Stock Markets

The stock markets started off the year with an impressive rotation where growth sectors, including technology and discretionary stocks experienced a sell-off while the value sectors such as energy and financials held steady. Overall, stock prices descended from their record highs at the start of the week’s trading. Simultaneously, longer-term bond yields ascended. The growth and technology stocks, particularly the Nasdaq Composite, reacted adversely to expectations of higher interest rates. The increase in the implied discount on future earnings caused the Nasdaq Composite to plummet to its biggest weekly loss in almost a year. Within the S&P 500 Index, the technology and health care shares suffered the most, whereas the energy shares surged upward due to the rise of domestic oil priced toward the $80 per barrel level. Financial stocks also outperformed the rest of the market.

Although the S&P 500 climbed to a new high on Monday, only five of its 11 sectors realized any gains. Tesla accounted for most of the gains due to having reported more fourth-quarter deliveries than expected. Heavy-weight stocks accounted for most of the S&P’s outperformance because without the gains recorded by Tesla, Apple, and Amazon.com, all mega-caps in the index, the S&P 500 would have been unchanged for the day. The stellar performance on Monday notwithstanding, investor sentiment headed south on Wednesday after the release of the minutes of the Federal Reserve’s meeting held on mid-December. The minutes disclosed that faster and more aggressive increases in the interest rates are contemplated by the policy-makers, with the first quarter-point hike in the official rate to be announced by March.

U.S. Economy

The 10-year Treasury yields rose by 0.40 percentage points over the past week, reaching around 1.75%. The rise in yields commenced early in the week, but it was enhanced when the Federal Reserve released its minutes on Wednesday. The minutes implied that not only was the Fed contemplating speeding up its balance-sheet tapering process, but it was also allowing the balance sheet roll-over and decline earlier than previously anticipated. The market was surprised by the possible sudden liquidity drop in the system, especially in areas with higher valuations. The move reduced the margin for speculative assets in the new environment.

The recent unemployment rate appears to be improving and getting near the natural rate of unemployment set by the FOMC. There appears, however, some underlying concerns by the Fed as to whether the recovery will be broad and inclusive (to bring down the elevated levels of the Hispanic and African American unemployment rates), the participation rate will pick up, and the effects of coronavirus uncertainty on labor. Given these concerns, the Fed cannot possibly conclude that the labor market is in the clear, and therefore might not want to aggressively restrict monetary conditions unless more conclusive labor data emerges.

When the Fed meeting took place on mid-December, it is important to note that the extent of the omicron spread was not yet factored in. Due to recent developments, there are indications that consumption may have slowed, as travel and leisure activities have decreased in reaction to the spread of the variant in the U.S. It is less likely that the Federal Reserve will be included to adopt more aggressive measures in light of the slowing economy and elevated virus impacts.

Metals and Mining

On Friday, gold prices moved up from their three-week lows, in reaction to slower-than-expected U.S. jobs growth data for last month. This was despite the Federal Rate signaling faster rate hikes that initially set gold up for a weekly fall. Gold prices are highly sensitive to rising U.S. interest rates, which tends to increase the opportunity cost of holding a non-yielding asset such as bullion. The reaction of gold prices implies that the market is more concerned about the coming inflation risks prior to the FOMC meeting. Surging COVID-19 infections also appear to take its toll on investor optimism about economic recovery.

The spot price of gold dipped this week by 1.78% from $1,829.20 to $1,796.55 per troy ounce, The spot price of silver also fell this week by 4.03%, from $23.31 to $22.37 per troy ounce. Platinum slid 0.68% from $968.75 to $962.20 per troy ounce, and palladium gained slightly by 1.59% from $1,904.84 to $1,935.20 per troy ounce. Base metals were also mixed for the week. Copper lost by 0.76%, dipping from $9,720.50 to $9,647.00 per metric tonne. Zinc pulled back 0.03% to close at $3,533.00 from the earlier week’s $3,534.00 per metric tonne. Aluminum, on the other hand, gained 3.81% from $2,807.50 to $2,914.50 per metric tonne. Finally, tin rose by 2.49%, from the previous week’s $38,860.00 to this week’s close at $39,826.00 per metric tonne.

Energy and Oil

Positioning for their largest weekly gain in three weeks is oil prices. Protests that have taken place in Kazakhstan have highlighted the fragile crude supply situation. The uncertainty of the immediate impact of the riots has pushed Brent prices significantly higher than the $80 per barrel level, even if the actual results of the unrest are difficult to estimate. Supply disruptions appear to be firmly on the table, considering that Libya is not likely to resolve its political dilemma anytime in the near future. It will most likely keep one-third of its nominal output frozen for an extended period. The rising crude prices are progressively reflecting the current oil production constraints, with Russian crude production stagnating for the last two months already.

Natural Gas

In recent days, the liquefied natural gas prices have surged in reaction to the lifting of price caps by the Kazakh government on the first of January. This sparked the initial demonstrations in a remote oil town on the coast of the Caspian Sea. The town is located in the oil-rich Mangistau region that provides roughly 25% of the country’s oil production. Uncertainties linked to this location will certainly impact natural gas prices in the region and possibly the world.

In the closing weeks of 2021, natural gas deliveries to the U.S. liquefied natural gas export terminals reached record levels. As the LNG facilities increased production to meet the surging demand in Asia and Europe, natural gas deliveries averaged 11.8 billion cubic feet per day (bcf/d) in December.

World Markets

European shares corrected downwards in light of concerns that the central banks are likely to wind down asset purchases and increase interest rates at an accelerated pace to control rising inflation. The pan-European STOXX Europe 600 Index closed the week 0.32% lower, although the main equity indexes in Germany, Italy, and France realized subtle gains. The FTSE 100 Index in the U.K. rose by 1.36% on the back of a rally by banks and energy stocks, involving industries where some of the largest capitalized stocks are included. The core eurozone bonds rose in tandem with the U.S. Treasury yields The minutes of the Federal Reserve’s meeting in mid-December indicated that a faster pace of rate hikes is needed. This resulted in a broad sell-off in developed market government bonds. Core yields surged on Friday in speculation of the rise in eurozone inflation data. UK gilt yields followed tracked core markets. The peripheral eurozone bond yields also increased as part of the global sell-off, although it faced additional upward pressure from reports of new supply in Italy. Furthermore, the coronavirus infections in Europe reached record levels, forcing countries to reimpose COVID restrictions although they fell short of instituting lockdowns.

Japan’s stock exchanges ended mixed for the week. The Nikkei 225 Index dipped 1.09% and the broader TOPIX Index advanced 0.17%. On the coronavirus front, the government placed three prefectures under quasi-states of emergency due to rising COVID-19 cases. Restrictions were returned for the first time since September 2021. Regarding monetary policy tightening by the Federal Reserve, worries about more aggressive measures announced by the Fed weighed down the prices of technology and other growth stocks. The yield on the Japanese 10-year government bond climbed to 0.14% from 0.07% at the close of the week earlier. This tracked the general rise in bond yields, holding around the high levels seen in April 2021. The yen weakened against the dollar to approximately JPY115.83 from the previous week’s close at JPY 115.11. Continuing weakness in the yen due mainly to the divergent monetary policy stance of the Bank of Japan compelled the Japanese Finance Minister to underscore the need for currency stability and the careful tracking of market movements that impact the economy.

In China, stocks ended lower for the week, with the CSI 300 Index descending 2.3% and the Shanghai Composite Index losing 1.7%. Causes may be traced mainly to the turmoil in the property sector and the more restrictive measures announced by the Federal Reserve in the middle of the week. The yield on China’s 10-year government bonds climbed to 2.837% from the 2.793% one week earlier, as investors factored in a reduced yield premium between China and the U.S. In currencies, the yuan weakened against the dollar in its largest weekly drop since the middle of September, reflecting the anticipated U.S. monetary tightening. The Chinese currency fell to a three-week low of 6.3832 against the U.S. dollar before it recovered to 6.376.

The Week Ahead

The PMI index and hourly earnings growth are among the important economic data to be released in the coming week.

Key Topics to Watch

- Wholesale inventories (revision)

- NFIB small-business index

- Consumer price index

- Core CPI

- Federal budget

- Beige book

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Producer price index

- Retail sales

- Retail sales excluding autos

- Import price index

- Industrial production

- Capacity utilization

- UMich consumer sentiment index (preliminary)

- Business inventories

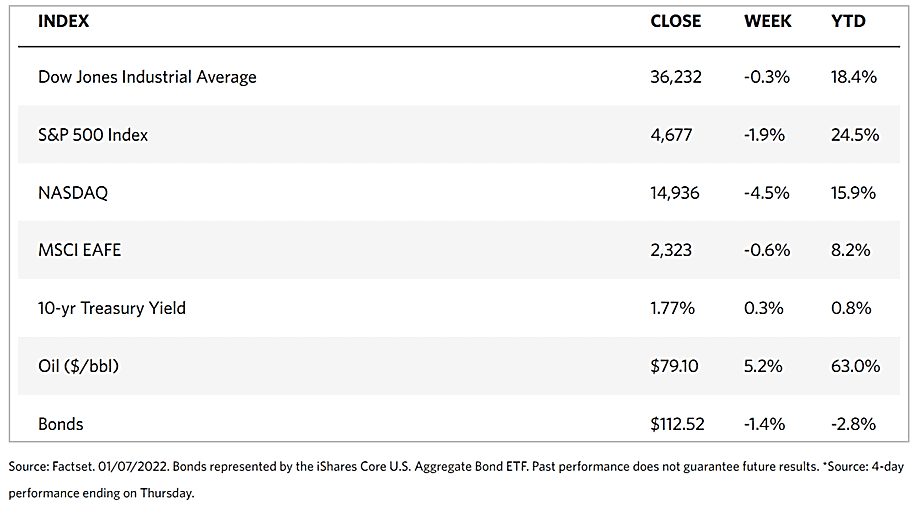

Markets Index Wrap Up