You’ll often hear that when it comes to saving for retirement, 401(k)s offer an advantage over IRAs. And there’s certainly some truth to that.

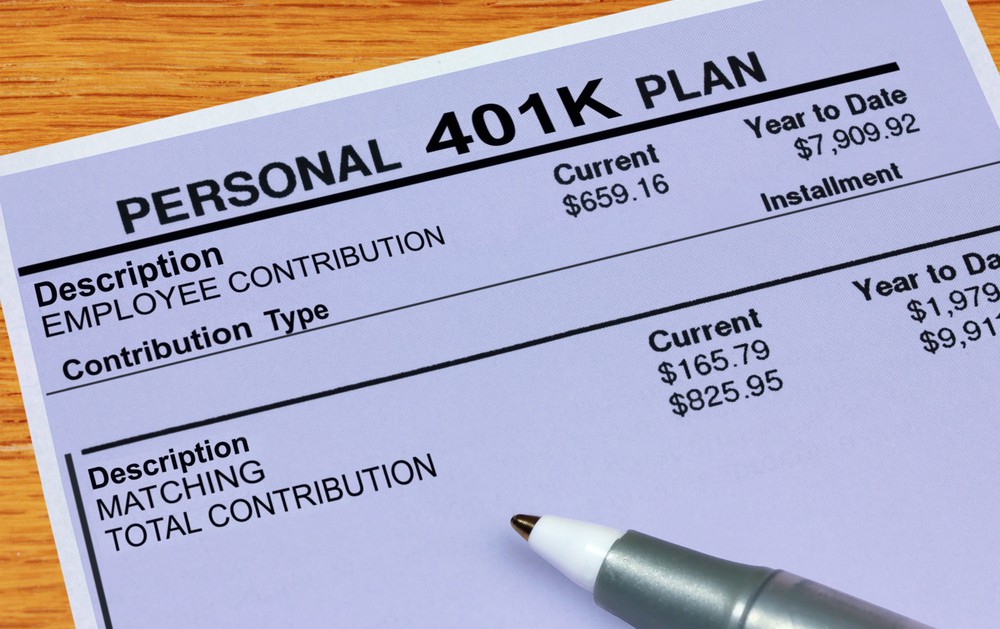

With a 401(k), you’ll get to contribute much more money toward retirement on an annual basis than you will with an IRA — $19,500 versus $6,000 if you’re under 50, and $26,000 versus $7,000 if you’re 50 or older. (These limits apply to 2020 as well as 2021.) Also, because 401(k)s are employer-sponsored, many offer an opportunity to snag matching dollars for contributing out of your own wages. Traditional and Roth IRAs don’t have matching contributions because they’re self-funded. And finally, 401(k) contributions themselves are seamless. You simply sign up with your payroll department to have funds deducted from your earnings, and voila — your account is funded.

But despite these benefits, saving for retirement solely in a 401(k) could actually limit your ability to grow long-term wealth. Here’s why.

1. High fees

Though not all 401(k)s are created equal, many charge hefty administrative fees that can eat away at your returns. And while you do get a say in the investment fees you’ll pay in the course of your savings (namely, by choosing certain funds over others), you can’t argue with the administrative fees being passed along to you.

2. Limited investment choices

IRAs let you invest in everything from index funds to individual stocks. With a 401(k), individual stocks are off the table. Rather, you’re limited to funds alone — sometimes, as little as a dozen. The problem here is twofold. First, fewer choices could make it harder to find investments that align with your strategy and contribute to the growth you’re hoping to achieve in your retirement plan. Second, you may get stuck paying high fees for funds with the best performance track record.

Now to be fair, most 401(k)s do offer a mix of costlier actively managed mutual funds as well as more affordable index funds. But having just a handful of choices could still set you back financially.

3. Auto-enrollment in target date funds

A target date fund is a fund that adjusts your investment mix as a specific goal nears. In the context of 401(k)s, target date funds start you off with riskier investments and then shift you toward safer ones as retirement nears. Many 401(k)s auto-enroll participants in target date funds when they first sign up, but that’s not necessarily a great thing. Though these funds take some of the guesswork out of long-term investing, they can also charge high fees and ultimately be too conservative, especially if you have a higher tolerance for risk.

Of course, as a 401(k) participant, you always have the option to move your money out of your plan’s default target date fund and into another fund. But many 401(k) savers don’t know to do that and wind up leaving their money in target date funds for years.

Though saving in a 401(k) can be a great way to grow retirement wealth, it’s not necessarily the best solution for you. This especially holds true if your employer’s 401(k) isn’t a particularly good plan. Rather than limit yourself to a 401(k), explore your options for saving in an IRA as well. If you’re entitled to a 401(k) match, you may want to save just enough in that plan to get that free cash and then put the rest of your money into an IRA. There are different solutions you can play around with, but the key is to not assume that a 401(k) — or, more specifically, your 401(k) — is automatically the best bet.