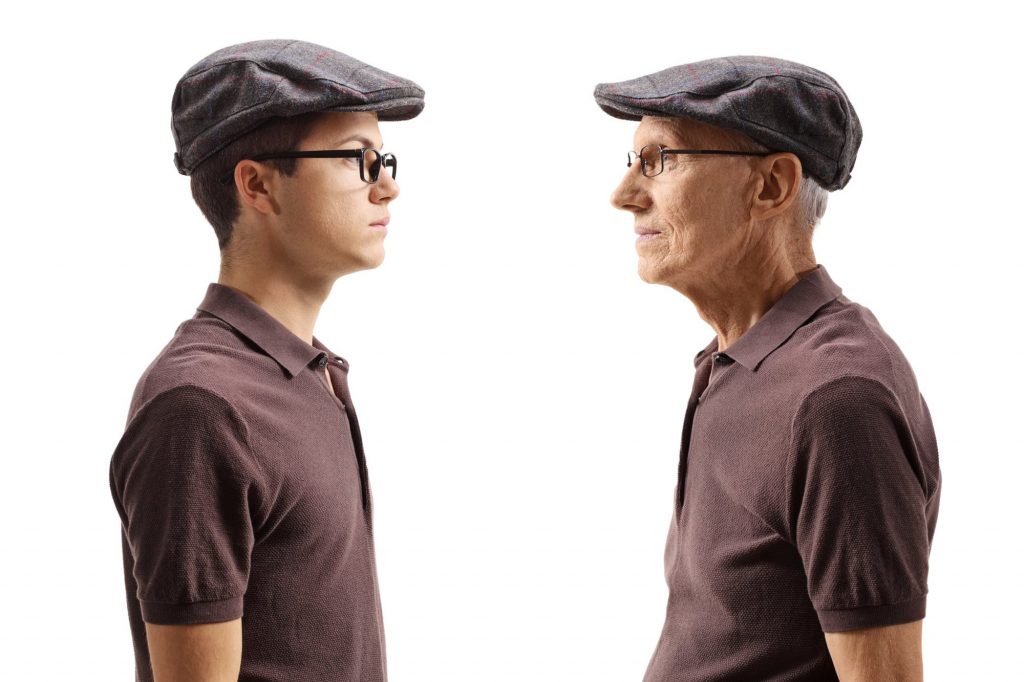

If you’ve ever taken the time to speak to retirees about their lives, you know they can have some great stories and sometimes great advice about everything from relationships to money. A recent Principal study asked retirees to share some of the financial advice they wish they could give to their younger selves, and the top five answers, listed below, came up over and over.

Following these tips may not stop us from ever making a money misstep again, but if you stick to them as best as you can, you can give yourself a decent shot at a comfortable future.

1. Start planning for retirement early

Nearly 70% of retirees said they would encourage their younger selves to start planning for retirement earlier in life: in their 20s, if possible. This isn’t always easy to do, particularly for college graduates who have a lot of student loan debt. But even if you can only afford to spare a few dollars each month, it’s worth setting them aside for retirement.

Your early retirement contributions usually end up being the most valuable because they have more time to grow. If you invested $100 today and earned a 7% average annual rate of return, it would be worth nearly $1,500 after 40 years. That’s a $1,400 profit. But if you waited five years to invest that $100, you’d only end up with about $1,068 after 35 years, over $400 less.

Even if all you have is an extra $5 or $10 bill in your wallet at the end of each month after paying your bills and creating an emergency fund, invest it. That will make saving enough for retirement a lot easier because you’ll have more investment earnings to help you cover your expenses.

2. Keep educating yourself about finances

There is always more to learn about managing your finances. That’s especially true for retirement planning because it takes decades, and a lot can change in that time, including the government’s rules about retirement accounts and our own lifestyle and plans for retirement. We have to know how to adapt to these changes in order to keep ourselves on track for our goals and make the best choices for our money.

One of the ways to ensure we’re able to do that is to keep asking questions and trying to do better. Learning more about how to invest, for example, can help you make smarter choices about where you stash your retirement savings so you can grow your nest egg more quickly and maybe even retire sooner than you expected.

3. Stay healthy

Staying healthy may not sound like financial advice, but your health and finances can easily become intertwined. If you’re in poor health, you’ll probably be visiting the doctor more often and paying for more prescription medications. You may also be forced to retire earlier than you’d expected, leaving you struggling to get by on what you’d managed to save up until that point.

Focusing on your health by eating right, exercising regularly, and learning healthy strategies for managing stress may not help you avoid healthcare expenses completely in retirement, but it can reduce them. That can lead to a longer and happier retirement with more money to spend on the things you enjoy instead of doctor bills.

4. Balance saving for the future with living for today

Saving for the future is essential if you ever hope to retire, but you also have to meet your needs and wants in the present. The movement known as Financial Independence, Retire Early (FIRE) encourages people to trim their budgets to the bare minimum, often forgoing enjoyable activities, so they can save as much of their income as possible and retire decades earlier than their peers. There’s nothing inherently wrong with this approach, but it’s not something that’s going to appeal to everyone.

Not allowing yourself to do anything fun in the present can make it more difficult to stick to your savings plan long term. It’s better to come up with a plan that’s sustainable for the long term. Figure out how much you need to save per month to retire when you want. And if that’s not feasible, consider delaying retirement or looking for ways to increase your income in the present so you can save for your future and have some money to enjoy now.

5. Take advantage of employer 401(k) matching funds

Nearly 40% of retirees surveyed said they would encourage their younger selves to choose a 401(k) deferral percentage that enabled them to take advantage of their company match. This is free money you get just for planning for your future, but it’s a limited-time offer. If you don’t put enough money into your 401(k) during the year to get the match, you forfeit it.

Hopefully you’re already contributing at least enough to your 401(k) to get your full match, but if not, the first step is to figure out how your company’s matching system works. Some may offer a dollar-for-dollar match while others may offer $0.50 on the dollar. Most companies cap your match at a certain percentage of your income.

Once you know what you need to do, try to increase your contributions accordingly. You may have to make changes to your budget, but it’s worth doing because it reduces how much you personally need to save for retirement.

The five responses above were the most common pieces of financial advice retirees gave, but they’re not the only ones worth following. Think about your own financial history and what you’d like to improve upon. Then, seek advice on how to do that.