Stock Markets

Markets were generally down for the week. The Dow Jones Industrial Average (DJIA) slipped by 0.16%. All sectors were down although the utility average bucked the trend and climbed by 1.39%. The S&P 500 Index descended by 1.21% while the Nasdaq Stock Market Composite slumped by 2.62%. The NYSE Composite fell by 1.37%. Meanwhile, the CBOE Volatility Index, which is the popular measure of stock market volatility based on the S&P 500, increased by 5.48%. The market drop was fueled by recession worries due to high inflation, supply bottlenecks, and expected Federal Reserve rate hikes. The negative returns for the week could also be seen as the market technically retracing from the strong gains of the preceding week. A sharp decline in the stock price of Facebook parent Meta Platforms dragged the S&P 500 Index down more than the other indexes.

U.S. Economy

On Thursday, St. Louis Fed President James Bullard voiced the question on everybody’s mind as to whether inflation has already really peaked despite the sudden downturn in the year-over-year CPI from 9.1% in June to 8.5% in July. Bullard called attention to the lack of statistical confirmation at this point, hinting that the Fed may again vote in favor of another 75-basis-point (0.75 percentage point) increase in the federal fund target rate at its next policy meeting. Other economic data that emerged this week showed that household finances may be a source of optimism. The economy is slowing, which was the intended effect of the rate hikes.

Personal consumption accounted for 70% of GDP, indicating that consumption holds the key to the path forward for the economy. The underlying retail sales, excluding auto and gasoline sales, increased by a healthy rate of 0.7% month-over-month. Online sales rose sharply while restaurant sales noticeably increased, projecting a balance between goods and leisure spending. The lower food and gasoline costs appeared to prompt consumers to redirect their purchasing power towards discretionary items instead of reducing their spending altogether. This is a healthy indication that there is further upside in consumption to move the economy forward.

Initial jobless claims registered at 250,000 this week, which is a downtick from the reading of the week before. While it is still historically healthy, it is 50% above the lows in March, reflecting some deterioration in employment conditions. It should be noted, however, that March figures were at all-time lows, so this week’s figures may still be seen as a return to historically normal levels. Caution should be taken as a material increase in initial jobless claims is an indicator of an emerging labor-market softness. It is worthy to note that the unemployment figure has actually declined during this same time.

Metals and Mining

Gold has declined for the last five trading days. Gold opened on Monday, August 15, at approximately $1,816 per ounce and registered strong price declines throughout the week. While the price declines were significant, they were not rare or historically unusual. On the other hand, the gains in the dollar index this week were rare and significant. In percentage terms, gold experienced a larger percentage drop than what the dollar gained. In just one week, the dollar index opened at 98.46 and closed at 103.48, advancing strongly by 502 points. Recall that gold prices are based on two primary underlying factors, dollar strength (or weakness) and traders bidding the precious metal higher or lower. Thus for this week, out of gold’s 3.86% decline, 1.65% is attributable to market players actively selling gold, and 2.21% to the dollar’s strength. It is generally accepted that gold and the dollar are in direct competition as a haven asset during times of economic uncertainty. Also, when the Fed raises interest rates, this weighs on the dollar which does not yield any interest. For this week at least, market participants are focused on further interest rate hikes rather than on the current level of inflation.

For this week, Gold began at $1,802.40 and ended at $1,747.06 per troy ounce, for a decline of 3.07%. Silver, which closed the week prior at $20.82, closed this week at $19.05 per troy ounce, losing 8.50%. Platinum dipped by 6.85% from the earlier week’s close at $965.33 to this week’s $899.21 per troy ounce. Palladium slid from $2,224.95 to $2,129.59 per troy ounce, declining by 4.29%. The three-month LME prices for base metals also took a hit for the week. Copper, which closed the previous week at $8,091.50, ended this week at $8,078.50 per metric tonne for a decline of 0.16%. Zinc began at $3,589.00 and closed this week at $3,487.50 per metric tonne for a loss of 2.83%. Aluminum closed last week at $2,434.50 and this week at $2,386.00 per metric tonne, sliding by 1.99%. Tin began at $25,177.00 and closed this week at $24,795.00 per metric tonne for a price attrition of 1.52%.

Energy and Oil

Oil prices began the week with a sudden plunge on week Chinese economic data and rumors that an Iranian nuclear deal may soon be finalized. Worries were alleviated for bullish oil market participants when large U.S. stock draws materialized across the oil and products spectrum, easing speculation of domestic demand destruction. U.S. refiners argued that there is little sign of demand destruction and that inventories are still below their optimal state. The refiners are expected to maximize their refinery runs over the upcoming weeks. Analysts are expecting a nationwide average of 94%, in line with second-quarter forecasts. As a result, WTI and Brent prices both experienced a strong bounce back.

Natural Gas

During the report week, from August 10 to August 17, 2022, the Henry Hub spot price ascended from $7.89 per million British thermal units (MMBtu) at the start of the week, to $9.51/MMBtu by the week’s end, for an increase of $1.62/MMBtu. Regarding futures, the price of the September 2022 NYMEX contract increased by $1.042, from $8.202/MMBtu to $9.244/MMBtu for the week. The price of the 12-month strip averaging September 2022 through August 2023 futures contracts rose by $0.813 to $7.545/MMBtu. Domestic natural gas spot prices rose at most locations during this report week. International futures prices for liquefied natural gas (LNG) cargoes in East Asia on average increased by $5.33 to a weekly average of $49.94/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas spot market in Europe, increased by $5.92 to a weekly average of $65.07/MMBtu.

World Markets

Stock markets across Europe pulled back due to renewed concerns that central banks will aggressively tighten their monetary policies to rein in persistently high inflation. The pan-European STOXX Europe 600 Index closed the week lower by 0.80% in local currency terms. France’s CAC 40 Index dipped by 0.89%, Germany’s DAX Index declined by 1.82%, and Italy’s FTSE MIB Index slumped by 1.90%. The UK’s FTSE 100 Index, however, bucked the trend by adding 0.66% due to the depreciation of the UK pound against the U.S. dollar. Weakness in the pound tends to raise the index since most of the listed companies are multinationals earning revenues overseas. Higher dollar revenues will fetch higher corporate earnings in terms of the pound sterling. The core eurozone government bond yields ascended in response to a double-digit increase in UK consumer prices. Also driving the increase in yields was a comment by European Central Bank (ECB) official Isabel Schnabel that inflation may rise further in the near term. Peripheral eurozone and UK government bond yields followed the trend of core markets.

Japan’s shares rose solidly through the first half of the week in reaction to the release of positive U.S. economic data. This bolstered expectations that the Federal Reserve may be less aggressive in its monetary policy and will not raise interest rates too high in the coming months. Japanese equity markets rallied on Wednesday despite mixed domestic economic news and weak data emerging from China that stoked worries that global growth may slow down. Both the Nikkei 225 Index and the TOPIX breached the psychological resistance levels of 29,000 and 2,000, respectively. However, by midweek, the optimism began to recede after the minutes from the U.S. Fed’s July meeting were released, pointing to a prolonged retention of high interest rates. The minutes reaffirmed that the Fed planned to continue raising interest rates in attempting to return inflation to its long-term objective of 2% (the July inflation rate figure was at 8.5%). This resulted in Japanese stock markets closing notably lower on Thursday. The yen weakened from its previous level of JPY 133.5 per USD to JPY 136.7 per USD. On the bond market, the benchmark 10-year JGB yields inched higher during the week, from 0.184% to 0.191%.

China’s stock markets also declined for the week in response to weak economic data and elevated levels of COVID cases, exacerbated by drought conditions in parts of the country. The broad, capitalization-weighted Shanghai Composite Index slipped 0.6% while the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, dipped by 1%. July’s retail sales data released during the week indicated that it grew by 2.7% year-on-year and that industrial output was 3.8% higher than one year ago. Both indicators were lower than expected, however. Data on the property sector showed that China’s home prices fell for an 11th straight month in July. Regarding COVID infections, this was the worst seven-day period in China since mid-May as more than 18,000 new local cases were recorded. A national drought alert was also issued by the government as rising temperatures threatened crops and industrial activity in certain regions of the country. The severe heat wave has sparked power shortages and forest fires. The 10-year Chinese government bond yield fell sharply after the People’s Bank of China (PBOC), China’s central bank, unexpectedly cut a key interest rate due to July’s disappointing economic data. In the meantime, the yuan hit a three-month low versus the U.S. dollar as the currency reacted to soft economic data and tracked the PBOC’s weakened midpoint guidance.

The Week Ahead

Personal income and consumption, jobless claims, and inflation are among the important economic data expected to be released in the coming week.

Key Topics to Watch

- Chicago Fed national activity index

- S&P U.S. manufacturing PMI (flash)

- S&P U.S. services (flash)

- New home sales (SAAR)

- Durable goods orders

- Core capital equipment orders

- Pending home sales index

- Initial jobless claims

- Continuing jobless claims

- Real gross domestic product revision (SAAR)

- Real gross domestic income (SAAR)

- Real final sales to domestic purchasers, revision (SAAR)

- PCE price index monthly

- Core PCE price index monthly

- PCE price index year-over-year

- Core PCE price index year-over-year

- Real disposable incomes

- Real consumer spending

- Nominal personal incomes

- Nominal consumer spending

- Trade in goods, advance

- UMich consumer sentiment index (final)

- UMich 5-year inflation expectations (final)

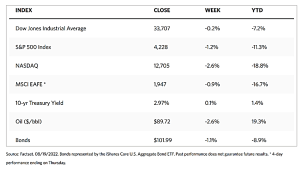

Markets Index Wrap Up