The IRS is now starting to distribute the third round of stimulus checks, worth up to $1,400 per eligible adult and child. But the timing of getting a check may depend partly on a bank’s policies, with some customers of JPMorgan Chase and Wells Fargo expressing frustration after the banks said the coronavirus relief payments won’t be available until March 17.

The reason, the banks say, is due to an issue outside their control. Although the IRS started issuing payments over the weekend, the official payment date isn’t until March 17, Wells Fargo and JPMorgan Chase told CBS MoneyWatch. Wells Fargo added that it “is not holding the funds” and that it will deposit the money into accounts as soon as possible.

Yet other banks are crediting the funds to customer accounts immediately. Current, a New York-based banking startup, is using its own balance sheet to credit the funds rather than waiting for settlement. Some of its customers received access to their stimulus funds on March 12, a day after President Joe Biden signed the $1.9 trillion bill into law.

The organization that manages electronic transfers said on Monday that the IRS set the settlement date of March 17, and added that there is “no mystery” about where the money is. “It is still with the government,” Nacha, the organization that governs the ACH Network, told CBS MoneyWatch in a statement.

“This is the date on which the IRS will provide the funds to the banks and credit unions to further make available to recipients,” Nacha said in the statement. “The Nacha Rules require the banks and credit unions to make the funds available to the account holders by 9:00 a.m. local time on the settlement date; again, in this case, March 17.”

It added, “The IRS chose the date of March 17, which is the date on which the IRS intends for settlement to occur.” It added that the payments should clear into accounts at 8:30 a.m. ET on March 17.

“This is literally the moment in time when the money will be transferred from the government to banks’ and credit unions’ settlement accounts at the Federal Reserve,” the group added.

Threatening to close accounts

Some customers have threatened to quit their banks on social media, citing the delay in accessing the funds as their reason.

But Chase and Wells Fargo said the funds won’t clear until Wednesday. Wells Fargo added that it would waive any overdraft fees that occur as a result of the issue.

“Our goal is to support our customers, and we will proactively reverse outstanding Wells Fargo fees, including overdraft fees, for those who have a qualifying negative ending daily balance when their stimulus payment is deposited,” the bank said in an emailed statement.

Wells Fargo added, “As we did for prior stimulus payments, we will reach out proactively to those customers who have a qualifying negative ending daily balance on the day prior to the deposit to inform them of the specific steps we have taken, which includes providing temporary repayment deferrals”

IRS: Days to weeks

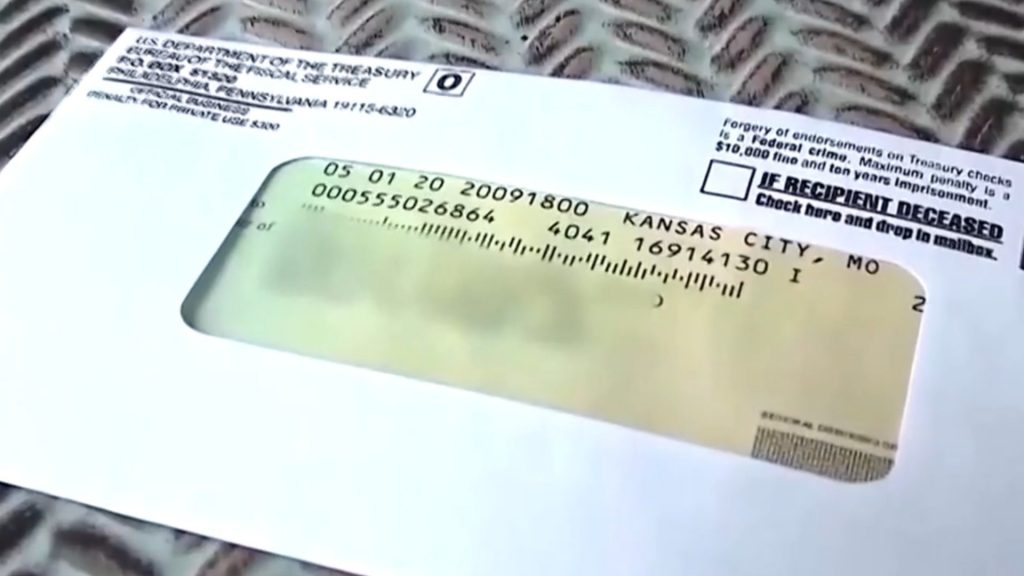

Most Americans will receive one of the $1,400 checks, but not everyone will receive a check immediately. The IRS will send the checks in batches over the next few days and weeks, although it hasn’t specified would would be the first to receive the checks.

People who have filed their 2020 or 2019 tax returns and have a bank account on file with the tax agency are more likely to quickly receive their stimulus checks through direct deposit, based on the prior payment rollouts. That’s because the IRS prioritizes getting the stimulus money out quickly to those that it knows it can reach — and it’s a massive effort, given that the tax agency has $422 billion in funds to distribute to more than 100 million taxpayers.

Most taxpayers don’t need to take any actions to receive the checks, Treasury and IRS officials said on Friday. People can also check the “Get My Payment” site at IRS.gov, which the tax agency reopened for the third round of stimulus checks.