It’s a somber retirement forecast for Generation X workers – those who are now between the ages of 41 and 56.

Many in the so-called latchkey-kid generation, who may have muddled through a childhood with less parent hand-holding than millennials and baby boomers, are now in need of some serious nurturing, according to a new report published by the National Institute on Retirement Security (NIRS).

The NIRS scrutinized the retirement readiness of Gen X, and it’s not pretty.

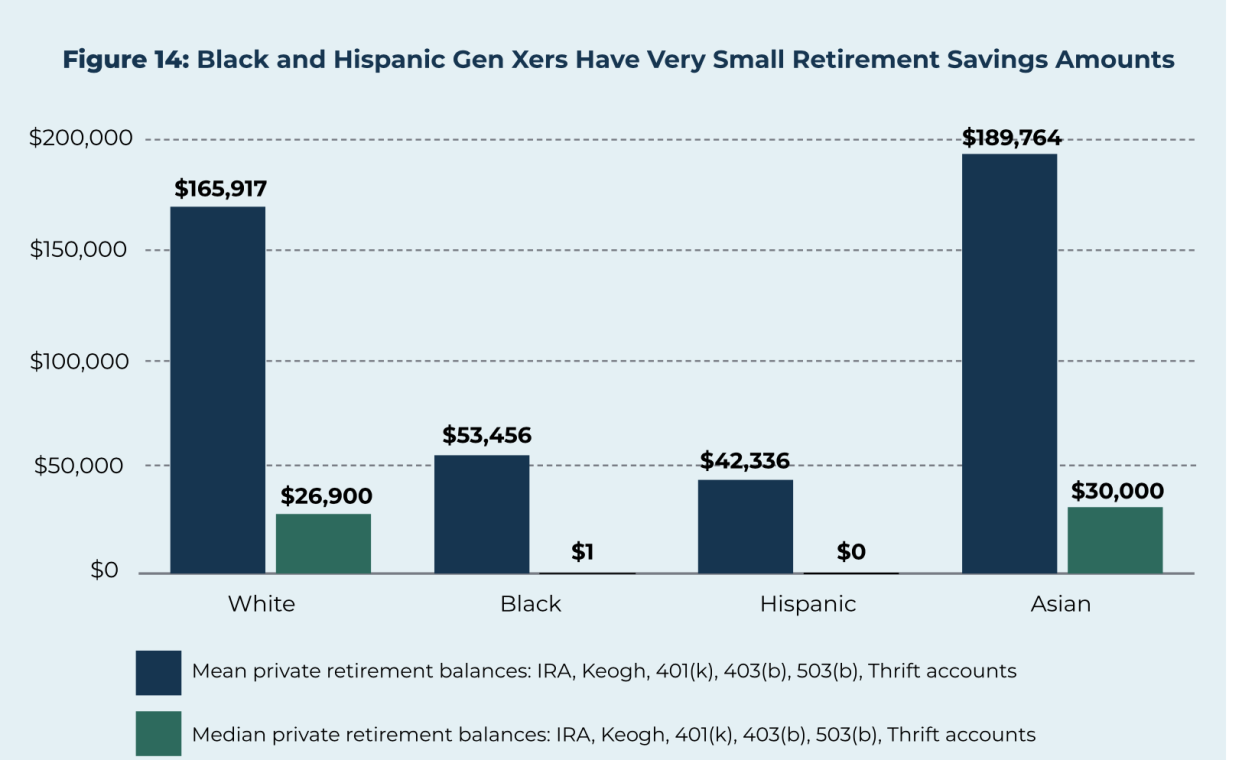

The typical Gen X household has only $40,000 in retirement savings — and those savings are concentrated among top earners — according to the findings published by the nonpartisan organization. Also, Blacks and Hispanics have considerably lower savings and access to employer-provided retirement plans as compared to whites.

Welcome to the ‘new retirement’

“Generation X represents the leading edge of the new retirement in America,” Tyler Bond, a co-author of the report and NIRS research director, told Yahoo Finance. “As the first generation to mostly enter the workforce after the move away from defined benefit pensions in the private sector, most Gen Xers will not enjoy the secure retirement income that pensions have provided to so many in previous generations.”

The report, which defines Gen X as those born between 1965 and 1980, about 64 million Americans, or nearly 20% of the US population, is based on research data from the Survey of Income and Program Participation (SIPP), which provides information on income, employment, household composition, and government program participation.

The tenuous outlook for Gen X has been trumpeted in a range of recent reports this year, including the finding from the 23rd Annual Transamerica Retirement survey that about one in three Gen Xers do not have any financial strategy for retirement.

“The retirement landscape shifted dramatically for this generation, and they’re at risk of falling through the cracks,” Catherine Collinson, CEO of Transamerica Institute and Transamerica Center for Retirement, said.

Zero retirement savings

The troubling crux of the NIRS research: The median account balance for an individual in Gen X is only $10,000, which means half of Gen Xers have less than that amount saved for retirement. One in four Gen Xers don’t have a retirement savings account at all. For Black Gen Xers, the median retirement account balance is $1 and half have nothing at all. Two-thirds of Hispanic Gen Xers haven’t even started a retirement savings account.

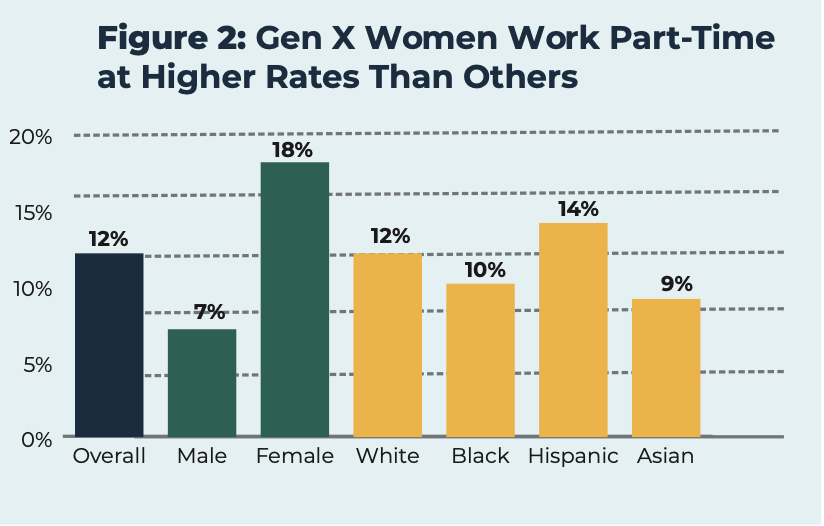

There’s a notable gender gap, too. The median retirement savings is $13,000 for single Gen X men and $6,000 for Gen X women. (That might be because Gen X women are more likely to work part-time.) Married men and women tend to have higher savings levels.

Read more: The best high-yield savings account rates for July 2023

Why is Gen X so behind?

One factor: 401(k)s were just coming online when Gen X entered the workforce — and relatively few workers had access to them. Only 14% of Gen Xers have a traditional employer pension plan, and only about half (55%) have access to an employer-provided retirement plan at their job like a 401(k).

That’s the overarching problem.

When workers don’t have access to an employer-sponsored plan, they typically don’t start their own retirement accounts. Only 5% of workers take the steps to open up a retirement savings account if it is not provided by their employer, according to Angela M. Antonelli, executive director of the Center for Retirement Initiatives at Georgetown University. If a worker has access to an employer-sponsored plan, participation jumps to 72%.

Having access to saving in a retirement plan at work is typically reserved for full-time employees. But 12% of working Gen Xers work part-time, the NIRS report found. Among Gen X men, 7% worked part-time. For Gen X women, it was more than double that number, nearly two in 10 (18%).

The fact is it’s easier to save when you have an employer-provided retirement account. Workers with an IRA or Keogh account had an average balance of $148,920 and the median balance was $44,100. For those with 401(k), 403(b) and other employer-sponsored plans, the average balance was $173,553 and the median balance came in at $50,000. “These are better than the overall numbers, but are hardly encouraging for a generation fast approaching retirement age,” Bond said.

It is no surprise that Gen X workers who are top earners are holding their own. The top quartile of Gen X workers with income of $76,789, and above, have savings of around $250,000, on average, while the bottom half — those with incomes of $43,921 or less — have almost nothing socked away.

When looking at the median, those Gen X households with $24,096 or less in income have only $200 saved for retirement. Those with income between $24,097 and $43,920: $4,290.

New policy initiatives may help

Is there hope?

If Gen Xers start saving now, they can make up for lost time. Most Gen Xers are in their peak earning years and the youngest Gen Xers have two decades to work with.

Some new public policy changes are likely to make it easier for many part-time workers. A new provision in the Secure 2.0 legislation, which will go into effect in 2025, requires that 401(k) or 403(b) plans allow a long-term part-time employee to participate in the plan, if that employee worked at least 500 hours per year for two consecutive years.

Meantime, a growing number of states have passed laws in recent years to help clear up this retirement savings dilemma. And the new legislation seems to be propelling a boost in employers opting to offer a 401(k) plan instead of participating in their state’s program, according to the National Bureau of Economic Research (NBER).

So far, 19 states have enacted retirement programs for private-sector workers. Fifteen of these states are auto-IRA programs. They require most private employers that don’t sponsor a savings plan of their own to enroll workers in a state-facilitated individual retirement account at a preset savings rate — usually 3% to 5% of earnings — and automatically deducted from paychecks.

Given the number of Gen Xers who are not currently participating in a retirement plan, increasing access to savings plans is potentially a big boost. But it’s just a beginning.

And then there’s the nagging shadow of Social Security. Many Gen Xers are not confident Social Security will be there for them when they need it, the NIRS researchers conclude. They either think that Social Security will go bankrupt before they are eligible to claim benefits, or that the benefits will be cut.

“There are looming retirement challenges facing Gen X,” Bond added, “and an urgency to strengthen the nation’s retirement structure for these workers and the generations that will follow.”