The stock market travels on the currents of supply and demand. That’s uncontroversial.

Yet as the indexes have sped to new highs, plenty of observers have argued that a relative shortage of stocks combined with somewhat mechanical sources of demand explain everything from Dow 29,000 to the trio of trillion-dollar market-cap giants that tower above the rest of the market.

The idea of an equity shortage usually hinges on the decline in the total number of U.S. public companies in recent decades, the relative dearth of initial public offerings and the consistent flow of share buybacks meant to reduce companies’ equity base.

These are all features of this bull market, for sure. But it’s an oversimplification to focus on the absolute number of stocks or the background hum of stock buybacks as key drivers of the market’s historic run. There are plenty of stocks to go around and buybacks aren’t wagging the indexes – it’s just that everyone wants the same kind of stocks.

What’s truly scarce are big, reliable cash flows that investors believe will endure economic wobbles and constant technological disruption. And this perceived scarcity of safe sources of profit and income is animating voracious demand for corporate debt and propelling the elite class of dominant secular-growth stocks to ever-richer valuations.

That’s not to deny there are literally fewer stocks on the market’s shelves than there used to be. The comprehensive Dow Jones Wilshire 5000 index now has about 3,500 domestic stocks, down from more than 7,000 in the late 1990s. But most of the stocks that went away were tiny, marginal companies. And the total number of issues has been about steady since 2012, and since then the Wilshire 5000 has more than doubled.

If the reduced number of stocks were an issue, then why would one-sixth of the names in the S&P 500 be languishing at 12-times forecast earnings or less?

And if public investors didn’t have enough names to choose from, why did the market fail to embrace the likes of Uber, Lyft and Pinterest last year?

Share buybacks are now a constant of corporate finance, and at the current pace amount to perhaps 2% to 3% of total stock market value per year. But a good portion of that purchasing is simply soaking up the stealth equity issuance through employee stock compensation. So as a swing factor in a $30 trillion stock market, its potency has diminished from a couple years ago.

The true issue is a scarcity of stability and growth — or a perceived scarcity of them, at least.

We live now in a world where triple-B-rated corporate bonds, the lowest-grade and largest segment of the investment-grade universe, yield 3%. Junk bonds — an asset class with a long-term annualized default rate of 3.5% — now yield 5%.

Clearly, the Federal Reserve’s three rate cuts and promise to stay on hold for a while is part of this backdrop, as are the stirrings of a global economic pickup following an inflation scare. But the massive demand for cash flows by an aging global investor base and return-starved institutions are the proximate actors on these markets.

Elite tier of stocks

A winner-take-most dynamic in multiple industries transformed by technology has also created an elite tier of anointed stocks. The acclaimed winners appear entrenched, their platforms self-reinforcing, profit margins sturdy, growth rates near-automatic.

This has created a vastly bifurcated market, and an unusually wide spread between the valuation of the most expensive 20% of stocks and the cheapest 20%, as this breakdown by KKR & Co.’s head of global macro Henry McVey illustrates.

In that upper tier, of course, are the Big Five of tech: Apple, Microsoft, Alphabet, Amazon and Facebook, together worth $5.2 trillion, or nearly 18% of the S&P 500. The first three, now sporting market values above $1 trillion, in aggregate are “worth” $3.7 trillion and will likely have net income exceeding $140 billion this year.

So, in aggregate Apple-Microsoft-Alphabet trades at 26-times this year’s profits, with no debt and enormous capacity to invest, buy back stock or fund future dividends. The broad market is below 19-times earnings.

The argument in the market right now is not why these stocks are working, but whether their premiums have grown too generous and investors too complacent about possible disturbances to this happy picture.

McVey says, “Our analysis does not mean that the ‘winners’ can’t still do well as long-term holdings, but the point is that the consensus has largely caught up to our thinking on the era of low rates and technological change — and what it means for return on capital across business models.” It’s just that this group today is starting from rich enough valuations that returns will likely be less impressive in coming years.

And yet, McVey says, “There are just too many broken business models in the value indexes.” So simply buying the cheapest is not a clear winning strategy. He favors scanning the middle of the valuation spectrum for companies combing earnings acceleration and dividend growth.

Bet the field?

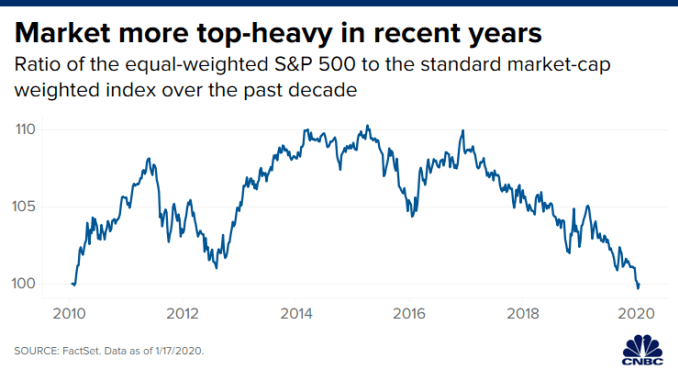

The exaggerated crowding into those winners has come at the expense of the “average stock,” at least on a relative basis. Here we see the equal-weighted S&P 500 sliding relative to the mega-cap dominated index. Over long stretches of time, equal-weighted indexing has outperformed. So is it time to “bet the field” against the favorites?

The forces carrying this rally are fairly rational and understandable. Yet along multiple fronts – technicals, valuation, sentiment – the rally seems near a point where it ought to calm down if it’s not going to go fully into unstable blow-off mode.

Still, it’s hard to figure what might soon short-circuit the cycle of money motivated by an apparent scarcity of cash-generating assets built to withstand a slower-growth, technologically transformed world.