You’re probably tired of hearing about it. Save money! Pay down debt! Invest for retirement! There is a reason why as a young worker you’re hearing so much about it. There’s one thing you have that older workers do not: time.

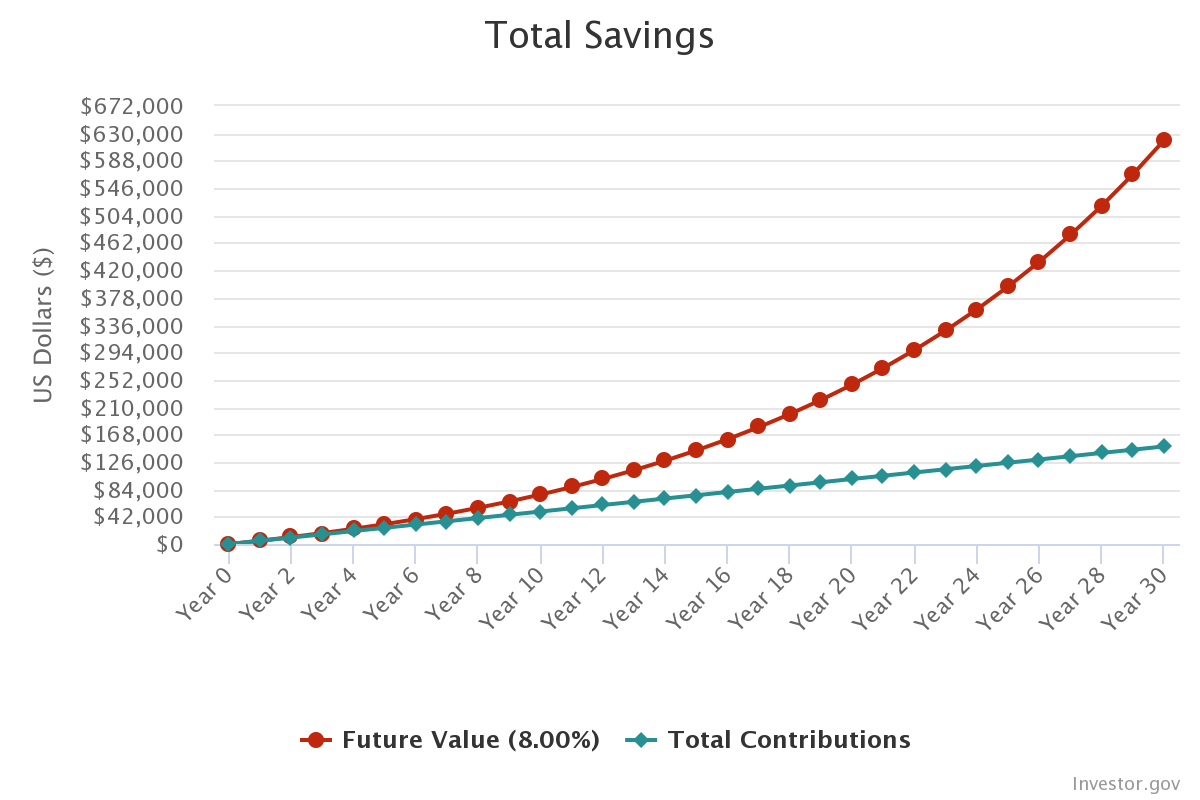

It doesn’t matter that you may not be making as much, because investing when you are young can make up for lack of money. Investing just $100 a month in a retirement account like a Roth individual retirement account (IRA) can net you over $630,000 by the time you retire.

The magic of compound interest

Compound interest is how you grow your wealth over time. It’s the interest you earn on your initial deposit and accumulated interest from previous periods. It is “interest on interest.” Albert Einstein once called it the 8th wonder of the world. Here is why.

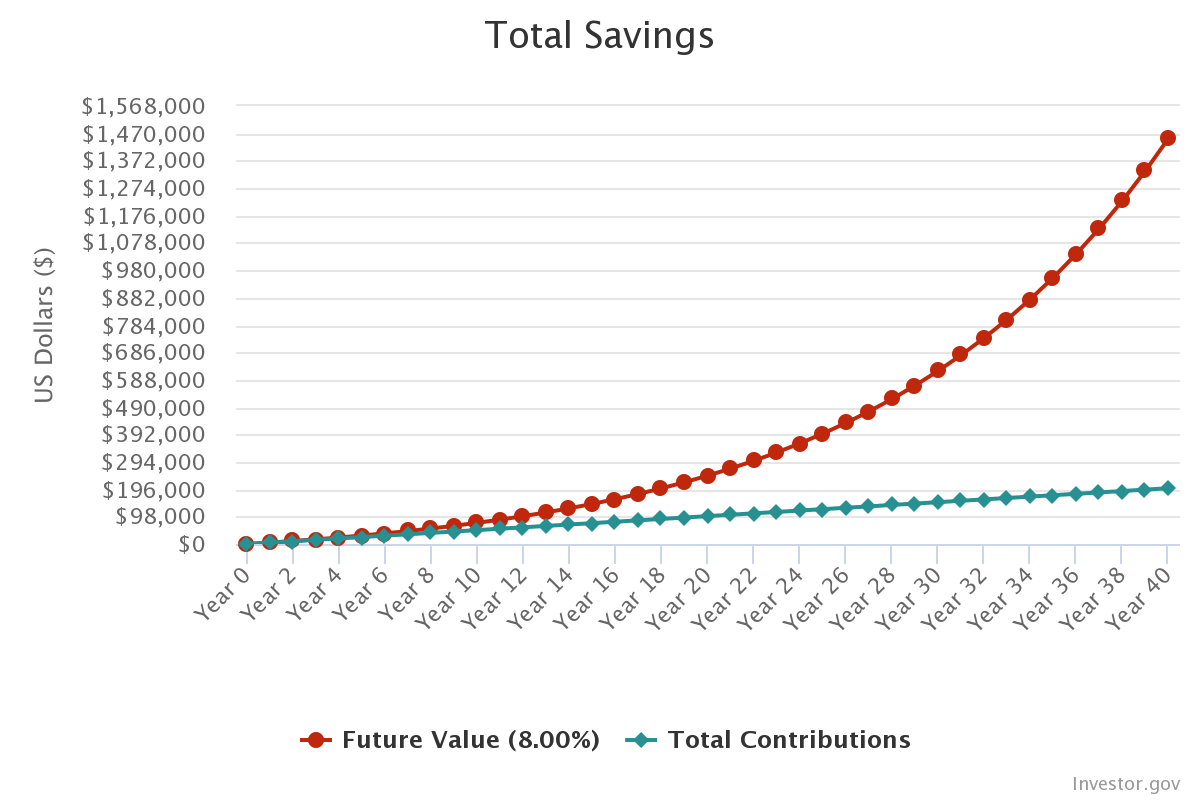

If two people invested the same amount of money ($5,000) each year, earned the same interest rate (8%), and stopped saving once they hit retirement (62), one would end up with more than twice as much as money just by starting at 22 instead of 32.

- Investor who started investing at 22 by age 62 would have: $1,452,259.26

- Investor who started investing at 32 by age 62 would have: $619,989.53

In other words, the investor who started saving 10 years earlier would have over $830,000 more at retirement. That is the power of compounding, and the importance of starting young.

A small amount can go a long way

Compound interest can substantially grow your savings even if it is a small amount. The key is to start with something, even if it is $20 per paycheck. Try to save a little more over time. When you get a pay raise, it’s tempting to spend on new things and raise your standard of living. A better bet is to keep your standard of living the same and sock away any pay raise you get.

The goal is to make saving an automatic habit. Three out of four millionaires said that they invested a regular and consistent amount of money over a long period of time. They didn’t become millionaires overnight. Only 5% attained that feat in less than 10 years. It took the vast majority 28 years to become a millionaire, and the average age they hit that milestone was 49.

If you can save $50 per paycheck, assuming you get paid twice a month, that would be $100 a month. If you are 22 and earn 10% in a retirement account like a Roth IRA, by the time you retire at 62, you would have over $630,000. Want more? Bumping that amount to $200 a month would result in about $1,265,000. Saving $350 a month would be $2.2 million!

When it comes to how much money you are able to earn while investing, the most important factor isn’t how much money you invest or the interest rate, but time. The longer the time horizon, the more you can take advantage of compound interest. Using an IRA, 401(k), or another retirement account will boost your savings even more. It doesn’t take much to become a millionaire as long as you are disciplined and save regularly. The best time to invest may have been in the past, but the second best time to invest is now.