The Federal Reserve’s economic outlook isn’t so much pessimistic as it is uncertain, with expectations running a wide gamut from a plodding recovery to a sharp rebound.

If that sounds a lot like the market lately, it’s probably not a coincidence.

Following its two-day meeting earlier this week, the Fed released its Summary of Economic Projections for GDP, unemployment, inflation and interest rates. The estimates largely reflected the current unprecedented downturn followed by expectations for varying levels of growth ahead.

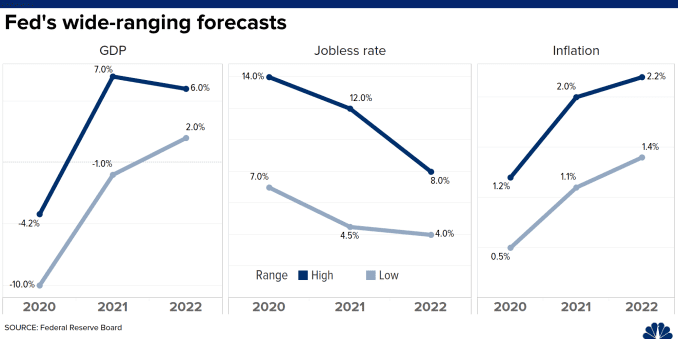

Specifically on GDP, which measures goods and services produced and is the broadest yardstick for economic growth, the median figures in each of the three years for which estimates were provided masked wide disparities of views from the policymaking Federal Open Market Committee’s 17 members.

For 2020, the median expectation was for a GDP decline of 6.5%. But that was merely the midpoint of forecasts that ranged all the way from -10% to -4.2%.

The difference gets even more pronounced in 2021, where the median is a 5% gain but the range goes from -1% — in essence, a continuation of the recession that started in February 2020 — to a 7% gain, which would be the fastest one-year growth rate since 1984.

The outlook for unemployment and inflation all showed a substantial disparity of opinions.

Such wide spreads over what the future holds now seem written in the financial markets and particularly stocks, which on Thursday suffered their worst one-day plunge since late March and now suddenly look wobbly after a stunning 2½-month run higher. The surge came against a bevy of jaw-dropping economic numbers that showed how much damage the pandemic has caused.

“They’ve been pretty honest and straightforward about the high level of uncertainty that they see around how the economy’s progressing, which is nice,” Kathy Jones, head of fixed income for Charles Schwab, said of the Fed policymakers.

“We all know the second quarter is the trough and things will get better and the market is trying to discount that,” she added. “But I think the markets got pretty carried away.”

Powell notes ‘high level of uncertainty’

Indeed, Fed Chairman Jerome Powell has been emphasizing that even with all of the rescue funding that the central bank and Congress have been providing, the strength of the recovery is largely dependent on the path of the coronavirus.

Powell even noted at the end of this week’s meeting that the SEP readings should be viewed cautiously. Because so much was unknown, the Fed declined to provide the quarterly summary at its main March policy meeting but elected to do so this week even with abundant questions about the future.

“Given the unusually high level of uncertainty about the outlook, many participants noted that they see a number of reasonably likely paths for the economy and that’s not possible to identify with confidence a single path as the most likely one,” Powell said Wednesday, noting that the SEP was “a full range of plausible outcomes and not one particular forecast.”

At a time when fears of a second round of Covid-19 infections are heightened, the Fed’s sketchy outlook helped precipitate a wicked Thursday market slide that was only partially offset by a Friday rally that continued to weaken as the day progressed. President Donald Trump weighed in Thursday, saying the Fed is “wrong so often” even though its 2021 forecast is for the fastest pace of growth since Ronald Reagan was president.

The Fed offered no additional policy tools to help guide the economy through what promises to be a murky road ahead, only assurances that short-term benchmark interest rates would remain anchored near zero through at least 2022.

The SEP “showed a remarkably wide range of potential outcomes for the American economy over the next 2 years,” wrote Nick Colas, co-founder of DataTrek Research. “Despite that, the Fed did not announce anything new [Wednesday] aside from some assurance that it will not employ negative interest rates.”

Markets for the moment are no longer pricing in a chance that the Fed in fact would go to negative rates anytime soon, despite persistent speculation that it might follow the example of Europe and Japan if things continued to deteriorate.

But the chasm of economic expectations between officials serves as a reminder of how in flux the future can be, even as investors continue to price in a best-case scenario.

“In the end, equity markets have made their bullish bet about future corporate profits specifically and the state of the US economy more generally,” Colas said. “Even a Federal Reserve with an unabashedly uncertain outlook will not change that much.”