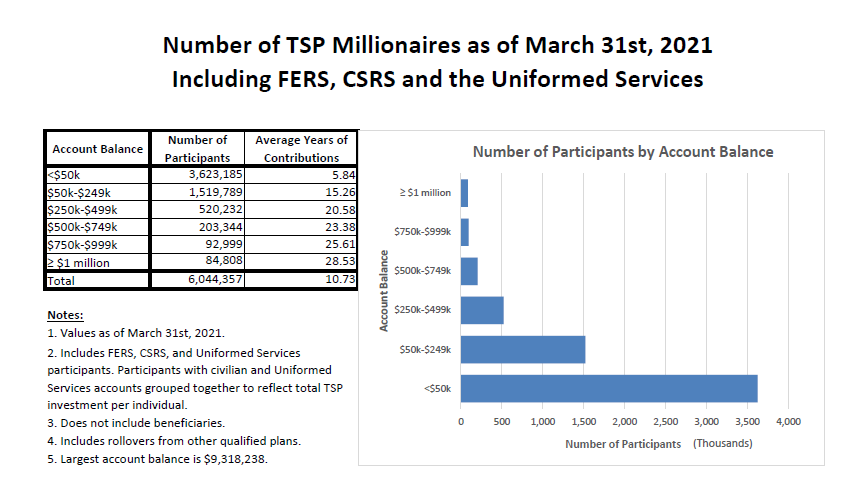

The number of active and retired feds with $1 million or more in their Thrift Savings Plan accounts has jumped to a record 84,808 as of March 31 of this year. That’s up from 27,212 TSP millionaires in March 2020.

The vast majority of TSP millionaires got there by investing steadily in the C, S and I funds — even when the markets tanked, like they did during the 2018-2019 Great Recession and the big downturn last March. The C fund tracks the S&P 500 index, the S fund is invested in the rest of the U.S. market and the I-fund is in international stocks. The TSP also has the F fund invested in bonds, and the G-fund in special U.S. treasury securities. There are also a series of self-adjusting L (lifecycle) funds that get more conservative as the account holder approaches his or her retirement date.

Early in the life of the TSP, all millionaires were elected or appointed officials who brought their outside retirements with them when they joined government. Now the vast majority of TSP millionaires did it by smart, long-term investing. The largest account balance the end of March 2021 was $9,318,238. In March 2020 it was $6.3 million.

Despite, and in some cases because of the COVID-19 pandemic the stock funds available to federal/postal/military investors have been moving steadily upward, going from 55,183 to 75,420 from September 2020 to December 31 of that year.

Equally impressive are the number of investors who have passed or are closing in on accounts worth $500,000-to-749,000 (203,444) of March, 2021, compared with 149,093 the same time a year earlier.

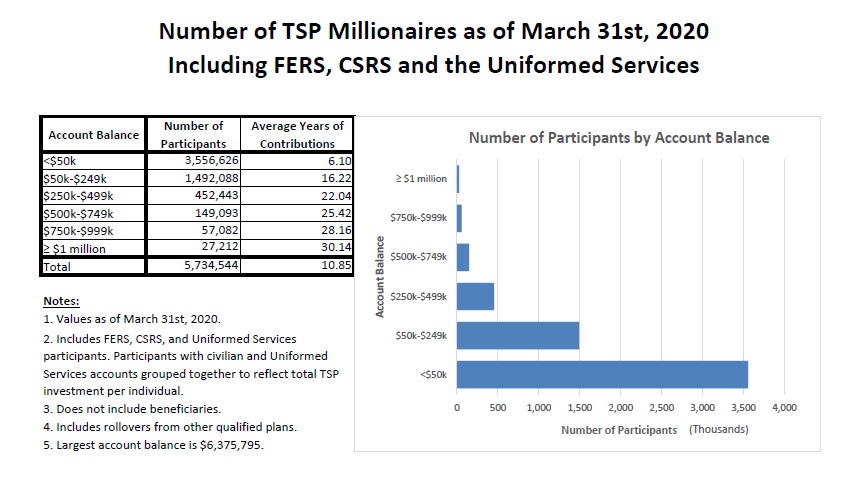

The charts below show where things stand now compared to where it was a year ago in March.

Many federal investors — too many in the opinion of many financial planners — stay in the “safe” G and F funds. While the G fund never has a loss, it often trails all the other in returns by a large margin. But many people still flee to it when the market dips, like they did in March of last year. Many who switched from stocks to treasuries during the Great Recession are still waiting for the “right” time to get back into the market.

So where are you compared to others in the giant federal 401k plan? Here’s a look at all TSP accounts as of March 31, 2021 compared with the same period last year.