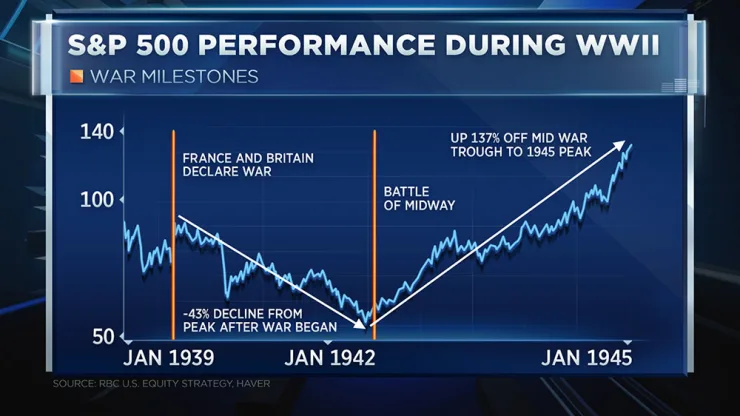

Wall Street may be ripping a page out of the post-WWII era.

According to RBC Capital Markets’ Lori Calvasina, stocks may be ignoring all signs of a recession.

“If you go all the way back to 1945, that was the recession coming out of World War II, the stock market just marched through it,” the firm’s head of U.S. equity strategy told CNBC’s “Fast Money” on Monday. “It is the only recession where it’s essentially been ignored.”

In a research note out this week, Calvasina tackled the S&P 500′s performance during recessions going back to 1937. She found the 1945 recession was the only one with no market pullback.

She listed the resemblance between the government war funding in 1945 to 2020′s massive Covid relief and the Fed’s rate hikes as a few examples.

“I actually found some interesting terms that were similar. It was described as a technical recession, just being driven by the fact that the wartime economy was shutting down, and we were pivoting to a peacetime economy,” said Calvasina. ”[This] idea of a manufactured recession that we were all talking about last year, you actually had it back then.”

However, she also acknowledged that there are differences between the two time periods and noted that she isn’t a believer of the bull case.

“I actually think that we priced in a recession back at the October lows, but I think people are tired of hearing that,” noted Calvasina.

Her S&P 500 year-end price target is 4,100. She adjusted her S&P EPS forecast last week to $200 from $199. The S&P closed at 4,135.32 today and is up more than eight percent year-to-date.