Tax planning is a life-long activity, but the importance of it increases significantly upon retirement. While working, your income is very stable, so as a federal employee, unless you have lots of after-tax or inherited money, multiple properties, or your spouse has a complex income structure from the private sector, your taxes will be relatively straight forward during your working years.

That all changes when you retire. The opportunity for generating “tax-alpha”, or significant value in tax savings increases upon retirement. Most families stay within a similar tax bracket in retirement as when they were working, but how far into that bracket might change. This creates valuable opportunities to be doing things that may help greatly reduce your taxes.

The objective of tax-planning is to reduce a family’s overall lifetime amount of taxes paid. Sometimes this means paying a little more taxes in some years, which feels counterintuitive. Good tax-planning is considered advanced financial planning, and we have found that many families are underserved by their advisory relationship as it relates to this category.

If tax-planning is ignored, a family runs the risk of approaching their Required Minimum Distribution (RMD) years with massive amounts of pre-tax retirement assets and may be forced into higher tax brackets than may have been required.

Not only that, but if the majority of your assets are all in “Traditional” types of retirement accounts, then any time you need to make a lump sum withdrawal to purchase something, it will cost the price plus ordinary federal and state income tax on the income you withdrew to pay for it.

Take the example of purchasing a car. The cost of a $35K car paid from a Traditional retirement account requires a distribution greater than $35K—it is $35K plus ordinary income tax. There is that much less money still invested and growing for you. Having after-tax and tax-free dollars to handle these kinds of expenses is incredibly important to the success of a retirement plan.

When to Roth

Roth accounts have taxes paid prior to contributions, and the corpus grows completely tax-free. Roth conversions involve moving a portion of a Traditional IRA (pre-tax) into a Roth IRA (post-tax) by paying the taxes on the amount that you convert. Notably, this cannot be accomplished in the TSP and requires moving money into an IRA before converting.

In most cases, waiting until you separate from service makes a good deal of sense before considering Roth conversions. This is because your household income has you locked into whatever tax bracket you’re in. When retired, you may see reduced taxable income, especially if you’ve been diligent at saving money outside of retirement accounts too that can be used, or if your pension income or income of only one spouse is sufficient to cover your lifestyle needs. Note that while pensions are taxable, whether FERS, military, VA, etc., you may still have and overall less amount of taxable income.

This presents an opportunity to consider converting some of your traditional retirement assets into Roth. Tax rates are relatively low when looking at history. And while we are not delusional enough to pretend to know where tax rates will be in the future, most economists agree that taxes won’t be going down from here, at least for some time.

Additionally, down markets offer extremely favorable tax planning opportunities through what we commonly refer to the “discounted Roth conversion”.

Discount Roth Conversions

It is advantageous to consider Roth conversions during periods of time that markets are down in value. A declining market can effectively make the Roth conversion “on sale” relative to prior to the decline.

This is because as your pre-tax account drops in value, the amount being converted into Roth represents a greater percentage of the pre-tax account, resulting in a larger ratio of your wealth getting to be reinvested in tax-free status and have the opportunity to grow tax-free once the markets recover over time.

There are various benefits to having money inside a Roth account. The primary reason is that growth and withdrawals are completely tax-free. This is the best type of account to have. If all you have is Traditional retirement assets, every dollar you own is completely taxable. Why does this matter?

Because Roth dollars also do not have Required Minimum Distributions (RMDs) like Traditional retirement dollars. High RMDs can mean you’re forced into a higher tax bracket and pay more taxes, as well as potentially causing your Medicare Part B premiums to increase as well. More on this below.

Penalizing Your Children

A few years ago, a new law was passed, called the SECURE Act. It did a lot of things, but one of the most questioned items was that it required a child that inherits retirement funds to fully distribute [and pay taxes] on those funds within 10 years. This feature was designed to accelerate and maximize the taxes going to the IRS.

People generally inherit money from their parents during the years in which they’re in their peak earning years. Having to distribute and pay taxes on inherited retirement accounts within 10 years could essentially force them into the highest tax bracket for an entire decade.

The rule states it must be emptied and tax paid by the 10th year but did not [yet] mentioned an annual requirement. Note that Inherited Roths also have a 10-year RMD. This one stumped us—why else make this rule apply to Roth accounts other than to hurt the middle class.

This means that you need to get ahead of this, especially if your retirement plan is projecting that you’ll be leaving substantial pre-tax assets to your kids.

And if you’re younger, then you need to be addressing this with your parents. Many planners do not mention thing to their clients, and it’s a huge oversight that can be avoided and save a family tens of thousands, if not hundreds of thousands, in taxes over their lives.

Other Considerations

Do not try to move money from your Traditional TSP directly into a Roth IRA.You will first want to transfer Traditional TSP funds into a Traditional IRA, then complete the Roth conversion IRA to IRA.

When completing the Roth conversion, it’s always best if you’re able to pay for the taxes from your after-tax accounts. These include your bank accounts, savings, or other non-retirement accounts. This allows the full portion being converted to enter Roth-status and grow tax-free. The less favorable alternative is to pay from the converting balance itself, but that means you’re starting with a lower principal in the Roth than was in the Traditional.

If you’ve planned properly, you’ll be tax-loss harvesting your taxable account in down markets and thereby have cash on hand to pay for the taxes “out of pocket” for the Roth conversion.

While anyone can complete a Roth conversion, various circumstances might make it less favorable for you to do so. One consideration in whether to utilize a Roth conversion is to determine whether you believe you will be in a higher tax bracket in the future.

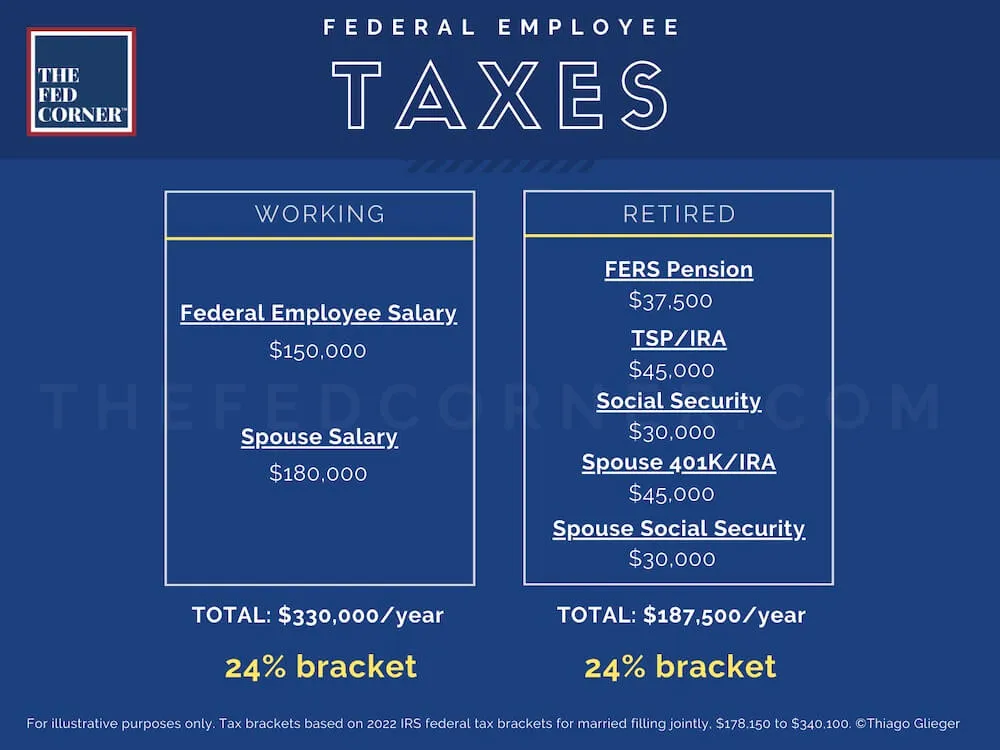

For most federal employees, it’s commonly believed that you’ll be in lower tax bracket when retired. We don’t always find this to be the case, mainly because your FERS pension is fully taxable as ordinary income in many states. That, combined with Traditional retirement withdrawals can easily put your taxable income in a similar bracket to when you were working. Your effective rate may be less, which is where there are significant planning opportunities, but you may still fall into the same federal income tax bracket.

If you’ve been diligent about saving money outside of retirement accounts (or inside a Roth), this is the exception. This allows you to draw money from your after-tax accounts and keep your ordinary income tax low, allowing you to fill those brackets with Roth conversions shortly upon retirement. This also gives you a long runway for the Roth to grow in its tax-free status.

Be careful not to push yourself into higher Medicare premiums. Medicare premiums are based on your taxable income levels. Roth conversions increase your taxable income. If your taxable income increases into the next threshold, you may have increased your Medicare Part B premium amounts. This is called the Income Related Medicare Adjustment Amount, or IRMAA.

Also make sure to consider that you can push yourself into a higher capital gains rate as well. For most families, capital gains will have federal taxes assessed at 15%, but if your taxable income is high enough—like in a year of a large Roth conversion—you may push into the 20% bracket instead.

A back-door Roth contribution is another way to get money into tax-free status if you earn too much money to qualify for regular Roth IRA contributions. But be careful, these have been on the chop block here in Washington, DC.

While they’ve not yet been prohibited, they may be revisited by law makers and there’s no guarantee they won’t make the rule retroactive, potentially requiring back-door Roth contributions performed in 2022 to be reversed. This isn’t something you want to have to fix, so just wait until December again before considering the backdoor, and make sure you understand the rules and implications.

Finally, I suggest working closely with your accountant and financial planner to properly coordinate the various complications of doing a conversion, transfers, tax payments, and subsequent reinvestment in the Roth.

The decision of whether and how to complete a Roth conversion is nuanced to individual circumstances, so make sure you’re analyzing these decisions within the context of your retirement plan. Mistakes can be costly and difficult to correct, and this decision should be a part of your overall strategy. After all, it’s not just your money, it’s your future.