Baby boomers own an outsize helping of the market and are constantly reducing it, a process with significant implications for the supply and demand for equities, the interpretation of fund-flow statistics and the kinds of stocks likely to perform better and worse in coming years.

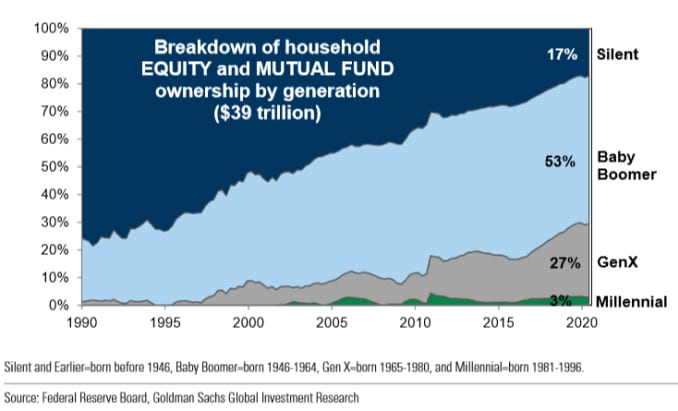

A breakdown of household-stock and stock-fund ownership by generation shows more than half is possessed by baby boomers, those born between World War II and the mid-1960s.

Millennials, now the largest generation, lack the size and financial wherewithal to absorb very much of the ongoing boomer liquidation in real time.

The good news, such as it is, might be that stock ownership is so concentrated at the upper end of the wealth strata that most of these holdings don’t need to be sold by their well-heeled owners to fund day-to-day retirement expenses. The Federal Reserve reports that the richest 10% of households own some 88% of all equities in individual hands.

This means the long-running story of boomers dumping their portfolios en masse on to the market and depressing equity values is mostly a red herring.

Still, a steady bleed of selling will persist for years.

Harley Bassman, a longtime fixed-income executive at Merrill Lynch and elsewhere who now writes the Convexity Maven newsletter, notes that a large and growing flow of selling is mandated by law. IRA assets, for instance, are subject to mandatory withdrawals beginning at age 72. More than a quarter-million Americans turn 70 each month. There is nearly $11 trillion in these accounts. Bassman calculates that this year $75 billion had to be sold, rising to $250 billion a year in 2030.

Those are not enormous totals in the context of a $30 trillion U.S. equity market, but represent a persistent and strengthening undertow of selling in the market.

Slow exodus from equities

Much of this systematic retreat comes by way of target-date retirement funds, a hugely popular asset-allocation vehicle that shifts from equities into bonds or cash gradually until a specified retirement year. There is nearly $3 trillion in these funds, which are often the default option in corporate 401(k) plans. More than 40% of that total is pegged to retirement years 2020, 2025 and 2030.

These funds, along with other mixed-asset approaches, also mechanically sell equities to rebalance to their proper allocations, so in a generally rising stock market such disciplined vehicles will be net sellers.

Again, this is all an overhang of supply of shares on the market but not in itself enough to drive sharp declines. For one thing, individuals control less than half of all U.S. equity value, so the demographic tidal shifts are one among many factors. But it helps explain the slow leakage of cash out of equity funds in recent years, illustrated here since the start of 2018.

These structural drivers of fund flows also mean it’s generally wrong to view equity outflows as a sign the public is fearful of stocks. Many strategists cite the cumulative outflow from stock funds in recent years as a bullish sign for the market, by the contrarian logic that says markets rarely peak unless and until retail investors have piled in. Yet we’ve had a 20% and 34% drop in the S&P 500 15 months apart over the past two years, without first having seen aggressive retail fund inflows.

There has, however, been an unusually heavy rush of money out of target-date portfolios this year, in part because it’s one of the round-number “target” years, and because the fast 35% collapse in the S&P 500 in February and March apparently spooked some older investors.

Millennials come in just in time

Good thing in this case, that millennials are now the largest generation, entering their peak career years, and younger people have become newly engaged with the markets — just in time to soak up some of the selling by seniors.

In fact, the spillage of cash from folks nearing retirement was almost – but not quite – fully offset by new inflows from younger people. Ben Johnson, head of ETF research at Morningstar, noted that through August of this year, some $17.5 billion exited those target-date funds for 2020, 2025 and 2030, while $15.7 billion was pumped into funds targeting retirement years 2050, 2055 and 2060. Given the higher equity allocations for younger investors, this was roughly a wash in terms of net stock-market impact.

Of course, this huge, slow-moving transfer of shares might not always match up so smoothly. For one thing, younger investors have had a harder time ramping up their earnings given two employment shocks in a dozen years and slower wage growth.

And this shift of stocks from graying Americans to greener investors could also be subject to a mismatch in styles and appetites around investing. Younger folks seem most interested in the familiar growth stocks whose products they know and use, not the Old Economy, dividend-paying blue chips boomer investors have held for decades.

And while buy-and-hold services such as robo-advisors have grown quickly catering to newer investors, the most recent influx of market participants has come in the form of small-time traders making short-term plays.

Tens of thousands of new online brokerage accounts were opened this year. The trading volume in speculative call options, which represent leveraged upside bets on share prices, has exploded to new records in recent months. And a Wall Street Journal article last week noted a particular zeal among newer traders for low-priced stocks, perceiving them to have more room to rise despite no real fundamental or mathematical basis for that idea.

This isn’t to scold the kids for their adrenaline-laced engagement with the market. It has infused a new energy into the market – more emotional and perhaps hopeful rather than the bloodless, mechanized grind of quantitative, algorithmically driven strategies that have dominated for years.

And trading is often the younger person’s introduction to investing, which can later give way to wealth-accumulation strategies, as it did for today’s affluent boomers. That, at least, is the hope.