Amazon Business, which sells bulk items to business customers, has shelved its plan to sell and distribute pharmaceutical products after considering it last year, according to people familiar with the matter.

Instead, the company is focused on selling less sensitive medical supplies to hospitals and smaller clinics through Amazon Business — and it has found that business to be more challenging than expected.

The setback illustrates the challenges of getting into the medical supply and pharmaceutical space, even for a company as big as Amazon. Several health-care and pharmaceutical distribution companies saw their stock take a nosedive following recent reports of Amazon potentially getting into the space, but it will likely take some time before those concerns turn into real threats.

The change in plan comes partly because Amazon has not been able to convince big hospitals to change their traditional purchasing process, which typically involves a number of middlemen and loyal relationships.

Moreover, Amazon would also need to build a more sophisticated logistics network that can handle temperature-sensitive pharmaceutical products, according to these people.

Still, Amazon hasn’t completely ruled out getting into the pharma distribution space eventually. Multiple reports have speculated that the company will someday add a direct-to-consumer prescription drug business. Amazon Business could also reconsider getting into the pharma space once it gains more scale, multiple people said.

Meanwhile, the company continues to explore other health-care projects through different teams across the company, including Alexa and the secretive Grand Challenge team, sometimes referred to as “1492.”

Shares of pharmacies and drug distributors, including Cardinal Health, CVS, McKesson and Walgreens, spiked on the news.

Harder than expected

Amazon has been selling medical products like glucometers, gloves and stethoscopes to medical clinics for several years. It now has the necessary licensing in 47 out of 50 states and the District of Columbia, according to its website.

But Amazon has struggled to land contracts with large hospital networks, despite convening an advisory board that includes major hospital executives, according to two people familiar. These groups of hospitals have long-standing contracts with distributors, like Cardinal Health and McKesson. Many hospitals also own a stake in entities called group purchasing organizations that negotiate on their behalf, leveraging their collective negotiating power.

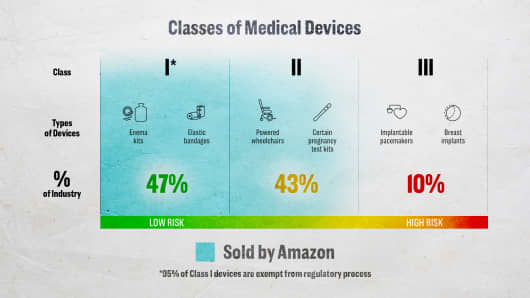

In addition, Amazon isn’t yet selling products considered high risk, known as “Class III” devices. For instance, it’s not selling anything that needs to be implanted into the human body and sustains life, like a pacemaker. Some large hospitals have been reluctant to move over to Amazon in part because it lacks these products.

An Amazon spokesperson told CNBC: “As we’ve developed Amazon Business, we’ve used our working-backwards methodology for consumers and applied it to the needs of business customers and sellers. One of the ways we do this is convening advisory boards from across the industry to give us feedback so we can continue innovating on behalf of customers.”

The health-care supply chain is well-entrenched and will be hard to break into, according to one expert. “The hospital and health-care systems have entangling alliances with their existing purchasing and supply chain partners,” said Tom Cassels, head of strategy and business development at Leidos Health. “It’s very difficult to replicate the Amazon buying experience in health care,” he said.

For now, the sweet spot for Amazon Business in health care is smaller practices, such as dental offices, free-standing ambulatory surgery centers and small physician practices, where the licensed providers appreciate the convenience and affordability.

Even then, several of the physicians interviewed by CNBC said they were sticking with their existing distributor for most supplies, but relying on Amazon for some items, or in emergencies.

Amazon told CNBC that it serves health practices of all sizes: “Amazon Business serves healthcare customers of all sizes, from large IDNs [integrated delivery networks, meaning systems that provide both medical services and a health insurance plan to patients] to small- and medium-sized community hospitals. We also serve customers from physician and dental offices to senior living and long-term care facilities.”

No ‘Cold Chain’

Another major barrier to entry has been Amazon’s warehouse and logistics infrastructure, which is not set up to store and deliver temperature-sensitive pharmaceutical products.

Many biopharma companies require their products to be stored and shipped in a tightly controlled supply chain system. For example, some products have insulation and need to be stored in a warehouse that can provide an ice-cold environment.

Amazon’s current logistics network doesn’t offer this type of sophistication. Today, some Amazon sellers that sell temperature-sensitive products use a customized delivery process, according to several people familiar with the company.

This part of the supply chain, called “Cold Chain,” would be costly to build out for Amazon.

Pharma products that require refrigerated storage and transport were worth around $283 billion as of 2017, and the segment is expected to grow 70 percent by 2021, according to Pharmaceutical Commerce.

“You can’t use FedEx or UPS trucks for delivery of these products,” said a seller of a health-care product on Amazon, who declined to be identified out of concerns it would jeopardize his relationship with Amazon. “It would be a massive undertaking [to build the infrastructure].”