Stock Markets

Fears concerning the possible fallout from the omicron variant of the SARS Cov-2 virus appear to have calmed down during the week as markets rebounded decisively, reversing two weeks of losses. The S&P 500 charted its best weekly gain since early this year, as most of the benchmark indices trod close to their record highs. The S&P MidCap 400 Index touched a new peak on Friday, hinting at a possible surge in the coming week. Driving much of the rally were information technology stocks, with Apple recording solid gains to push its market capitalization close to $3 trillion. This cements Apple’s reputation as the world’s most highly valued public company. The financial sector and utilities underperformed the rest of the market but still posted solid gains. The market was taking its cue from the announcement last week by Dr. Anthony Fauci, the U.S. president’s chief medical advisor, that the omicron variant does not appear to have “a great deal of severity,” even as the Centers for Disease Control and Prevention (CDC) commented that U.S omicron cases have been mild.

U.S. Economy

The week’s economic news also helped to significantly bolster investor sentiment. The Labor Department reported on Thursday that 184,000 Americans applied for unemployment benefits the week before. This is the lowest number of people to have done so since 1969. The number of open jobs in the U.S. rose to 11 million, much more than anticipated, mostly accounted for by accommodation and food services. A decades-high inflation rate was also noted. On Friday, the year-over-year November consumer price index was reported at 6.8%, the highest since 1982. Part of the reason lies in the rising energy costs, although overall the increase in inflation rate was broad-based. Excluding food and energy, the core rate rose 4.9%, suggesting that principal causes could also be traced to supply chain issues and wage pressures. The tally, however, shows that both these components were generally consistent with expectations.

The Fed Chair, Jerome Powell, provided some indication that the coming monetary policies may assume greater restriction. Powell suggested that the word “transitory,” which was consistently used to describe the current inflationary push, be omitted, acknowledging by implication that inflation will become more persistent and should no longer be perceived as temporary. He also implied that the anticipated tapering of asset purchases may be advanced a few months sooner than previously planned. Such a move was perceived to make sense to allow some flexibility for when the FOMC could begin raising rates. This is a move that would be inevitable should inflation continue to remain stubbornly high. The same idea was expressed by other Fed governors during the week, suggesting the likelihood of its impending announcement.

Metals and Mining

According to some of the biggest international banks, gold is soon to experience renewed investor demand as inflation becomes increasingly regarded as more than transitory. Inflation is shaping up to be the most important economic challenge as 2022 approaches. On Friday, the announcement of a jump in the Consumer Price Index to an annualized 6.8% drew attention as the highest inflation reading in 39 years, signaling an even higher trajectory to possibly peak in the first semester before moving gradually down. Some analysts and economists see that there remains some headroom for further movement. What all of this means is that gold will continue to attract investors seeking to protect their wealth and purchasing power in an environment of growing uncertainty and risk.

Gold hardly moved over the past week as investors sought cues from a market of conflicting signals – the encouraging news of a mild omicron virus versus the persistent increase in the inflation rate. Gold lost 0.03% while silver slid by 1.42%. Palladium sank deeper 2.92%, although platinum bucked the trend to rise by 1.01%. The base metals were also mixed. Copper gained 0.94% and zinc went up 5.28%. Tin inched up 0.17%, but aluminum dipped by 0.63%.

Energy and Oil

The oil markets gained some breathing space last week with the welcome news that the Omicron variant of COVID-19 is a mild infection that will not likely cause any major disruption in the global economic recovery currently underway. Demand remains largely stagnant at present while global crude inventories are still lower than the five-year average, keeping Brent marginally above the $75 per barrel price, and WTI at $72 per barrel. Covid aside, there are still some concerns that may keep global demand down, such as the lackluster air traffic activity in China and elsewhere in the world where travel restrictions are still effective. There is also the possibility of bankruptcies of large-scale Chinese property companies such as Evergrande and Kansa that may pull the market southward if they materialize. At the other extreme is what appears to be the start of a bullish situation in the U.S. resulting from soaring inflation, which is balancing off the negative sentiment. Although the anticipated Strategic Petroleum Reserve (SPR) release is still assumed to materialize by January to April 2022, the U.S. strategic crude inventories have already descended to 600 million barrels in the past week, the lowest level since May 2003. Even now, there is widespread speculation that the U.S. may enact an oil export ban because of the dwindling domestic reserves and the increased export outflows, but the Biden administration has stated that a ban is not considered as an option for the time being.

Natural Gas

During the report week December 1 to December 8, the Henry Hub spot price dropped from $4.23 per million British thermal units (MMBtu) to $3.79/MMBtu. The international gas prices remain close to their record highs, with swap prices for liquefied natural gas (LNG) cargos in East Asia for the rest of December averaging $35.06/MMBtu for the week, down by $1.41/MMBtu, lower than last week’s average of $36.57/MMBtu but still the second-highest weekly average since January 2020. The prices along the Gulf Coast fell due to lower heating demand expectations, while Midwest prices also fell, then rose, responding to lower-than-normal temperatures across the region. Prices in the West also rose due to colder-than-normal weather, but also because of the impaired capacity on the pipelines delivering natural gas to Southern California. In the Northeast, prices rose due to a winter storm traversing the region. The U.S. supply of natural gas decreased slightly while consumption remained unchanged for the week and U.S. LNG exports increased week-on-week,

World Markets

Mirroring the U.S. European shares rebounded from their previous slump as concerns about the impact of the Omicron variant on the world economy abated. The pan-European STOXX Europe 600 Index closed the week higher by 2.76%, with France’s CAC 40 Index up 3.34%, Italy’s FTSE MIB Index up by 3.02%, and Germany’s Xetra DAX index also up by 2.99%. The UK’s FTSE 100 Index ascended 2.38%. Core eurozone bond yields also climbed in response to indications from Pfizer and BioNTech that their booster shot may be effective against the Omicron variant. This calmed fears about the likely economic repercussions of another covid spike, thereby contributing to the surging yields. There was a subsequent pullback on the yields, however, when speculations spread that the European Central Bank may raise asset purchases through its standard Asset Purchase Program when its emergency purchases are concluded in March 2022. UK gilt yields ended higher when the UK government announced the resumption of a new round of coronavirus restrictions. In response, the market moderated its expectations for potential interest rate increases.

The bourses in Japan made headway during the week as the Nikkei 225 Index gained 1.46% and the broader TOPIX Index advanced 0.90%. As in other global markets, concerns about the impact of another covid variant were brushed aside. So, too, did Japan appear to discount the downgrade to its third-quarter economic growth. In his policy speech to parliament, Prime Minister Fumio Kishida outlined his administration’s vision to usher in a new era in Japan, focusing on areas such as digitalization opportunities, climate change mitigation, and strengthening the start=up ecosystem. The yield on the 10-year Japanese government bond remained unchanged at 0.05%, while the yen weakened against the U.S. dollar to about 113.6 from 112.8 week-on-week as it remained vulnerable to expectations of further policy tightening by the U.S. Federal Reserve.

In China, the stock markets recorded weekly gains after the central bank reduced the reserve requirement ratio for banks. Inflation concerns also eased with the calming of the November factory gate inflation. The CSI 300 Index ascended 3.1% and the Shanghai Composite Index rose 1.6%. Nevertheless, concerns about the likelihood of defaults in the property sector and the withdrawal of additional U.S.-listed Chinese companies reined back sentiment after Didi Global, the ride-hailing app, indicated that it would delist from the New York Stock Exchange earlier this month. Yields on the country’s 10-year government bonds dipped to 2.861% from 2.926% the week earlier. Regarding currencies, the renminbi tested a five-year high of 6.3649 against the U.S. dollar on Friday after a weaker-than-expected midpoint was set by the People Bank of China (PBOC). The value of the renminbi is permitted by the central bank to rise or fall 2% against the U.S. dollar from an official midpoint rate it sets daily.

The Week Ahead

The PMI composite, Retail Sales growth, And the Fed Funds rate are among the important economic data to be released in the coming week.

Key Topics to Watch

- NFIB small business index

- Producer price index

- Retail sales

- Retail sales excluding autos

- Import price index

- Import price index excluding fuels

- Empire State manufacturing index

- NAHB home builders’ index

- Business inventories

- Federal Reserve FOMC announcement

- Jerome Powell press conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Building permits (SAAR)

- Housing starts (SAAR)

- Philadelphia Fed manufacturing index

- Industrial production index

- Capacity utilization

- Markit manufacturing PMI

- Markit services PMI

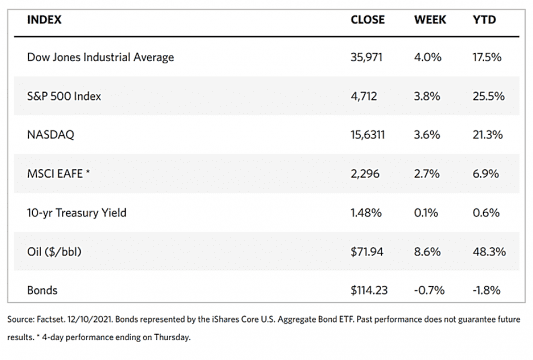

Markets Index Wrap Up