Microsoft shares fell as much as 3% in extended trading Wednesday after the company reported better-than-expected fiscal fourth-quarter earnings that exceeded analysts’ expectations, although quarterly revenue guidance was lighter than expected.

Here’s how the company did:

- Earnings: $1.46 per share, adjusted, vs. $1.34 per share as expected by analysts, according to Refinitiv.

- Revenue: $38.03 billion, vs. $36.50 billion as expected by analysts, according to Refinitiv.

Microsoft’s overall revenue grew 13% on an annualized basis in the quarter, which ended June 30, according to a statement. Revenue went up 15% in the prior quarter, which saw less impact from the coronavirus pandemic.

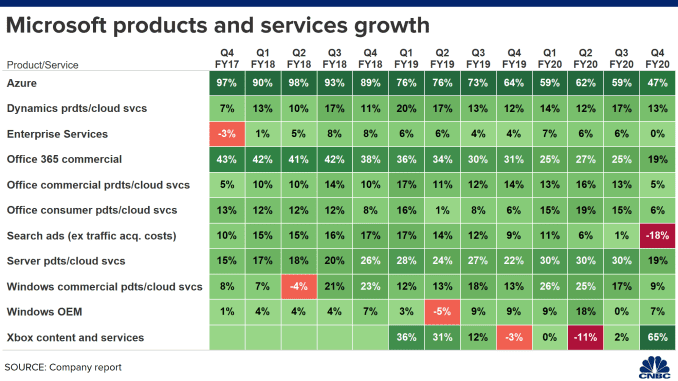

Microsoft’s Intelligent Cloud business segment, which includes the Azure public cloud, Windows Server, SQL Server, GitHub and enterprise services, posted $13.37 billion in revenue, up 17% year over year and above the $13.11 billion consensus among analysts polled by FactSet. Azure revenue growth slowed to 47% from 59% in the previous quarter. Microsoft does not disclose Azure revenue in dollars, but did say its commercial cloud business surpassed $50 billion in revenue for the fiscal year.

Capital expenditures came to $5.8 billion, almost double what they were three years ago as the company looks to expand the infrastructure to deliver Azure and its own online services.

The Productivity and Business Processes unit, which contains Office, Dynamics and LinkedIn, contributed $11.75 billion in revenue. That’s up 6% and less than the FactSet consensus of $11.91 billion. LinkedIn’s revenue grew 10%, the slowest growth since 2016 as Microsoft closed the $27 billion acquisition, given the weaker job market and less spending on advertising. The operating margin for that part of the company, at 33.8%, was the lowest since 2017. Marketing of the Teams communications app that competes with Slack partly caused an increase in the unit’s operating expenses.

The company’s More Personal Computing unit, including Windows, search, Surface and Xbox, had $12.91 billion in quarterly revenue, which is 14% up and higher than the $11.48 billion FactSet consensus. Xbox content and services revenue was up 65% with record engagement as people stayed home and played games. The performance, which included benefit from the company’s Minecraft video game, was better than the company had expected, Amy Hood, Microsoft’s chief financial officer, said on a conference call with analysts Wednesday.

Sales of licenses for commercial Windows devices shrank 4%, the slowest growth since 2016, while licenses for consumer devices accelerated to 34% after falling 10% one quarter earlier. Search ad revenue, excluding traffic acquisition costs, declined 18%, with customers reducing how much they spend.

The company’s earnings were pulled down slightly by a shift in Microsoft’s retail strategy. On June 26 Microsoft said it would close its physical stores, resulting in a one-time charge of $450 million, or 5 cents per share, before taxes.

Also in the quarter Microsoft disclosed a plan to shut down its Mixer video game streaming service, and announced the acquisitions of CyberX, Metaswitch and Softomotive. Industry research group Gartner estimated that PC shipments, a factor in Microsoft’s Windows sales, returned to year-over-year growth in the quarter, following a decline in the first quarter in connection with the pandemic.

Microsoft called for $35.61 billion in revenue for the fiscal first quarter, implying 8% revenue growth. The forecast was lower than the $35.91 billion that analysts polled by Refinitiv had been looking for. The company is changing its accounting to better reflect the useful life of server equipment, raising it to four years, and that adjustment will benefit operating income for the full 2021 fiscal year by $2.7 billion, Hood said. Amazon, the leader in the public cloud market, announced a similar shift in January.

Excluding the after-hours move, Microsoft shares are up about 34% since the beginning of the year.