Inflation is at a 40-year high and workers must plan for a retirement that could last more than 30 years. That leads to the question: Does the 4% rule for retirement spending still work in today’s environment?

A panel of financial experts discussed the challenges of retirement planning today and whether the 4% rule still makes sense during a webinar on Wednesday.

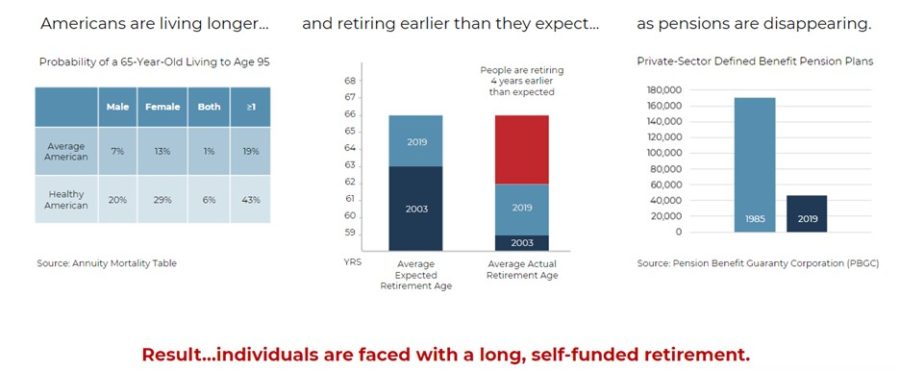

“Planning for retirement has never been more challenging than it is today,” said David Lau, founder and CEO of DPL Financial Partners. He pointed to the triple threat of Americans today living longer than previous generations, people retiring earlier than they expected and fewer people having pensions. “All of this is a real challenge when a client must self-fund a retirement that could last 30 or 35 years.”

“There is no way to describe how awful this year has been” in looking at the performance of various asset classes through the third quarter of 2022, said David Blanchett, adjunct professor of wealth management at The American College.

He noted that bonds can no longer provide reliable income as they once did. In addition, retiring in a down market can derail a retirement plan, putting a retiree at risk of depleting their portfolio while still needing income. Anxiety about running out of money during retirement can lead retirees to underspend their retirement savings.

“Of all the times people need help, this is an example of it,” he said.

The 4% rule is a rule of thumb that suggests retirees can safely withdraw the amount equal to 4% of their savings during the year they retire and then adjust for inflation each subsequent year for 30 years. But the panelists said that traditionally “safe withdrawal” rule doesn’t necessarily work in today’s environment.

“Four percent is not a bad starting place,” Blanchett said. “The problem is that it is an incredibly generalized rule. It should be a very basic starting point but it’s used more by advisors today than it ever was intended for.”

Lau gave some of his objections to the 4% rule.

“The 4% rule is not meant to be a retirement plan. It’s meant to be the guideline for a retirement plan,” he said. “It is meant to be a piece of the retirement plan and provide guidelines for how to withdraw income from the portfolio. The 4% rule doesn’t take your client’s risk tolerance into account. And finally, you can’t have a strategy built around only one aspect of someone’s retirement – their portfolio.”

Another retirement risk – the down market

The sequence of returns risk is one of the biggest risks in retirement, Lau said.

“If you retire in a bear market, that’s a problem,” he said. “If you retire in a bull market, that’s a good thing. You can have clients who have done really well and done all the right things, but if they retire in a bear market, that’s a big problem.”

He provided an example of two retirees: one who retired as the market was going down and another who retired three years later as the market was going up.

“If person who retired in the bear market and ran out of money had retired three years later in a bull market, they would end up with more assets than they started with,” he said.

Components of modern retirement planning

Retirement has evolved over the years, with everything from interest rates to complexity changing, Lau said. Retirement planning strategy has evolved as well to keep up with those changes, with the traditional move from equities to bonds and funding retirement from yields evolving to the current strategy of staying in equities and having to sell the principal to supplement yields.

“Now your client has to get into much riskier investments to fund their retirement,” he said. “Complexity is very high. The execution risk of delivering a 4% withdrawal is a very complex way of generating income. Equities were not designed to generate income. Variability used to be low – you knew what your income would be. Now variability is high. Your client’s income is now dependent on the market. But having that being the premise of their entire retirement plan doesn’t sit well with a lot of people.”

Another issue that can throw a wrench into a client’s retirement plan is having to retire earlier than planned.

Blanchett said the average American retires three years earlier than they plan to.

“If your client plans on retiring at a particular age but then is faced with having to leave the workforce because of their health or a layoff, the result can be devastating,” he said.

Annuities could be an answer

Equities frequently take the place of a pension in many retirement portfolios. But annuities might make more sense, Lau said.

“Annuities fund retirement income more efficiently than bonds do,” he said. He showed an example of how annuities compare with bonds in funding an income stream.

“Annuities have both low asset volatility and low income volatility,” Blanchett said.