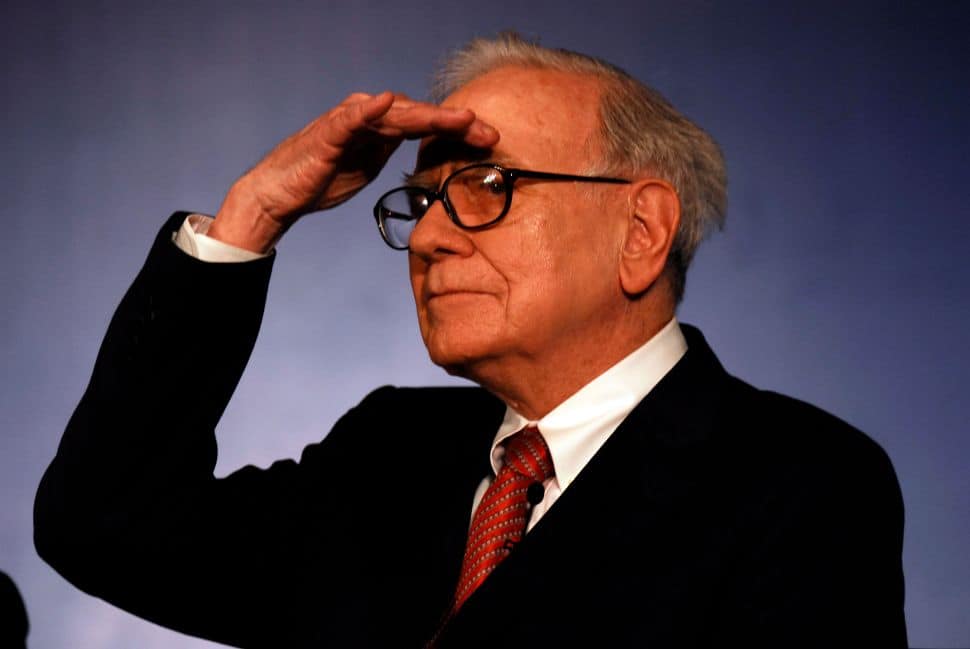

Warren Buffett warned people not to think investing is an easy way to make a fortune as he answered a variety of questions at the annual meeting of his conglomerate Berkshire Hathaway.

Speaking in Los Angeles, the legendary billionaire investor said it could be tough to pick the long-term winners. He pointed out that in 1903 there were more than 2,000 car companies, and nearly all of them failed, even though cars have transformed the country since then.

“There’s a lot more to picking stocks than figuring out what will be an incredible industry in the future,” said Buffett, who is 90. “I just want to tell you that it’s not as easy as it sounds.”

The meeting was held online for the second year running because of the pandemic. It was hosted on the west coast for the first time, rather than at the company home in Omaha, to accommodate Buffett’s California-based vice-chairman, Charlie Munger.

Buffett has said that most people will fare better by owning an S&P 500 index fund instead of betting on individual stocks. He said many of the novice investors who jumped into the market recently and drove up the value of video game retailer GameStop are essentially gambling.

Stock trading platforms that allow people to buy and sell stocks for free, such as Robinhood, were only encouraging a “gambling impulse”.

“There is nothing illegal to it, there’s nothing immoral, but I don’t think you build a society around people doing it,” he said.

He spent several hours answering questions on Saturday afternoon alongside Munger and fellow vice-chairmen Greg Abel and Ajit Jain.

The executives held forth on a variety of topics at the meeting, including the policies of the Federal Reserve and the stimulus packages passed by Congress, which Buffett said have done a good job of propping up the economy and keeping interest rates low.

He said the government clearly learned lessons from the Great Recession in 2009 and acted quickly in response to the pandemic, but it was hard to predict the long-term consequences of those policies.

“This economy right now – 85% of it is running in a super-high gear and you’re seeing some inflation and all that. It has responded in an incredible way,” Buffett said.

On the value of cryptocurrencies, Munger said he did not welcome a currency that was “so useful to kidnappers and extortionists… Nor do I like shovelling out a few extra billions and billions and billions of dollars to somebody who just invented a new financial product out of thin air. I think I should say modestly that I think the whole damn development is disgusting and contrary to the interests of civilization.”

Buffett said he did not regret selling off Berkshire’s $6bn stake in all the major airlines last year, even though those stocks have grown significantly since he sold them last spring. Buffett also said he thought the airlines might not have been able to secure as much government aid as they have during the pandemic if they still had “a very rich major shareholder like us”.

Berkshire, which is based in Omaha, Nebraska, has a $145.4bn in cash and short-term investments because Buffett has struggled to find major acquisitions for the company for several years.

One investor, Cole Smead, said he would love to see the company get more active the next time the market swoons.

“We do not question whether Buffett and Munger have patience. That’s obvious. The question is do they have any aggression. That’s not obvious,” Smead said.

Buffett, who is 90, said he wanted to invest more of Berkshire’s cash, but the current competition he faced from private equity and other investment funds had made it difficult for Berkshire to find reasonably priced acquisitions. He said that a year ago, it was hard to predict how the economy would respond to the pandemic and all the government stimulus.

The meeting has become a legendary event over the years, drawing a crowd of up to 40,000 investors to Omaha.

Author Bob Miles said he missed “mingling with like-minded and self-selected shareholders” and talking with executives who run Berkshire subsidiaries who routinely spend part of the meeting in their company’s booth in the huge exhibit hall that adjoins the arena.

Berkshire companies such as Geico insurance, See’s Candy and Fruit of the Loom sell their products to shareholders each year.