The worst may be be over when it comes to pessimistic earnings estimates. And that’s giving the markets some newfound confidence.

Companies slashing their profit forecasts had been a major reason why stocks tanked in December. As corporations tempered expectations, investors had largely expected two straight quarters of negative earnings growth, which is known as an “earnings recession.” But it appears as though that much-feared event has been avoided.

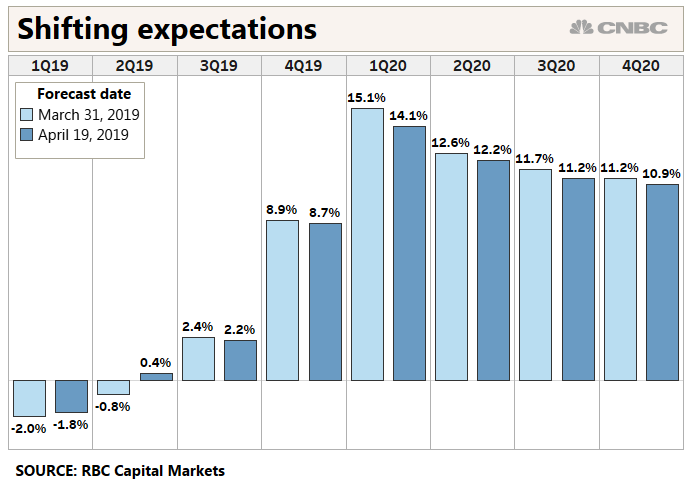

Between March and April, earnings forecasts turned positive for the second quarter at 0.4 percent growth, according to data from RBC Capital Markets.

According to RBC, January “remains the low point for growth” and consensus EPS growth is expected to rebound into positive territory this current quarter with more acceleration into 2020. Lori Calvasina, RBC head of U.S. equity strategy, said based on revised estimates in recent weeks it’s looking like “an earnings recession will be avoided.”

“We continue to see evidence that earnings sentiment bottomed in January,” RBC Head of U.S. Equity Strategy Lori Calvasina told CNBC in a phone interview. “I would argue that these consensus numbers are too conservative.”

Just 32 percent of earnings revisions were upward increases in January 2019. That stat improved to 47 percent in mid April, according to RBC.

Companies had reasons for a glum view heading into January. Stocks had posted their worst December since the Great Depression, and traders had partially blamed actions by the Federal Reserve. The ongoing U.S.-China trade war and weakening global economic growth helping up the U.S. dollar had also threatened to crimp profits for multinational companies. Calvasina said a tougher economic backdrop is already baked in, meaning things could be even better than average sell-side analysts are anticipating.

“Companies put out conservative guidance and I don’t blame them for doing that — the analyst community was also cautious,” she said. “I think that was that was all prudent.”

Despite low expectations, Calvasina said companies are generally describing the macro backdrop, underlying economy, and customer bases as “pretty healthy and solid.”

Consensus estimates in the first quarter of 2019 are tracking at -1.8 percent, an improvement from -2.2 percent in early April, according to RBC. If the current trend continues, profits are expected to be flat for the year — which is still better than expected.

.1556039703279.png)

Through Thursday, 77 percent of companies in the of S&P 500 had beat consensus estimates for earnings, while 47 percent beat on sales, according to data from FactSet and RBC.

“Companies are managing to come up with the earnings beat despite the fact that it’s been a little bit tougher on the revenue side,” Calvasina said. “They’re pulling all of their levers and they’re getting that done.”