Retiring wealthy is on everyone’s mind, yet there are very few people who actually manage to save and grow their money well enough to retire with an easy mind. As expats, this can be harder, especially if you’re supporting family back home.

Expats in the UAE have a prime opportunity to earn and save tax-free while enjoying a high quality of life. HSBC’s Expat Explorer Survey of 2019 ranks the UAE ninth overall among best countries to live and work in for expatriates. Given that UAE residence is contingent on employment for most, preparing for retirement either in one’s home country, the UAE, or another country is critical.

Why and when to start preparing for retirement

Life is only going to get more expensive as time goes on and you won’t be able to work in direct employment forever.

So, even if you’re 20 and starting on your first job, or 50 and close to wanting to retire in a decade, you must start thinking of money matters now.

In fact, research shows that youngsters have more saved for retirement. Recently published research shows that, compared to Gen X and Baby Boomers, millennials (aged between 24 and 41 now) have better retirement plans. One-fourth of all the millennials in America, according to Bank of America’s 2020 Better Money Habits Millennial Report, already have $100,000 (roughly Dh367,000) in their retirement savings account.

For many, retirement is a comfortable bank deposit account while for others it may be a valuable set of assets such as property which could make income or be sold for profit. While there is no fool proof method to create a sustainable retirement nest, there are diverse options available.

Ask yourself these first

Assets and liabilities – What is my net worth? Income and expenses – How much can I save?

These four aspects and two questions will show your financial position and your ability to retire comfortably.

Assets

Sit down with a pen and paper or an Excel worksheet, and jot down everything you own.

Use realistic market values for your car, house, and property here or back home, jewellery, etc. Also jot down money saved in banks, fixed deposits, insurance policies and investments. Don’t forget to note down any inherited wealth.

Liabilities

From ongoing large debts like your car loan, any mortgage and personal loans to smaller credit card debts – list out every single penny you owe and the existing payment plan for each. Having the payment plan detailed out enables efficient budgeting for further debt management. Be brave and put ‘none’ in case you don’t have a payment plan, we will get to all of it.

Also lay out your credit card debt in ascending order if you have multiple credit cards – for families, include the entire list of credit cards in use. Why the ascending order? The smallest debt is going to be the easiest one to pay off, so it helps to have it in that order.

Include any payment installments (that you arranged for big electronic or gold purchases) on each card separately, and the cancellation policy for each – some cancellations may cost you, so having that in writing can help remember the nitty gritty of it all.

Income

If you’re sitting down to start saving, combining household income is your best option. This will reduce the burden to save from one person and also ease liabilities. When jotting down income, don’t forget to include any rental income (from property back home) or dividend income from investments that come directly to your account.

Expenses

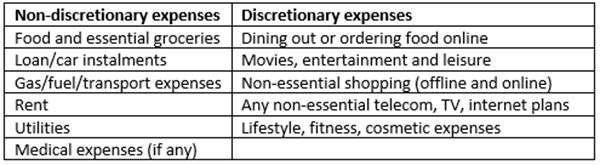

Categorise your expenses into discretionary and non-discretionary – ones you can avoid and the ones you can’t.

This table can help you decide where to nip spending if in a pinch and also lays out how much you could actually save.

First, start cutting

After the initial listing, you would now know exactly what is eating up all your money. If it is a non-discretionary expense, there isn’t much you could do, except maybe change your situation. For example, if your rent is more than 60 per cent of your income, moving to a more affordable area might be wise. Look at the reason you spend that amount and see if the reason is worth the expense.

However, if you have a Dh300 telecom plan that you may not be utilising completely, that is something you could cut. Do you use all that data, do you really need 1,000 minutes or maybe, as we found out, you could get more benefits for less? Cancelling a telecom contract will now only cost you one month’s rental, so take the leap and downsize.

Do the same thing for each expense – can you spend less and get equal or more value for a lower amount. If you eat out a lot, try 2-for-1 coupon books or websites; for gym rats, maybe you could get a cheaper plan or a closer gym; in terms of daily taxi fare or gas, ride to work with your friend and share expenses.

Even if you don’t immediately start cutting, calculating your savings using these methods can demonstrate exactly how much you can save and if it’s worth the cutting.

You cannot save if you have debt

A truth that many of us forget when starting out to save is that debt, more often than not, eats into any small savings you make. Unresolved debt can pile up with interest and create a burden that you might try to pay out of savings.

So the first thing to do is to pay off debt while starting on saving.

There are methods identified and recommended by financial experts on tackling debt and ‘snowball’ is one of them. The snowball method focuses on tackling debt, all at a time, finishing them off from smallest to largest. List all your debts, except home mortgage, in an ascending order along with interest rates and minimum payments.

If you have Dh1,500 that you can save in a month, check how much of that you can use to try and completely pay off one debt, while paying off a minimum on the others. It is also key to ensure that no additional debt is taken on – pay off every expense as it comes and avoid any big unnecessary purchases.

Another way to tackle debt is to attack the one with the highest interest/profit rate first.

Sample

John has a credit card debt of Dh10,000 on one credit card with a monthly fee of Dh300, and Dh15,000 on another card with a minimum of Dh300. After all his expenses and automated loan payments, John realises he has Dh1,500 in hand. Looking at his debt, he decides to tackle his Dh10,000 credit card and gives himself 12 months to do it.

According to a simple calculator, he must pay at least Dh1,134 to attain this goal. In addition to this, he should pay the minimum required (Dh300) to cancel out the fee on his other card. At the end of the first 12 months, he can pay off his Dh10,000 in full while ensuring debt on the other card doesn’t grow exponentially owing to the fee.

Next, to pay off Dh15,000 on his second card, John should pay Dh1,550 to tackle debt and the monthly fee, eliminating it in another 12 months.

Key tips

- It is okay to set a longer goal if it is more achievable based on your income/expenses.

- Anything you have left after paying each month’s debt should be saved in an account separate from the one you use often – you can create an e-savings account within your bank account.

- Ask your creditor or bank the right questions – ask for a lower rate or free consolidation of debts.

- Don’t settle for one opinion given by a tele-seller. Ask around on whether you are paying too much on the loan.

Sample

Sheena had credit card debt of Dh13,000. She was paying her minimum amounts (around Dh600 each month) but noticed after a few months that her debt didn’t seem to be reducing.

After calling customer care, she found that the card had a Dh550 monthly fee if outstanding debt was not paid in full. The minimum she paid, Dh600, only covered Dh50 of the loan each month.

Her customer care executive suggested she pay Dh2,700 each month for six months to cover the monthly fee and a part of the debt (Dh2,166) each month. However, after hanging up, Sheena realised she would end up paying Dh3,300 as fees in addition to paying off what she owed.

Looking at other options, Sheena called her bank. All she had in hand was Dh2,000.

She was told that she could get an immediate cash-on-call advance of Dh8,000 on the remaining credit card balance. She would have to pay back Dh1,383.3 per month on this for six months, including a monthly fixed fee of Dh50.

On pay day, Sheena added Dh3,000 to her savings of the last month (Dh2,000) and activated her cash on call of Dh8,000 bringing up total available cash to Dh13,000 – with which she paid off her entire debt in one go. Since she activated the cash on call in January, her first payment of Dh1,383 showed up on her next billing cycle in February giving her breathing room for the next payment.

At the end of six months since starting the payback towards cash-on-call, Sheena has no debt and only paid Dh300 as fees (Dh50 per month) instead of the initially suggested Dh3,300 (Dh550 each month) in the same time period.

Start saving today

Debts, expenses, income are all variables that can change, so you should ideally start saving today. While you pay your debt and manage your expense, your savings should still grow, even if it’s at a minor rate.

We spoke to Steve Cronin, UAE-based founder of the blog Dead Simple Saving, about the ideal time to start saving and he said, “It’s never too late to save, but you may need to really boost income and slash expenses if you haven’t saved much in your 40s, 50s or 60s.”

Talking about expat savings in the UAE, Cronin told Gulf News, “There are too many ways to spend your money here, and we are away from home, working hard. Don’t try to keep up with your neighbours! They probably bought everything on credit cards and will soon slink off to the airport, broke.”

But how much should I save/earn?

The savings depend on various factors, including goals, age, income, etc.

Retirement destination

For many people, the retirement destination might be their home country. However, some people may decide on a different country owing to lower costs of living, healthcare and better housing. Based on the destination, your retirement goal will change. Numbeo, which aggregates statistical data pertaining to cost of living, rent, etc., is an easy way to start your research.

In 2020, for example, Numbeo’s ‘cost of living plus rent’ index features Switzerland in the top spot with the highest costs. In Asia, Hong Kong is the most expensive place to live in 2020, while Pakistan and India feature at the lower end of the index.

The index uses New York as the base for cost measurement at 100 per cent, and Switzerland falls at 87.89. UAE’s spot is 19 from the top with an index of 51.98, while India at spot 130 marks an index of 15.54 – both in comparison to New York city expenses of living and rent.

So to start your retirement fund, decide where you want to retire and how you want to live. After the goal is set, you can start saving and investing with a focus on that destination.

The ‘World’s Best Places to Retire in 2020’ report released by International Living, with inputs from expats, is a good place to start looking for destinations for retirement other than your home country. This year, Portugal, Panama, Costa Rica, Mexico, Colombia, Ecuador, Malaysia, Spain, France and Vietnam make up the top 10 on the list.

Retirement expenses by destination

Cronin said, “Think how much you want to live on in retirement – cheaply in Thailand or expensively in New York? Multiply that by 25 and that is how much you need invested in a portfolio of stocks and bonds to retire on.”

Talking in annual figures, this amount will also then have to be adjusted for inflation and readjusted if your situations change.

For instance, based on the Global Retirement Index in 2020, living in Vietnam costs an average of US$1,500 a month for two people. For one person, this would mean Dh2,752 a month and Dh33,030 a year. Multiplying this by 25, as per Cronin’s suggestion, would mean a goal of Dh825,750 for retirement without inflation.

Cronin added, “For every 10 years retirement is away, multiply the portfolio size by 1.2 to account for inflation. If you have real estate income, you can subtract that income from your retirement expenses so you need a smaller investment portfolio.”

For a 40-year old who wants to build up a nest egg for Vietnam, for example, would need Dh1,307,988 on retirement (at 65) in invested money (accounting for inflation for 25 years). This would mean monthly savings and earnings amounting to Dh4,360 each month.

Per cent of annual/monthly income

As a general rule, retirees spend less than their last drawn annual income because responsibility for saving and expenses reduce after retirement. 85 per cent of annual income each year after retirement is considered an average starting point for planning savings. However, if you plan to retire in an expensive city or intend to travel, this percentage can go as high as 100 per cent of your last drawn income.

We used a couple of online calculators to find out what the ideal saving/earning percentage should be.

Our sample person is 30 years old, expects to retire at 65 and earns Dh120,000 a year now. Aiming to spend 80 per cent of current income after retirement, which means he or she needs Dh8,000 a month post retirement. He or she has a life expectancy of 100 and zero savings. Inflation is calculated at roughly 3 per cent, rate of return on investment at 7-8 per cent and around 3 per cent in post-retirement returns. All other variables such as critical illness, unexpected situations and market conditions have not been taken into account.

Based on an average of all the results we got, this person should aim to save at least 20 to 25 per cent of his or her current salary (at least Dh2,000 to Dh2,500 each month) for this to happen.

In each of these calculations, don’t forget to account for your current net worth that you noted down in the very beginning.

Not just saving, grow your money

“Socking away recurring small amounts with a conservative rate of return is going to change nobody’s life and they’ll be working till they’re 60. We are living in a tax-free environment and we should make the most of it”, Cronin said.

Growing money involves investments and nowadays a lot of products are available to grow one’s money over time based on each person’s risk appetite.

Safety nets

After paying off high-interest debt, create an emergency fund(s) to ensure you are not strapped for liquid cash should the need arise. The amount saved should be placed in a flexible deposit or easy-to-access account. For example, some banks in India offer flexible fixed deposits with a higher rate of return than regular savings with terms of six months, each time extendable with compounded interest.

The first fund can be a cash buffer, to manage any sudden unplanned expense that arises. Cronin advised a cash buffer amounting to 3-6 months’ of total expenses.

After this, one should focus on goal-focused funds. This could mean a short-term life goal such as getting a car, or getting married. While you learn how to invest and grow your money, put a bulk of savings in these funds and then add contributions over the years.

Stock investments

Cronin suggests investing everything left over after savings and emergency funds, at least 50 per cent, “in a mix of global index-tracking stock ETF (exchange-traded fund) and global bond ETF.”

As defined by Investopedia, an exchange-traded fund (ETF) is a basket of securities that trade on an exchange, just like a stock, and tracks an index. The advantage here is that ETFs are a great way to diversify your investments at lower costs and less management.

If you’re starting small and don’t have the confidence or the time to go it alone on investments, using a robo-advisor like Sarwa could help. Sarwa is an all-digital and low-cost investment platform based in the UAE, which is perfect for the investor of today. You could start with a free Starter account with a minimum balance of $500 or Dh1,835. The advantage for UAE expats in using platforms like Sarwa is the accessibility to international investment funds at costs that are affordable.

Speaking about UAE expat struggles he has seen or faced himself, Cronin said, “It is very hard to find out how to invest your money cheaply and easily as an expat. Large investment platforms like Vanguard and Charles Schwab do not want to deal with us. You need to open an offshore brokerage account with a broker like Interactive Brokers or Saxo Bank. Then invest in global index-tracking ETFs.

“It’s never been easier to do this by yourself and don’t let any financial advisor tell you otherwise…” he added.

Cronin recommended a shift in portfolio on retirement and said, “As you get closer to retirement, this [investment in ETFs] should move from about 80 per cent stocks to 60 per cent stocks. Then when you reach your target portfolio size, you can retire and take out 4 per centof that portfolio size each year (adjusted for inflation) to live on. Don’t be surprised if you retire many years earlier than you expected!”

Then there are other products that offer investment elements such as certain life insurance policies.

However, Cronin explained that fees and costs of some of these are so high that your money doesn’t grow at all.

People are persuaded by commission-driven financial advisors to invest in long-term savings plans and whole life insurance. Often they are invested irresponsibly and are expensive to get out of. Just say no! There is a reason they have been banned in most developed countries

– Steve Cronin

“People are persuaded by commission-driven financial advisors to invest in long-term savings plans and whole life insurance… Often they are invested irresponsibly and are expensive to get out of. Just say no! There is a reason they have been banned in most developed countries,” he added.

Real estate and assets

Investing in real estate is a great idea for expats, especially once the retirement destination is set. For example, buying a house or investing in a property in the retirement destination could mean either rent-free retirement or additional income or profits pre and post-retirement. The kind of property you invest in would depend on what your objective for the investment is.

You could start making money right away from renting the property out as vacation rentals or yearly rentals, or the investor could pocket gains by investing in increasing the value of the property before selling it.

Some countries also give residency and citizenship benefits based on such investment. The simple way to analyse rate of return from property is to divide the income from the property by the purchase price. For example, for a property that costs Dh1,000,000, if you anticipate rental income of Dh84,000 a year, the rate of return is 8.4 per cent. This would change based on the location, value of the property.

Insurance

A good insurance policy can ensure that you don’t pay out of your retirement fund in case of a critical or terminal illness, or accidents. If your chosen retirement country does not have good healthcare benefits, choose a well-suited policy ahead of retirement so that you can account for premium payments in your retirement portfolio. Some life insurance policies also offer critical illness cover.

Travel

If your retirement plan involves travel, the fund needed would be exponentially higher. In this case, it is better to plan ahead and save for the specific travel goals separate from your retirement fund. For business travel, retiring in a city that is a travel hub can have its advantages in terms of competitive air fares and ease of travel.

Retiring in the UAE

For many expatriates, the UAE is home. However, since residence is tied with employment and income, many expats choose to return to their countries of origin after retirement.

In September 2018, the UAE Cabinet approved a law to provide retired residents over the age of 55 a long-term renewable residency visa for a period of 5 years. The criteria for eligibility and renewal are financial, as the applicant should have at least one of these:

- Property investment worth Dh2 million

- Financial savings of no less than Dh1 million

- Active income of no less than Dh20,000 per month

The gold card is another viable option for retiring in the UAE. A ‘gold residency visa’ or ‘gold card’ grants the holder five or 10 years of residency in the UAE, the renewal of which is subject to certain terms and conditions. The visa extends to the sponsored family members of the holder as well.

This option is open to UAE-based individuals including business people, ‘talented’ individuals in various fields such as sports, arts, etc., innovators, scientists and other specialised professionals, and high-income executives.

*This is an informative guide meant for educational purposes only. Financial planning should be done based on individual requirements and factors based on the advice of a qualified financial advisor.