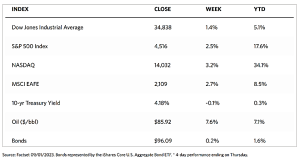

Stock Markets

Major indexes are up this week, helped by hopeful signs on the inflation front, although this was the first month since February that stocks closed negative. The Dow Jones Industrial Average (DJIA) gained 1.43% while the DJ Total Stock Market Index almost doubled this gain by moving up by 2.75%. The broad S&P 500 Index climbed 2.50% and technology-heavy Nasdaq Stock Market Composite surged by 3.25%. The NYSE Composite ascended by 2.06% and the Russell 1000 went up by 2.68%. The CBOE Volatility Index which tracks investor risk perception declined by 16.52%.

Growth shares were boosted by a decrease in longer-term interest rates over much of the week which reduced the implied discount on future earnings. The significant year-to-date gap between large caps and smaller cap stocks which outperformed this week. Many observers noted that during the week, bad news for the economy was considered good news for stock prices because of the interest rate implications. The big market push came Tuesday when the S&P 500 Index recorded its best one-day gain since June. On that day, job quits were announced to have considerably fallen. Markets are scheduled to be closed on Monday, September 4, in observance of the Labor Day holiday.

U.S. Economy

The Labor Department reported that job openings unexpectedly fell by 338,000 in July, hitting their lowest level since March 2001. As mentioned earlier, job quits, which are considered by some to be a more reliable indicator of the strength of the labor market, fell significantly. The unemployment rate hit its highest in 17 months. The closely watched nonfarm payrolls report released on Friday appeared to confirm loosening labor market conditions. Employers added 187,000 jobs in August which is slightly above consensus expectations; however, gains for the previous two months were revised lower by a total of 110,000. Average hourly earnings came in somewhat below expectations, increasing by only 0.2% for the month.

Most importantly, the unemployment rate ticked up from 3.5% to 3.8%, its highest level since February 2022. The labor force participation rate hit 62.8%, its highest level since the start of the pandemic in February 2020, as 736,000 people reentered the job market. Despite the slowdown in the labor market, people appeared to grow hopeful for a “no landing scenario,” that the economy would escape even a substantial slowdown in 2023. The Commerce Department reported on Thursday that personal spending jumped by 0.8% in July. This is above expectations and well above a 0.2% increase in consumer prices during the month. Then on Friday, the Institute for Supply Management reported that its gauge of manufacturing activity climbed unexpectedly to its best level since February, although it still indicated a contraction in the sector. Also surprising on the upside was a gauge of overall business activity in the Chicago region.

Metals and Mining

While gold appears to show relative strength despite facing significant headwinds from rising bond yield and the U.S. dollar, the precious metals market continues to lack a catalyst that can drive gold back to the $2,000-per-ounce level and, hopefully after that, record highs. Gold prices hit a brick wall at $1,980 per ounce heading into the long weekend holiday. This level is a critical psychological level in gold’s long-term uptrend. So far, gold is stuck in a neutral trading channel, but it appears that when the right conditions have been met, gold has the potential to move northward. In the week just ended, some cracks appear to be forming in the U.S. labor market, an essential pillar of strength for the economy so far this year.

The precious metals spot market ended mixed for the week. Gold gained by 1.31% from its previous price of $1,914.96, closing at $1,940.06 per troy ounce this week. Silver, which closed at $24.23 the week before, ended this week at $24.19 per troy ounce which is slightly down by 0.17%. Platinum ended this week at $963.85 per troy ounce, 1.63% higher than the previous week’s closing price of $948.43. Palladium, which ended the previous week at $1,227.74, closed this week at $1,221.87 per troy ounce, for a loss of 0.48%. The three-month LME prices of industrial metals were also mixed. Copper closed at $8,500.50 per metric ton, 1.69% higher than the previous week’s price of $8,359.50. Zinc, which ended one week ago at $2,394.00, closed this week at $2,485.50 per metric ton for a weekly gain of 3.82%. Aluminum gained by 3.68% from its previous price of $2,157.50 to close the week at $2,237.00 per metric ton. Tin ended the week at $25,806.00 per metric ton for a loss of 0.25% from the previous week’s closing price of $25,870.00.

Energy and Oil

An unusually tight oil market in the United States has resulted from continuous U.S. stock draws equivalent to a one million barrel per day decline over the past five weeks. This added upward pressure to oil prices despite the country’s economic woes. Adding to the bullish sentiment are widespread expectations of OPEC+ extending production and export cuts as well as recovering Chinese manufacturing activity adding to the demand. These pressures have pushed ICE Brent above the $87 per barrel price level. According to Russia’s deputy price minister Alexander Novak, OPEC+ members have agreed on the main parameters of production over the upcoming months but will only announce it next week. This suggests that Riyadh and Moscow are to continue their production and export cuts.

Natural Gas

For the report week beginning Wednesday, August 23, and ending Wednesday, August 30, 2023, the Henry Hub spot price fell by $0.10 from $2.59 per million British thermal units (MMBtu) to $2.49/MMBtu. Regarding the Henry Hub futures price, the September 2023 NYMEX contract expired Tuesday at $2.556/MMBtu, up by $0.06 for the week. The October 2023 NYMEX contract price increased to $2.796/MMBtu, up by $0.20 through the week. The price of the 12-month strip averaging October 2023 through September 2024 futures contracts rose by $0.05 to $3.345/MMBtu.

International natural gas futures prices decreased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.76 to a weekly average of $13.33/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.13 to a weekly average of $11.22/MMBtu. During the week last year that corresponds to this week (i.e., the week from August 24 to August 31, 2022), the prices were $64,02/MMBtu in East Asia and $83.62/MMBtu at the TTF, the highest weekly average TTF price on record. Due to uncertainty about Australian LNG supplies amid the potential for labor stoppages, international natural gas prices have been volatile throughout August.

World Markets

European stock prices rose for the week reflecting investors’ optimism that interest rates would soon peak and that a recession, while still possible, would be short-lived and shallow. Equities rose on positive news of China’s efforts to bolster its beleaguered economy. The pan-European STOXX Europe 600 Index climbed by 1.49%. Major European stock indexes in the UK, Germany, Italy, and France also advanced for the week. As core inflation data and comments from policymakers suggested that the European Central Bank (ECB) could be nearing the end of its monetary policy tightening cycle, European government bond yields edged further downward. The yields on the 10-year government bonds issued by France and Germany inched lower as did the yield on UK 10-year sovereign bonds which descended close to one-month lows on softer economic data.

Japan stock markets rose over the week. The Nikkei 225 Index rose by 3.4% while the broader TOPIX Index gained 3.7%. Expectations that the U.S. Federal Reserve was moving closer to pausing its interest rate hiking cycle were boosted by weaker-than-forecasted U.S. economic data that emerged during the week. China’s latest measures to boost its markets and economy were likewise welcomed by investors. In the meantime, the yield on the 10-year Japanese government bond dipped to 0.63% from 0.64%, its level at the end of the previous week. Weighing on yields was the announcement by the Bank of Japan (BoJ) of its intention to conduct bond-buying operations one day before its auction of 10-year notes. This is scheduled for the week beginning September 4. The yen strengthened from JPY 146.4 against the dollar a week ago to JPY 145.4 this week. It remains historically weak, however, prompting speculation that Japan’s monetary authorities could intervene in the foreign exchange markets to prop up the currency.

After Beijing issued a series of stimulus measures aimed at reviving the economy, Chinese stocks rose for the week. The blue-chip CSI 300 Index and Shanghai Composite Index both advanced for the week. The Hong Kong benchmark Hang Seng Index also rose for the four-day week that ended Thursday. Financial markets were closed on Friday due to an approaching typhoon. On the Friday preceding, China’s bank reduced the amount of foreign currency deposits that domestic banks are required to hold as reserves. The foreign exchange reserve requirement ratio was reduced from 6.0% to 4.0%, effectively freeing up more foreign currency in the local market to buy the renminbi currency. This helped to support the local currency which in August had fallen to its lowest level against the U.S. dollar since 2007. The central bank issued its directive hours after China’s financial regulator announced that it would reduce minimum down payments for homebuyers nationwide. It encouraged lenders to lower rates on existing mortgages.

The Week Ahead

This coming week, important economic data scheduled for release include the July factory orders, the Fed Beige Book, and the ISM Services PMI report for August.

Key Topics to Watch

- Factory orders

- U.S. trade deficit

- S&P final U.S services PMI

- ISM services

- Fed Beige Book

- Initial jobless claims

- U.S. productivity (revision)

- Unit-labor costs (revision)

- Philadelphia Fed President Patrick Barker speaks

- Chicago Fed President Austan Goolsbee speaks

- New York Fed President John Williams speaks

- Atlanta Fed President Raphael Bostic speaks (Sept. 7, 3:45 p.m.)

- Atlanta President Raphael Bostic speaks (Sept. 7, 7 p.m.)

- Dallas Fed President Lorie Logan speaks

- Wholesale inventories

- San Francisco Fed President Mary Daly speaks

- Consumer credit

Markets Index Wrap-Up