Stock Markets

Most of the major equity indexes ended slightly lower, although the small-cap Russell 2000 Index managed to eke out a slight increase. This is a sign that investors appear unsure about the future direction of the market and the economy in general due to the conflicting signals they are receiving from environmental sentiment, policy statements, and emerging economic indicators. Although the economic data being released appear encouraging, concerns remain unabated regarding supply chain challenges, elevated valuations, and the market’s response to the eventual tightening in monetary policy. Within the S&P 500, energy shares rose because of the rising oil prices even as resilient auto-related shares lifted stocks in the consumer discretionary sector. Meanwhile, the small materials and utilities sectors underperformed. For most of the week, trading volumes were restrained, although the expiration of options and futures contracts were expected to lift transactions on Friday. The sluggishness earlier in the week was attributed in part to weakening hopes that a stimulus package is forthcoming.

U.S. Economy

The recent Consumer Price Index (CPI) released during the week appears to indicate that inflation may be on the rise, impacting everything, including consumer goods, commodities, houses, and other durables. Notwithstanding the CPI report, inflation appears to have slowed down in August due in part to the transition of the base effects, referring to the year-on-year comparisons moving past the lowest points of the pandemic. The slowdown of inflation is also due somewhat to the alleviation of the mismatches between supply and demand. While core inflation remains high, it eased last month to 4%, down from June’s 4.5%. The markets should welcome this as a sign that the rise in consumer prices is indeed temporary, as announced by the Fed. Monetary policy may thus remain to be accommodative, fending off speculations of eventual tightening.

- Over the past year, there has been an almost 20% increase in housing prices due to demand overtaking supply. New buying trends have been fueled by the pandemic, with the work-from-home trend driving preference for suburban locations and remote work spaces. The robust demand for housing combined with the recovering economy and consumers’ healthy financial condition will continue to support the housing market. Consumers have enough credit capacity to drive home purchases, with the household debt-service ratio remains close to record lows. Current debt costs as a percentage of disposable income stand at only 8%. Supply will eventually catch up with demand for housing and ease the rising home price increases.

- Corporations are expected to realize more robust earnings growth over the next four quarters. In the second quarter, corporate profits grew year-on-year by 92%, and expectations are for the average annual earnings growth rate to be 22% for 2021 and another 9% in 2022. Furthermore, although long-term interest rates are forecasted to gradually rise as the economic expansion gains momentum, at present, interest rates still remain at their historic lows. For the coming year at least, the Fed is unlikely to adopt any monetary tightening that would increase interest rates. Therefore, the above-average equity market valuations will continue to be supported by the continuing low0interest -rate regime. If the economy continues to expand, monetary policy remains accommodative, and corporate earnings growth is sustained, it is likely that the pre-pandemic bull market will resume its course.

Metals and Mining

The price of gold fell by $40 during the week, seeming to affirm a bearing market for gold in the coming week. Gold hit its lowest in four weeks, descending from a high of $1,790 per ounce to $1,750 per ounce following more solid U.S. retail indicators. This news has captured investors’ attention because of the possibility that tapering may be adopted sooner than expected, depending upon the Fed’s interest rate announcement next week. Analysts observe that a short-term downtrend is in place and gold, together with the other precious metals, does not seem to be responding to the usual drivers and is instead focused on the macro indicators.

Gold closed the week at $1,754,34, down 1.86% from $1.787.58 per ounce week-on-week. Silver dropped 5.69%, from the previous week’s close at $23.74 to yesterday’s close at $22.39 per ounce. Platinum ended the week at $942.79 from the earlier week’s close at $960.75 per ounce, registering a 1.87% loss. Palladium ended in the same direction, losing 5.68% when it closed this week at $2.017 per ounce from the previous week’s $2.138.37 close.

Base metals generally went in the same direction as precious metals. Copper spot price fell 3.95%, closing this week at $9,312.00 per metric tonne from the earlier week’s close at $9,694.50. Zinc lost nearly 1% from the previous week’s close of $3.119.00 per metric tonne to this week’s close at $3.088.00. Aluminum slid 1.32% to close this week at $2.885.50 per metric tonne from the previous $2,924.00 close. Tin outperformed the rest, gaining 1.66% week-on-week from $33,583.00 per metric tonne to $34,140.00 this week.

Energy and Oil

Slowly the U.S. Gulf of Mexico is one more opening up and restoring production that was temporarily interrupted. At present, approximately 25% of oil output remains offline. However, speculation of further supply draws in the U.S. has turned market sentiment negative, bringing Brent prices down to the $75 per barrel level. Further supply disruptions will only worsen the market constraints in the next few weeks. The growing oil demand of the recovering economy may continue to outpace incremental supply, although the OPEC+ continues to increase their production output and add more barrels to the market. Meanwhile, China’s oil consumption is forecasted to peak at 16 million barrels per day (mbpd) at around 2026.

Natural Gas

If China’s natural gas consumption is an indication of the future market for natural gas, it appears that increasing demand may continue for almost two more decades. Consumption of natural gas in China is expected to reach its maximum level much more gradually than oil, at about 2040, according to China’s leading refiner, Sinopec. For this report week beginning September 8 and ending September 15, natural gas spot prices rose at most locations. The Henry Hub spot price ascended to $5.60 per million British thermal units (MMBtu) by the week’s end from its beginning at $4.78/MMBtu, indicating a narrowing supply situation in the natural gas market. Internationally, prices are surging, with swap prices for October LNG cargos rising to an average of $18.69/MMBtu for the week in East Asia. This exceeds the previous record high arrived at in January 2021. At the most liquid European natural gas spot market,, the Title Transfer Facility (TTF) in the Netherlands, prices averaged $17.96/MMBtu over the week, the highest weekly average on record since September 2007. It is higher by $2.56/MMBtu from the previous report week’s average price of $15.40/MMBtu. During the same period, average prices were $4.34/MMBtu and $3.11/MMBtu in East Asia and the TTF, respectively.

World Markets

European equities slumped as continuing worries about COVID-19’s delta variant and its impact on the global recovery superseded expectations that the central bank continues its supportive policies. The pan-European STOXX Europe 600 Index closed the week lower by 0.97% in listless trading, although major indexes were mixed. Germany’s Xetra DAX Index dipped 0.77%, and France’s CAC 40 Index slid 1.40%. Italy’s FTSE MIB Index, on the other hand, realized modest gains. The UK’s FTSE 100 Index followed the direction of Germany and France with a 0.93% loss. Core eurozone bond yields rose as it took its cue from U.S. Treasuries, together with a report by the Financial Times that the European Central Bank (ECB) will be meeting its 2% inflation target by 2025. So far, it is on target to raise interest rates over the next two years, which is significantly ahead of consensus expectations. UK gilt yields rose on reports that inflation rates rose in August, igniting worries that further movement in this direction will likely prompt the Bank of England to raise interest rates ahead of expectations.

Japanese stocks surged over the week, posting their fourth weekly gain in a bid to catch up with the world’s bourses. The Nikkei 225 Index ended 0.39% higher, and the broader TOPIX Index climbing 0.41%. The increasingly enlivening political market is gaining traction with the start of campaigning for the presidential race for the ruling Liberal Democratic Party (LDP). The winner will succeed Yoshihide Suga as Japan’s next Prime Minister. Regarding the pandemic, Shigeru Omi, the country’s top coronavirus adviser, declared that the peak of the 5th COVID-19 wave has mostly passed.

Nevertheless, he warned that a close watch should be maintained over Japan’s medical system. The coronavirus restrictions are expected to be loosened in November, when a majority of the population would have been vaccinated. With this optimism, the yield on the 10-year Japanese government bond rose to 0.05%. There was little change in the yen’s exchange rate to the dollar, remaining at JPY 109.9.

China’s stock market fell precipitously for the week as investor sentiment was weighed down by lackluster August economic data, combined with a new outbreak of COVID-19 in Fujian province, a worsening debt crisis for property developer China Evergrande Group, and speculation of constricting gaming regulations in Macau. The CSI 300 Index of large-cap stocks lost 3.1% of its value while the Shanghai Composite Index fell 2.4%. The sell-off may be partly due to players closing their positions ahead of a shortened trading week. China’s stock markets are closed on Monday and Tuesday in celebration of the Mid-Autumn Festival. Trading resumes on Wednesday. Yields on China’s bonds remained unchanged for the week. The renminbi (RMB) lost 0.2% against the U.S. dollar.

The Week Ahead

In the week ahead, criticaleconomic data expected to be released are the Fed Funds Target upper bound, the PMI composite, and Housing Starts, among others.

Key Topics to Watch

- National Association of Home Builders Index

- Building permits (SAAR)

- Housing starts (SAAR)

- Current account

- Existing home sales (SAAR)

- FOMC statement

- Fed Chair Jerome Powell news conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- Leading economic indicators

- Real household net worth (SAAR)

- Real nonfinancial debt (SAAR)

- New home sales (SAAR)

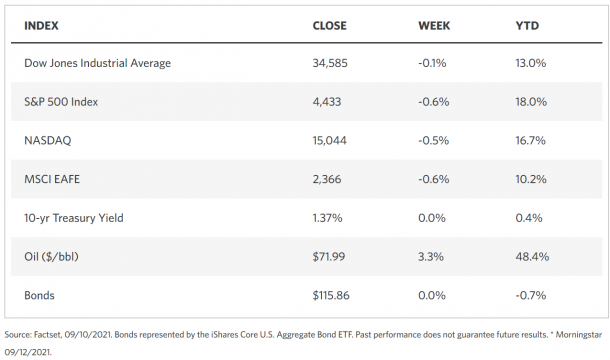

Markets Index Wrap Up