As economists scratch their heads, the surprise gain of 2.5 million jobs in May shows that markets were right to bet on an improving economy.

The one-month employment gain was the largest on record, and an amazing contrast to Wall Street’s forecast of deep job losses of 8.3 million payrolls. The unemployment rate fell to 13.3%, from 14.7%, instead of rising to near 20%, as expected by the Dow Jones forecast of economists.

“The market has clearly leaned into the reopening narrative. The country is gradually reopening and you’ve seen that in a rotation into the economically sensitive sectors. Clearly thus far, that’s been the correct posture,” said Art Hogan, chief market strategist at National Securities.

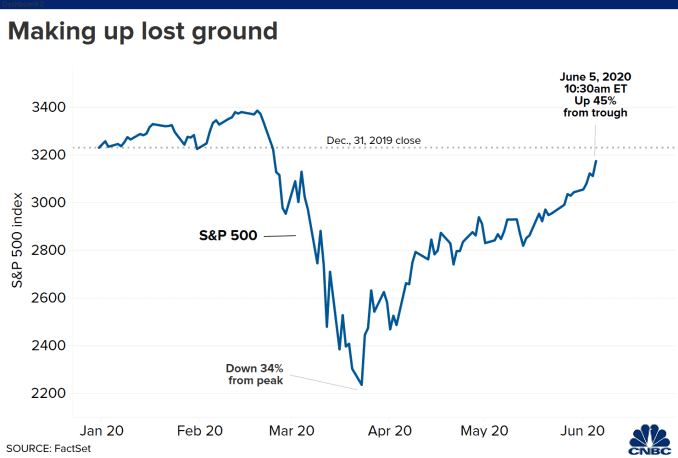

The S&P 500 surged after the report, and it is more than 46% above its March 23 low. In recent weeks, investors have been increasingly putting money into the sectors that were most beaten down, like airlines, or would do best in a recovery, like financials and industrials. Airlines were up 30% in the first four days of the week, with half the move Thursday on news American Airlines, United Airlines and Southwest were adding back routes for the summer.

“The transports have been telling us the story long before yesterday’s airlines bonanza. The transports have been telling us for the last two weeks that the economy was picking up,” said Hogan. “Sometimes you have to listen to what the market is telling us more than the tone of the news. We’ve had social unrest and demonstrations in every major city. It’s hard to separate that and the emotions you have from what’s truly the economy.”

Industrials and financials led stocks higher Friday morning with gains of 5.5% and 4.8%, respectively. Real estate was also strong, up more than 3.5%. The Dow Jones Transports zoomed ahead by 5%.

Consumer staples, communications services and health care, groups that rose when investors bet on a stay-at-home trade in March and April. Stocks like Netflix surged when investors bought companies that would benefit from people staying at home. That stock was up just 0.1% Friday.

The big difference this week came when the bond market finally began to participate in the reopening trade. Yields, which move opposite price, had been rising, but began to move higher much more quickly after ADP reported job losses of 2.76 million in May, about 6 million less than expected. The 10-year Treasury yield has moved from about 0.70% Wednesday morning to as high as 0.95% right after the Friday jobs report, released at 8:30 a.m. ET.

“It’s good for risk. It’s bad for fixed income if you start to entertain the idea that the Fed might not be on hold forever now,” said John Briggs, head of strategy at NatWest Markets. He said the 1% level on the 10-year, which influences mortgages and other loans, would be psychologically important. The 10-year is at its highest level since March.

“This jobs report is great news. It suggests people are getting their jobs back, but you still have a long way to go. You have tens of millions of Americans that are still unemployed,” said Ed Keon, chief investment strategist at QMA. Keon said the rise in bond yields is good news for the markets.

“It’s positive. That’s what you’d expect if the economy was improving,” said Keon. “Maybe the value rotation has some legs. Banks have been doing better. Economically sensitive stocks have been doing better. This rotation towards value, often predicted and not seen, may have some legs.”

Keon said the market move appears to have some momentum behind it, but he is still cautious, based on the fact valuations have risen so much. “We’re benefiting from the market’s rise, but we’re not all in,” he said. Keon said he monitors news on the virus closely, since a total recovery is not expected until are able to move about freely and travel again. He said it’s positive in that the number of deaths have fallen in the past week.

The economy still has a long way to go now that it appears to have bottomed. The number of unemployed Americans remains large, with 21 million people still out of work in the May report, a number that lines up closely with the number of people receiving unemployment benefits in the weekly continuing claims data. In the past 11 weeks, 42.6 million claims have been filed for unemployment benefits.

The number of people who were temporarily laid off fell by 2.7 million to 15.3 million. The government revised its numbers for March to 1.4 million job losses from 881,000, and April’s job losses rose to 20.7 million from 20.5 million.

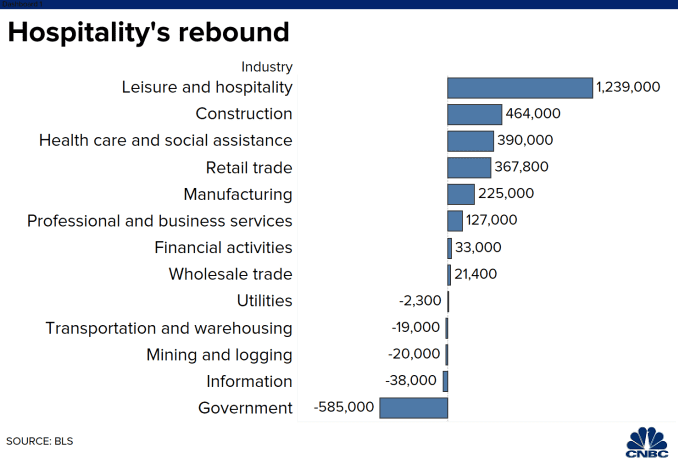

“The good news is this looks like this was rehiring people coming off the temporary unemployment,” said Diane Swonk, chief economist at Grant Thornton. “It’s also the PPP [Payroll Protection Program]. Those PPP jobs are also coming through in leisure and hospitality, and we saw some contribution in education and health care, but the losses were still large in state and local governments.”

Swonk said while the report was very positive news for the economy, it needs to be treated with caution since the economy is coming off a very low level and the spending data still reflects a very deep recession.

Some of the job gains by sector parallel the improvement in cyclical stocks. Leisure and hospitality added 1.2 million jobs, following a decline in March and April of more than 8.2 million. Construction gained 464,000, after losing 995,000 in April.

Employment also increased in health care by 312,000, with dentists gaining 245,000.

The jobs report could help the confidence of consumers, who watch the unemployment rate closely. Economists say confidence can continue to rise if there’s not another outbreak of the virus, and confidence helps both spending and the stock market.

“Calibrating this in a number this size is much more an art than a science,” said Hogan. “We get the weekly jobless claims and we try to extrapolate that with the other inputs on what the overall change in payrolls will be. We know 42 million people filed for unemployment that’s a known quantity. What we don’t know is how accurate that is and it’s hard to collect data during a pandemic.

Hogan said he expects the reopening trade to continue in June and July.

In morning trading, the Dow was up 3.6% and the S&P 500 was up 2.9%. The Nasdaq lagged, rising just 2%.

“The interesting thing is everyone is pointing to the Nasdaq. It’s not participating as much in the rally. It shouldn’t. The Nasdaq is dominated by the stay at home trade,” said Hogan.