How much should my mortgage be?

The main thing you and your lender should care about isn’t the total mortgage amount. Rather, you should focus on monthly mortgage payments and whether you can easily afford them.

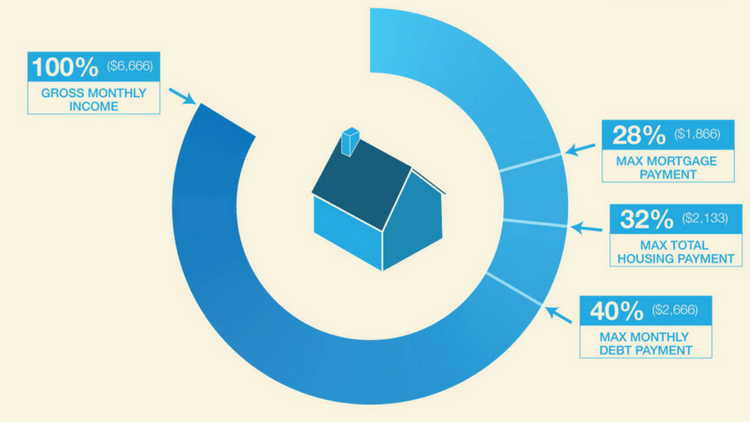

Lenders use your debt-to-income ratio (DTI) as a measure of affordability. And they see a 36% DTI as an excellent one.

Ideally, that means your monthly debts including the mortgage payment aren’t more than 36% of your monthly income. But lenders can be flexible, so if your DTI is a little higher, don’t worry.

The trick is finding the right loan amount and mortgage program for your situation. Here’s how.

Mortgage payments and income

Your mortgage should be an amount you can comfortably afford in your monthly budget. So when determining the right loan size, you have to work backward — find the right monthly payment first, and calculate the home price based on that number.

When it comes to monthly payments, one number is key in determining what you can afford: your debt-to-income ratio.

Of course, other factors matter too, like your credit score, mortgage rate, and down payment.

But DTI has a huge impact on affordability. So it’s important to understand how mortgage lenders look at this number.

What is your debt-to-income ratio (DTI)?

Your DTI is the percentage of your gross (pre-tax) monthly income you spend inescapable financial obligations — in other words, on debt.

That includes include payments on your new home, minimum payments on credit cards, fixed payments on car loans, student loans, and other loans, and things like alimony and child support.

But your DTI does not include discretionary spending. So you should not include groceries, gas, utilities, eating out, cellphone and internet bills, and all the other spending that you can control each month.

How DTI affects your mortgage

Why is DTI key to your mortgage loan amount? Because the more you spend on debt, the less money you have leftover for your mortgage payment.

Some types of loans allow higher DTIs than others. But, with most mortgages, lenders will want you to have a DTI of 43% or less.

For example, say you have a monthly gross income of $5,000. You already pay $1,000 per month on existing debts. How much mortgage can you afford?

- Max DTI: 43%

- 0.43 x $5,000 = $2,150

- Max debt payments: $2,150

- Existing debts: $1,000

- Max mortgage payment: $1,150

Now you know you can only afford a house if the monthly payment comes out to $1,150 or less.

Remember to include property taxes, homeowners insurance, and private mortgage insurance (PMI) when estimating your mortgage payment.

Depending on your lender, a DTI above 43% may be allowed.

On some conforming loans, Fannie Mae and Freddie Mac set their maximum DTIs at 45% to 50%. And it’s possible to get an FHA loan or VA loan with up to a 50% DTI.

However, you’ll likely need ‘compensating factors’ to make up for the high DTI — like a big down payment or a great credit score.

How much should my mortgage be in the real world?

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount — because of your DTI, credit score, down payment, and personal finances — doesn’t necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum we’re allowed. But that doesn’t mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean you’re sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely don’t want to be saddled with the biggest mortgage possible if you’re in a job where firings are commonplace — or if you plan to change jobs soon and you’re not sure you’ll earn the same amount.

Lenders have these questions in mind, too. That’s why they typically want to see two years’ employment history on your mortgage application. They also want to know any income you’re using to qualify for the loan will continue for at least three years.

Mortgage payment examples

Here are just a couple examples to show you how factors like DTI and credit can affect your home buying budget.

Million-dollar home

The Mortgage Reports looked into the question, How much income do you need for a million-dollar home? And the answer revealed a surprisingly broad range of earnings.

We found that a “prime” borrower (with a small DTI, stellar credit score, and 20% down) might be able to buy a $1 million home with a household income as low as $100,000.

But someone with lots of existing debts, moderate credit, and the smallest down payment allowable could need an annual income of $225,000 to afford the same home.

How come? Well, as we just established, your income is only a part of what determines your maximum mortgage borrowing capacity.

Your debts play a big part, as do your credit score and the size of your down payment.

$100,000 salary

Similarly, we answered the question How much house can I afford if I make $100,000 per year?

Again, the answers varied widely depending on those same factors: DTI, credit score, and down payment.

Borrower 1, with a 760 credit score, no existing debts, and a 20% down payment might be approved for a loan of roughly $721,000.

But Borrower 2, with a 650 credit score, $250 in monthly debt payments, and a 15% down payment might be offered only $561,000.

That’s a difference of $160,000 in the homes these two borrowers can comfortably afford — even though they make the same amount of money.

Also remember that to get the best deal and lowest mortgage rates, you need to be in a seriously good financial position. Everyone else pays a bit — or a lot — more.

How to afford a bigger mortgage

You can afford a more expensive home by following three simple steps as you prepare to apply for a mortgage:

- Pay down some debt, especially credit card balances. Not only do you reduce your DTI, but lowering card debt should boost your credit score

- Save a bigger down payment. The more skin you have in this game, the more lenders like you. A bigger down payment often earns you a lower interest rate and/or better home

- Work on your credit score. As long as you’re paying bills promptly, credit card balances are often the main drag on your score. Each needs to be below 30% of the card’s credit limit. Also, in the months leading up to a mortgage application, you should avoid opening and closing credit accounts

Of course, these steps may be easier said than done, especially for a first-time home buyer.

How are you supposed to pay down debt and increase your savings at the same time? Often it’s a struggle to even meet monthly expenses.

But nearly everyone — at least, nearly everyone with homeownership plans — can find some economies in their household budgets. And it’s surprising how often just a small improvement in your DTI, down payment, or credit score can make a big difference to the mortgage deal you’re offered.

So do what you can. But if your financial situation isn’t perfect, don’t let that stop you. Mortgage programs today are flexible, and you might be surprised at what it takes to qualify.

How to calculate your DTI

We talked a lot about debt-to-income ratios in this article. Knowing yours is key to learning how much house you can afford.

So, in case you were wondering, here’s how you can calculate your own DTI ratio for mortgage qualifying.

First, add up all the monthly expenses included in your DTI:

- Estimated monthly housing expenses (you can use a mortgage calculator for this)

- Minimum credit card payments

- Car payments

- Other monthly loan payments

- Obligations like alimony and child support

Next, you need to know your gross monthly income.

Remember, that’s the highest figure on your pay stub, before deductions for tax and so on. If your income varies considerably — perhaps seasonally — use an average over the last year or two.

Now, divide the first figure (total monthly debt) by the second (pre-tax income).

Federal regulator the Consumer Financial Protection Bureau gives an example:

“If you pay $1,500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. ($1500 + $100 + $400 = $2,000.)

“If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent. ($2,000 is 33% of $6,000.)”

If you use a calculator, you’ll need to multiply the result by 100 to get a percentage. So your display says 0.3333 but your DTI is 33.33% (33% when rounded by your lender).

What are today’s mortgage rates?

Today’s rates are still low, which is good news for home buyers. The lower your interest rate, the more real estate you get for your dollar.

Remember, there’s no ‘perfect’ amount to spend on your home loan. The decision is personal — it depends on how much you make, how much you currently spend each month, and how large of a housing payment you’re comfortable with.

So explore your options, check your rates, and pick the right mortgage amount for you.