs, multiple COOs, and a revolving door of lower-level executives. To put it plainly, it’s hard enough to restructure a business when leadership remains intact; most companies that go through that kind of executive change are complete disasters.

I think the key is that Chart’s board has done an admirable job of making sure each person assuming the CEO role was looking to continue execution of the existing strategy, not change direction, and much of the change in its executive ranks was started by the relocation of its headquarters from Ohio to Georgia, and the retirement of its longtime CEO in 2017. Furthermore, each of its new CEOs since then was an internal promotion, not an outsider, and I think that’s made a difference in the continuity of Chart’s execution.

When Chart reports on Feb. 14, investors will get an update on both the state of its current business and its progress toward closing a deal which will greatly increase its footprint in Europe. As global investments in LNG continue to ramp up, Chart’s new lean, focused business is prepared for even bigger profits in the future.