Stock Markets

Stocks finished the week higher, capping the shortened July 4th holiday week. The second quarter also saw the Dow Jones having its best quarter on record since 1987, closing up 17.8%. Favorable jobs data came in as confirmed cases of coronavirus reach record highs and some states begin to suspend or reverse reopening plans. Analysts believe the better-than-expected economic news, coupled with the worsening pandemic, shows an economic recovery is taking shape but there is still some distance to go before the economy can pick up full steam.

US Economy

We’ve reached the halfway mark in 2020. If you’d glanced at the stock market on Jan. 1 and then not again until June 30, you’d see it was down a modest 4%. But as we are all well aware, that doesn’t even begin to tell the story of the first six months of this year.

The first half of 2020 contained an all-time high for stocks, a global pandemic, the deepest recession since the 1930s and the sharpest bear market drop on record, followed by a market rally that included the fifth-strongest quarterly gain in the postwar era. Analysts believe the U.S. economy is in the early stages of its recovery. They say the initial rebound will take shape more swiftly given the unique nature of this environment in which the economy is being reopened, unleashing a certain amount of pent-up demand from consumers. They expect positive GDP in the second half of the year.

While the economic restart will foster the initial recovery, analysts don’t expect output to return to pre-pandemic levels swiftly. They think the reopening of the economy will proceed in a “two steps forward, one step back” fashion as new cases and hotspots slow reopening plans and certain industries and regions experience lingering impacts.

Metals and Mining

The gold price enjoyed another week of gains — mixed sentiment had some investors storing the safe haven, while others opted for more risk. Edging closer to US$1,800 per ounce mid-week, the yellow metal hit a seven year high on Wednesday, when it rallied to US$1,788.90. Gold futures passed the US$1,800 mark this week. The first week of the third quarter also saw silver in the green, while platinum struggled and lost ground. The base metals were a mixed bag, with all but lead trending higher.

Having added over 1 percent to its value this session, gold is expected to hold above US$1,750 on steady increases to total global coronavirus tallies. Silver also spent the period in the green, on track for a fourth week of gains. The white metal broke the US$18 per ounce threshold on Tuesday. Rising to US$18.40, silver has now achieved pre-COVID-19 lockdown price territory. After dipping below US$18 briefly on Thursday, silver is progressing towards a month of steady gains. Platinum also performed positively this session following a month of declines. On Wednesday, the catalyst metal climbed as high as US$822 per ounce, its highest value since May 21. Palladium was also in the green on Friday morning, after trending lower for most of June. Prices had been slipping since mid-May, falling as low as US$1,799 per ounce.

In the base metals space, copper pulled ahead this week as industrial demand in China experienced a reinvigoration. Starting the week at US$5,957 per tonne, the red metal had added just over 2 percent to its value by the end of session. Lower-than-expected job loss data out of the US also helped prop up prices of the industrial metal. Copper was trading for US$6,080 on Friday. Zinc faced some headwinds, causing volatility in the price. Following a mid-week dip that saw nickel fall to US$12,555 per tonne, the metal was able to regain lost ground to end the week higher. Lead was the only base metal to end the week in the red. Starting the first week of July at US$1,783 per tonne, the price fell to US$1,761 mid-session. By the end of the week, lead had edged slightly higher, but was still below its Monday (June 29) value.

Energy and Oil

Crude oil hit four-month highs on Thursday, aided by a tightening market and a better-than-expected U.S. jobs report. The caveat is that the jobs survey took place before the latest Covid-19 wave and the associated closures. Analysts still expect oil to face resistance to any further gains. “Gasoline has carried the load on recovery and demand, and it’s not clear whether that could continue into August and September,” Andrew Lebow, senior partner at Commodity Research Group, told media. Oil prices retreated during midday trading on Friday. OPEC+ is scheduled to ease production cuts beginning in August, and sources say that the group will likely refrain from an extension. Saudi Arabia also reportedly put pressure on Nigeria to increase its compliance. On Thursday, Russian energy minister Alexander Novak reiterated that position. “At present, there are no decisions to prepare any changes…Next, under the current agreements we should have a partial restoration of the volume of reductions starting August 1,” he said, according to TASS. Russia is set to cut oil exports to Europe to just 900,000 bpd in July, the lowest level since 1999, as supplies from elsewhere continue to gain market share. U.S. oil, in particular, has gained a foothold. Saudi Arabia and Kuwait have restarted production at the Al-Khafji oil field in the neutral zone between the two countries. Natural gas spot prices rose at most locations this week. The Henry Hub spot price rose from $1.48 per million British thermal units (MMBtu) last week to $1.58/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the July 2020 contract decreased 4¢, from $1.638/MMBtu last week to $1.597/MMBtu this week. The price of the 12-month strip averaging July 2020 through June 2021 futures contracts declined 8¢/MMBtu to $2.286/MMBtu.

World Markets

European stocks rose through Thursday on encouraging news related to the development of a potential coronavirus vaccine and improving economic data. In local currency terms, the pan-European STOXX Europe 600 Index ended 2.11% higher for the first four days of the week. Germany’s DAX Index rose 3.33%, France’s CAC-40 Index added 2.41%, and Italy’s FTSE MIB Index gained 3.11%. The UK’s FTSE 100 Index increased 0.58%.

Purchasing managers’ indexes (PMI) for manufacturing in the eurozone continued to show significant improvement with the easing of lockdown restrictions. The June flash manufacturing PMI rose to 46.9 from 39.4, exceeding expectations. Manufacturing in the UK returned to expansion in June, with the flash PMI rising to 50.1 from 40.7. Eurozone inflation quickened to 0.3% in June from 0.1% in May, although core inflation slipped to 0.8% from 0.9%.

Stocks in China rallied for the week until Thursday after several data points suggested that the economy was firmly recovering after a historic contraction in the year’s first quarter. On Thursday, the blue-chip CSI 300 Index closed at its highest level since January 26, 2018, while the benchmark Shanghai Composite Index rose to its highest close since January. China’s sovereign 10-year bond yield was broadly flat for the week until Thursday.

Investor sentiment brightened after two separate gauges showed a pickup in the country’s manufacturing sector: On Wednesday, the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) rose to a six-month high reading of 51.2 in June from May’s 50.7. The privately administered Caixin survey came a day after China’s official manufacturing PMI rose to a three-month high of 50.9 in June, its fourth straight month of a reading above 50, which signals improving conditions from the prior month. Meanwhile, car sales in China surged 11% in June from a year ago for the third straight monthly gain, according to an industry group.

The Week Ahead

Important economic news coming out next week includes the Markit PMI Composite index, domestic auto sales and Consumer Credit data.

Key Topics to Watch

- Markit services PMI (final)

- ISM nonmanufacturing index

- Job openings

- Consumer credit

- Initial jobless claims (regular state program)

- Continuing jobless claims

- Wholesale inventories

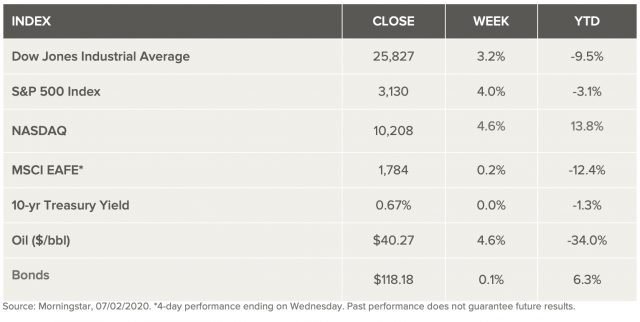

Markets Index Wrap Up