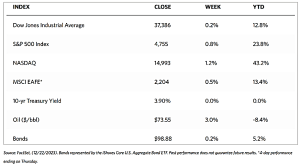

Stock Markets

It was a quiet week with little news and economic data, the absence of market motivation causing indexes to move marginally upward to extend their winning streaks. U.S. Stock markets were up for the week ahead of the Christmas holidays when markets will take a break. The Dow Jones Industrial Average (DJIA) was up slightly by 0.22% with the DJ Total Stock Market Index gaining 0.91%. The broad S&P 500 Index rose by 0.75% while the technology-heavy Nasdaq Stock Market Composite outperformed with a 1.23% gain. The NYSE Composite is likewise up for the week, advancing by 0.97%. The investor risk perception metric CBOE Volatility (VIX) indicator rose by 6.11%.

U.S. Economy

For the 16th year since 1980, the average quarterly U.S. GDP growth in 2023 topped 3%. This fact highlights the surprising resilience of the economy, even in the face of strong headwinds resulting from the Federal Reserve rate hikes in its bid to curb inflation. In the third quarter of this year, GDP grew by 4.9%, the strongest quarterly growth rate since 2014, excluding the past-pandemic reopening period. The U.S. GDP grew at a rate of 5% or more in 26 quarters from 1980 to 2020. The main catalyst for economic growth in 2023 was consumer spending and its main driver was a historically strong labor market. The lowest point in the unemployment rate going back to 1980 was 3.4%, which matches the lowest unemployment figure since 1969. A lower jobless rate can only be found by going back to 1953 when unemployment registered at 2.5%.

Metals and Mining

The spot market for precious metals was up this week. Gold gained 1.66% from its close last week at $2,019.62 to end at $2,053.08 per troy ounce this week. Silver climbed by 1.38% from the previous week’s close at $23.86 to end the week at $24.19 per troy ounce. Platinum, which closed last week at $944.51, ended the week at $976.60 per troy ounce for a gain of 3.40%. Palladium, which closed a week ago at the price of $1,177.06, closed this week at $1,205.81 per troy ounce for a gain of 2.44%. The three-month LME prices of base metals ended mixed. Copper closed this week at $8,595.50 per metric ton for a gain of 0.54% over last week’s closing price of $8,549.00. Zinc ended the week at $2,547.00 per metric ton to mark a 0.59% increase over last week’s close of $2,532.00. Aluminum closed this week at $2,244.00 per metric ton for a slide of 0.16% from last week’s closing price of $2,247.50. Tin closed this week at $25,153.00 per metric ton, a loss of 0.09% from the previous week’s close at $25,175.00.

Energy and Oil

With Christmas just around the corner, trading liquidity was thin. Angola parted ways suddenly with OPEC, which nevertheless failed to move the needle either way on this lackluster trading week. ICE Brent remained at approximately $80 per barrel whilst WTI moved up to $75 per barrel as the Red Sea diversions became the new trend in international shipping. This marks the second consecutive week-on-week gain in WTI which fully rebounded to levels it treaded one month ago, Angola left OPEC due to a quota spat. The African country’s departure dealt a political blow to the group which said that membership provided Angola with no gains and no longer serves its interests. Angola follows in the footsteps of Ecuador and Qatar in this sudden and bold move.

Natural Gas

For the report week from Wednesday, December 13 to Wednesday, December 20, 2023, the Henry Hub spot price rose by $0.16 from $2.33 per million British thermal units (MMBtu) to $2.49/MMBtu. Regarding the Henry Hub futures, the price of the January 2024 NYMEX contract increased by $0.112, from $2.335/MMBtu at the beginning of the report week to $2.447/MMBtu at the end of the week. The price of the 12-month strip averaging January 2024 through December 2024 futures contracts increased slightly to $2.564/MMBtu.

International natural gas futures decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $2.47 to a weekly average of $13.30/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.84 to a weekly average of $10.89/MMBtu. In the week last year corresponding to this report week (from December 14 to December 21, 2022), the prices were $34.420 and $34.99 in East Asia and at the TTF, respectively.

World Markets

The pan-European STOXX Europe 600 Index inched up 0.21% higher this week in local currency terms and remained near its almost one-year high. Some major continental stocks showed softness while others moved sideways in listless trading on thin volumes just before the Christmas holidays. France’s CAC 50 Index declined by 0.37%, Germany’s DAX ticked down by 0.27%, and Italy’s FTSE MIB was modestly down, The UK’s FTSE 100 Index rose by 1.60%. UK’s inflation slowed more than expected, from 4.8% in October year-on-year to 3.9% in November year-on-year. The unexpected drop was due to a fall in prices for food, motor fuels, recreation, and culture. Core and services inflation showed that underlying price pressures eased, coming in at 5.1% and 6.3%, respectively. All inflation metrics remain well above the 2% inflation target set by the Bank of England (BoE). Revisions by the Office for National Statistics to the Gross Domestic Product (GDP) indicate that the economy performed worse than previously thought in certain quarters. In the April to June period, the GDP was lowered from 0.2% to flat, while the estimate for the third quarter indicated that the economy shrank by 0.1%. Despite lower inflation figures, the BoE stated that interest rates are likely to remain at elevated levels, according to BoE Deputy Gov. Ben Broadbent.

In Japan, the stock markets registered modest gains for the week. The Nikkei 225 Index rose by 0.6% while the broader TOPIX Index gained by 0.2%, with support from a dovish Bank of Japan (BoJ). In line with expectations, the BoE retained its ultra-accommodative monetary policy stance at its December meeting, including forward guidance. The central bank avoided commenting on possible policy adjustments next year, seemingly pushing back against market expectations of a near-term interest rate hike. The yield on the 10-year Japanese Government Bank (JGB) fell to 0.62% from 0,70% at the end of the previous week. The yen initially weakened but finished broadly unchanged for the week, ending at the low levels of the JPY 142 range versus the U.S. dollar. Data released towards the end of the week showed that Japan’s core consumer price index rose by 2.5% year-on-year in November, lower than the 2,9% October reading and the softest inflation level it has been since July 2022.

Chinese stocks declined in response to government announcements imposing new restrictions in the gaming sector. The Shanghai Composite Index fell by 0.94% while the blue-chip CSI dipped by 0.13%, its sixth consecutive weekly decline and capping its largest losing streak since January 2012. The Hong Kong benchmark Hang Seng Index gave up 2.69%. A draft of new rules was announced by Chinese regulators. The new measures are aimed at curbing spending and rewards for online video games. The regulations eliminated almost US$80 billion in market value from some of China’s largest gaming companies, reflective of investors’ concerns about the potential impact on earnings and the possibility of another government crackdown on the sector. In the past, Beijing set strict playtime limits for players younger than 18 and suspended the approvals of new video games, effectively kicking off in 2021 a two-year clampdown on big technology companies. The restrictions were formally ended in 2022 as the government resumed new game approvals and eased regulations for most of 2023.

The Week Ahead

Economic news will be light this week due to the Christmas holidays when the markets will be closed. Expected for release are initial jobless claims and consumer confidence reports.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities) for October

- Consumer confidence for December

- Initial jobless claims for December 23, 2023

- Advanced U.S. trade balance in goods for November

- Advanced retail inventories for November

- Advanced wholesale inventories for November

- Pending home sales for November

- Chicago Business Barometer for December

Markets Index Wrap-Up