So we’re now roughly two weeks removed from the start of the FTX meltdown. The coverage on CoinDesk has been without peer.

Here are the biggest FTX-related stories from last week by my count:

-

FTX founder and former CEO Sam Bankman-Fried says “F*** regulators” in a Twitter Direct Message interview with Vox.

-

The new CEO of FTX, John J. Ray III, who led Enron through bankruptcy and is leading FTX through theirs, wrote about FTX that he has never “seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

-

Alameda Research, the crypto hedge fund which was joined at FTX’s hip, had a “Secret Exemption” from FTX liquidation protocols, basically a “god mode” button, as CoinDesk contributing editor Zack Seward put it, so as to not lose money when they should have.

But beyond topics directly related to FTX, let’s discuss this contagion – this crypto credit contagion – everyone seems to be talking about.

Crypto credit contagion is contained to crypto

Financial contagion is used to describe a crisis which spreads from one market or economy to another. An example: Home prices started falling in 2006, by September 2007 Lehman Brothers collapsed because of losses associated with subprime loans, and then a lot of people lost their jobs (like a lot).

This contagion was a credit contagion that spread everywhere. The reason these types of things happen is because of the complicated web woven among the countless financial institutions selling and buying countless financial instruments among each other. When one part of the web breaks down, other parts of the web start breaking down until all you’re left with is a shredded mess.

This is very clearly happening within crypto. Since the FTX fallout began we’ve had crypto lender BlockFi halt withdrawals from its platform citing exposure to FTX, then another crypto lender Genesis Global Capital also halted withdrawals, and then Winklevoss-owned crypto exchange Gemini shut down its Gemini Earn program which offered yield to customers through, you guessed it, crypto lending through Genesis.

(Genesis Global Trading is part of Genesis Global Trading and is owned by Digital Currency Group (DCG). DCG also owns CoinDesk.)

Oh, what tangled webs we weave.

But here’s something different between the 2006 credit contagion and the 2022 FTX-induced crypto credit (which is what lenders do, they extend credit) contagion. The 2006 credit contagion led to a global financial crisis which was probably the most serious financial crisis since the Great Depression. Crypto is simply not big enough to have a serious impact on the broader economy.

Don’t believe me?

Here are some proof points:

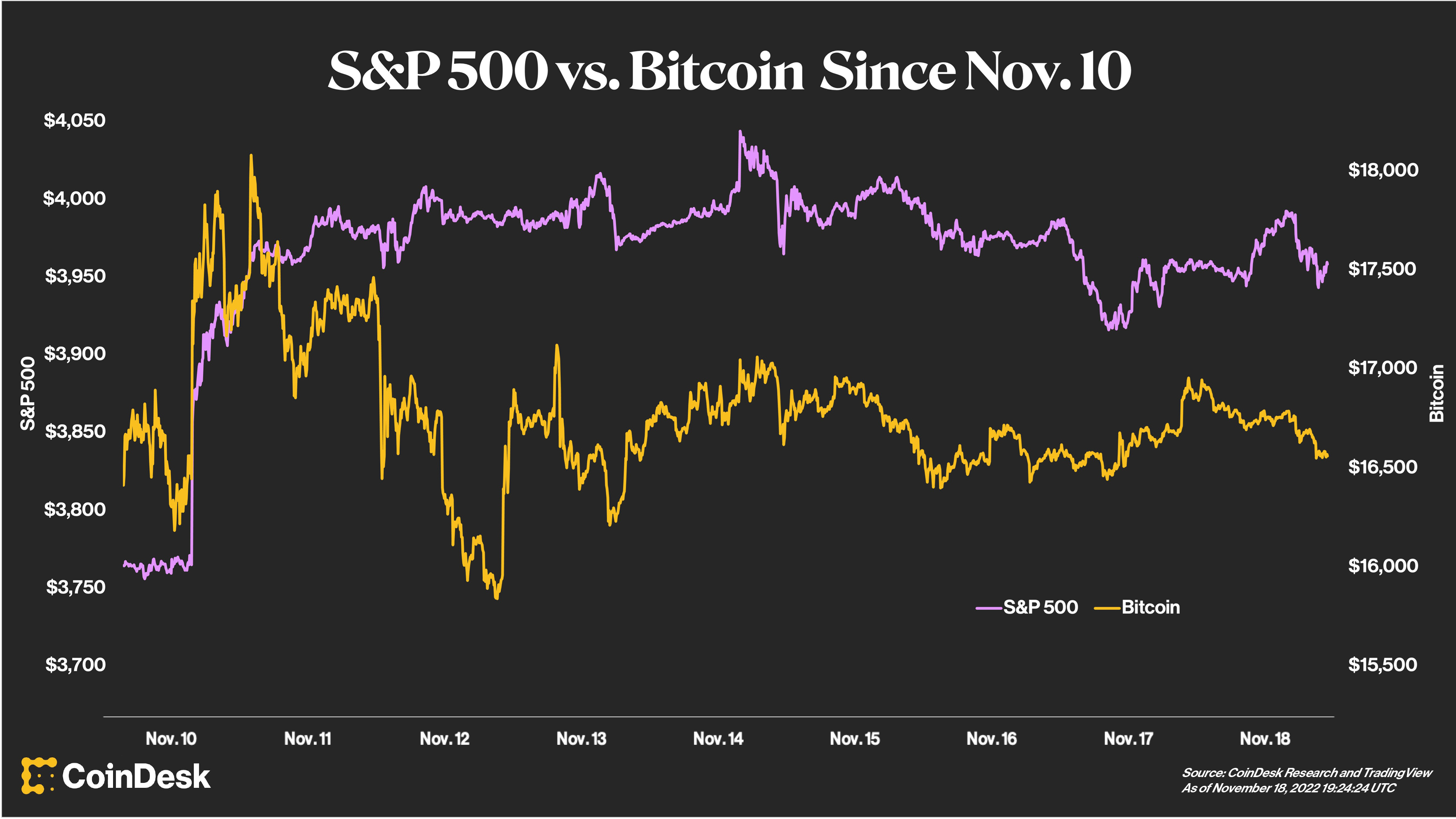

(CoinDesk Research and TradingView)

-

On Thursday, Nov. 10, the U.S. Labor Department reported that the consumer price index (which helps measure inflation) slowed to “just 7.7%,” which was below expectations, so the S&P 500 (a stock price index) shot up from $3,760 to over $4,000 by the next day and is now sitting around $3,950. Bitcoin experienced a similar price movement, moving from $16,000 on Thursday to over $18,000 by Friday. The difference being that bitcoin’s price now sits around $16,600 as of writing.

-

On the day of the FTX collapse, most mainstream publications were more focused on covering something else: U.S. midterm elections. I know this is anecdotal, but you’ll just have to trust me on this one.

-

Companies in general are still more concerned about supply-side recessionary pressures. The only companies talking about crypto are crypto companies (and maybe Twitter’s new owner).

I’m not suggesting that the crypto credit contagion is not bad. In fact, it is bad. A lot of regular people have lost money. Even the Ontario Teachers’ pension fund lost $95 million investing in FTX (although that is only <0.05% of the fund’s total net assets). But in totality it really isn’t as bad as some might make it out to be. I believe this crypto credit contagion will be contained to crypto, which would by definition disqualify it as a contagion at all.

This, too, shall pass.