Financial fraud has become so rampant that it’s hard for consumers to keep up. Nearly every person who holds a debit or credit card has received alerts about charges they may not have made, and tens of millions of Americans have had some of their cards replaced in the wake of data breaches at retailers they’ve patronized.

The number of ways our personal financial data can be exposed is overwhelming, and the risks are hard to keep track of, but that does not mean that people are willing to ignore the issue. Most Americans (79%) say they are at least somewhat concerned about financial fraud, and 36% are very concerned, according to a new LIMRA Secure Retirement Institute study.

What are people worried about?

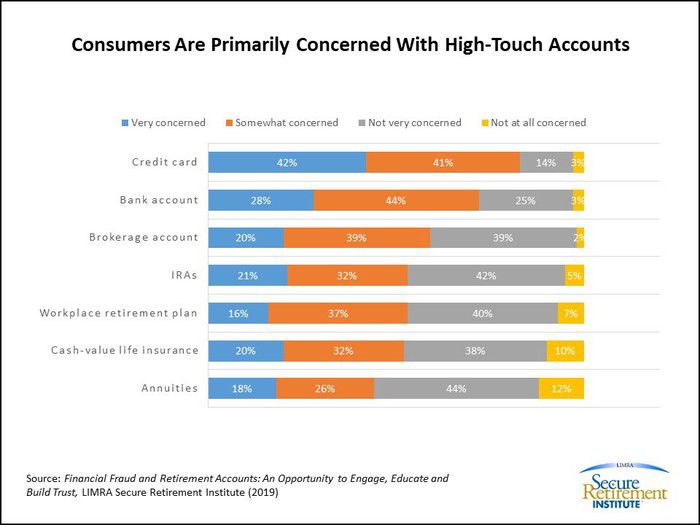

Consumers worry more about criminals gaining access to their “high touch” accounts — things like credit cards and checking accounts — and are less concerned about long-term accounts like workplace retirement plans, IRAs, and annuities. That makes sense, because it’s easier to overlook an improper transaction in an account you use often.

Credit card fraud was the most common worry on the list: 42% of respondents said they were very concerned about it, and 41% were somewhat concerned. That put it well ahead of the second-most prevalent source of worry: bank account related fraud, which had 28% of those surveyed very concerned, and 44% somewhat concerned.

Those fears make sense, but LIMRA SRI Research Associate Ryan Scanlon believes that “the 30 percentage point difference between consumers who are concerned over their credit card and those who are concerned over their retirement plan highlights a dangerous blind spot.” He’s not saying that people are wrong to worry about malefactors getting hold of their Visa number — it’s that he believes that they ought to be equally concerned about fraudsters gaining access to their retirement accounts.

“While it may be natural for consumers to worry more about products they use more often, recent LIMRA research confirms that the incidence of fraud is increasing among individual life insurance contracts, individual annuities, and DC retirement plans,” he said in a press release. “This evolution is driven not only by the increased appeal of financial accounts that hold larger pools of money but also by new developments in security for credit and debit cards that have prompted criminals to reevaluate their targets.”

Checking your accounts — all of your accounts — can help protect you from financial fraud.

What can you do?

Protecting yourself from fraud requires vigilance, and today, it’s fairly easy to be watchful when it comes to everyday accounts. Most people can easily review their recent checking, savings, and credit card transactions on their smartphones. If you’re checking in on those accounts with some frequency, you’re much more likely to notice if there’s a charge for something you never bought, or a balance that seems off.

But most of us don’t check our retirement or other long-range accounts as often — and some may not review them at all, outside of glancing at the top lines on their quarterly statements. That’s a bad habit we ought to change. You don’t need to review these accounts every week, but you should give them a once over on a regular basis. Schedule a time once a month to check in, and make sure nothing odd or potentially fraudulent has happened. And a couple of times a year, it wouldn’t hurt to pull your own credit report, which will allow you to see if someone else has opened an fraudulent account in your name or done something you didn’t authorize.

At a more basic level, do what you can to protect your financial data from being hacked. For the individual, the name of the game is password security. It may be convenient to use (for example) your spouse’s name and a number as your bank password, but such obvious options are easier for criminals to crack. You would do better to use computer-generated passwords that contain no actual words at all, but if you don’t, at least be clever (and careful with keeping your choice safe). Also, don’t use the same passwords on your financial accounts as you use elsewhere online. You never know when the company behind one of your social media or gaming apps might get hacked.

Vigilance alone won’t stop financial criminals. It can, however, minimize the damage by letting you spot their actions soon after they strike.