“We teach them how to make money in school, but we don’t do a very good job teaching them what to do once they make money,” said Stukent CEO and founder, Stuart Draper.

Draper is hoping Stukent will change that, with their ‘Mimic Personal Finance Simulation’ course.

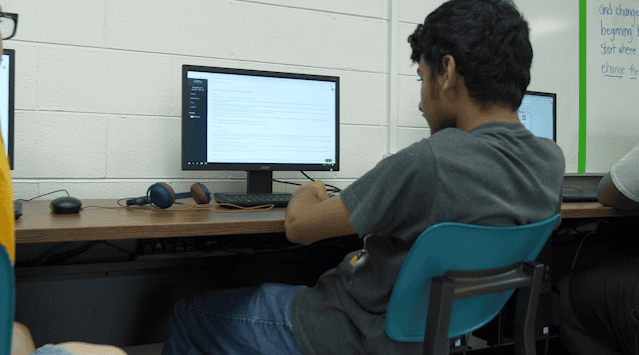

It gives students a hands-on experience on how to manage their finances. It first gives them a salary, career, bills and weekly paychecks with taxes taken out.

Then the student gets products to purchase, like houses, cars and more. All are associated with real-life decisions to be made, in their classroom setting.

“If you purchase a house that’s equal to buying this seat at this desk. That’s right next to an outlet. Now you can charge your phone in class. And so there’s value in paying more, it puts a real value on the digital dollars,” Draper said.

The program is already being used in more than one thousand high schools across the nation. With the help of Idaho Central Credit Union, it can easily be taught in every high school in Idaho for free for five years.

“They (ICCU) said, we want every student in Idaho to go through this experience this is incredible, how can we help,” Draper said.

In Idaho, it’s not a requirement that students take a personal finance class in order to graduate. Stukent is hoping to change that.

“If we can make that happen. These students will go out into the workforce, more prepared to save. We have a big issue right now with students graduating and not knowing how to manage their money,” Draper said.

At the end of the semester, students use their newfound budgeting skills to buy their grade.

“It can be boring to talk about interest rates and mortgage insurance and what that is, but when all of a sudden they’re competing with their peers to see who’s saved up the most money and who’s going to be able to buy an a and who can at the end of the semester that really goes a long ways,” Draper said.