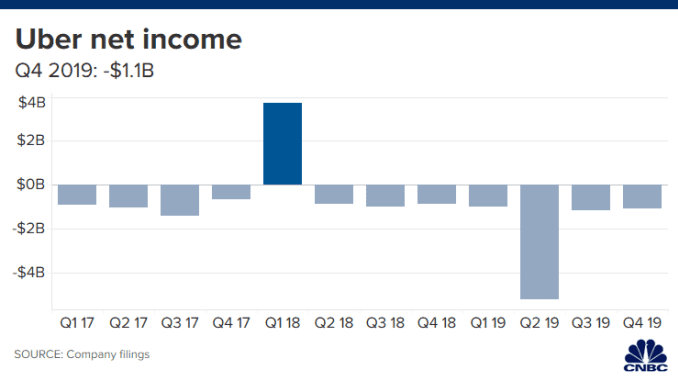

Uber stock rose in extended trading on Thursday after the company announced a fourth-quarter loss that was narrower than analysts had expected and moved its EBITDA profitability forecast forward.

The company’s shares spiked as much as 10% after hours when CEO Dara Khosrowshahi said on the company’s earnings call that the company was moving its EBITDA profitability target to Q4 2020, ahead of its original promise of profitability in 2021. They’re now trading up about 5% after hours.

Here’s how the company did:

- Loss per share: Excluding certain items, 64 cents, vs. 68 cents as expected by analysts, according to Refinitiv.

- Revenue: $4.07 billion, vs. $4.06 billion as expected by analysts, according to Refinitiv.

Uber’s revenue growth accelerated on an annualized basis to 37% from 30% one quarter ago, the company said in a statement. Net loss attributable to Uber for all of 2019 totaled $8.51 billion, primarily because of stock-based compensation.

With respect to guidance, Uber is forecasting a $1.35 billion loss at the middle of the range in terms of in earnings before interest, taxes, depreciation and amortization (EBITDA) for 2020. The estimate is less than the FactSet analyst consensus of a $2.83 billion loss.

Uber’s top segment, Rides, including ride-sharing services and fees from drivers, delivered $13.51 billion in gross bookings, up 18% and below the $13.60 billion estimate among analysts polled by FactSet.

Uber attributed growth in Rides to ongoing global expansion, access to pick up and drop off passengers at airports the world over, and higher-priced premium offerings for passengers like Uber Comfort, which uses vehicles with more head- and legroom.

Moving ahead, executives said they planned to grow their core, ride hail business geographically, using tech to improve pricing and driver-to-passenger matching, and through “enterprise” offerings. Uber for Business shouldn’t be expected to drive bookings growth, but should help Uber improve its margins, the CEO said.

The company is also promoting lower-cost rides on its platform, including on JUMP dockless and electric bikes. JUMP recently expanded to Australia, New Zealand and Washington D.C.

Gross bookings from the Eats segment, including payments from restaurant and delivery partners, came in at $4.37 billion, up 71% and above analysts’ $4.13 billion estimate.

Uber is still paying out a massive amount of what it calls “driver referrals and excess driver incentives” to drivers in its food and ridesharing business.

Eats referrals and incentives for drivers cost Uber $1.13 billion in 2019, and $319 million in Q4 alone, according to the filing. Rides driver referrals and excess driver incentives cost Uber $123 million in 2019, with $20 million of that in Q4, the filing said.

In its Q4 release, it also reminded shareholders that it is now the most downloaded app globally in two categories, ridesharing and food delivery on both the Apple App Store, and Google Play Store, according to SensorTower.

‘The year of subscriptions’

Looking ahead, Khosrowshahi said, “2020 is going to be the year of subscriptions at Uber.”

The CEO noted that when an Uber user tries at least two different Uber services, like ridesharing and food delivery, they triple their overall usage of Uber. Subscriptions encourage that increased usage.

While Uber recently sold its food delivery business in India to Zomato, Khosrowshahi said Eats is in “very early innings” and looks promising in other regions. He noted that, in Australia, Uber Eats business on a top line basis is comparable to its Rides business. It’s not close to that on a global business, he said. But “long-term rationalization” for Eats is there.

Executives said self-driving technology would not figure in their business near-term, outside of research and development efforts.

Uber scored a $1 billion in funding to spin out its Advanced Technologies Group (ATG) in April 2019. Toyota and Japanese auto-parts supplier Denso planned to invest $667 million, while Softbank’s Vision Fund committed to invest $333 million.

Executives on Uber’s Q4 call said that capital pre-funded about 18 months of development work.