Goldman Sachs sees the U.S. labor market maintaining its momentum well into 2022.

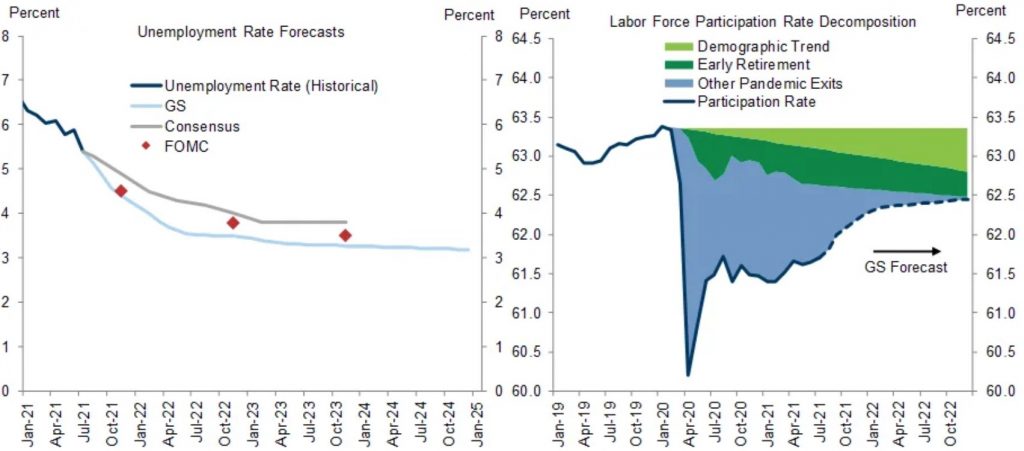

Economists at the firm led by Jan Hatzius lowered their year-end 2021 unemployment rate forecast slightly to 4.1% on Monday. For 2022, Hatzius and his team projects a 3.5% unemployment rate. If achieved, the unemployment rate would be at a 50-year low as the economy powers back from the COVID-19 pandemic.

Employment at those levels in 2022 would bring the economy to full employment, Hatzius says.

“We expect further solid job gains in the rest of the year. One reason is that labor demand remains very strong. We also see further scope for fairly quick job gains from additional reopening, the expiration of federal unemployment benefits, and the return of in-person school,” explains Hatzius.

The bold call from Goldman arrives after a considerably strong read on the labor marker for July.

The U.S. economy created 943,000 jobs in July, the most growth since August 2020. Job growth was also upwardly revised for May, coming in at 614,000 versus the 583,000 previously reported. For June, jobs saw an upward revision to 938,000 from 850,000. The unemployment rate for July ticked down to 5.4% from 5.9% in June.

Stocks cheered the news, despite the strong report and upward revisions likely meaning the Federal Reserve will begin tapering bond purchases sooner rather than later.

“Suffice it to say, cyclical momentum remains strong despite the peak growth hysteria sweeping through Wall Street. Our forward proxies for earnings estimates growth and capital spending trends still point to above-trend growth. July payrolls improved for the second month in a row, as the supply side impediments previously holding back job gains appear to be easing,” said Michael Darda, MKM Partners chief economist and strategist.

Nevertheless, the economy is still trying to recoup millions of jobs lost since the start of the pandemic. On net, the economy has shed 5.7 million payrolls since March of last year, with much of this deficit still present in the leisure and hospitality industries. These employers shed a total of nearly 2 million jobs since the pandemic first brought about shutdowns across the U.S.

Remarked Bleakley Advisory Group Chief Investment Officer Peter Boockvar, “Bottom line, after losing 22.4 million jobs in March and April 2020, we’ve since recovered 16.7 million of them.”