Netflix shares soared as much as 15 percent after the company beat earnings estimates in its latest quarterly report on Tuesday.

The company posted in its third-quarter earnings report:

- Revenue: $4 billion vs. $4 billion estimated, per a Refinitiv consensus estimate

- Earnings per share (EPS): 89 cents vs. 68 cents estimated, according to a Refinitiv consensus estimate

- Subscriber additions: 6.96 million

- Domestic subscriber additions: 1.09 million vs 673,800 estimated, per FactSet

- International subscriber additions: 5.87 million vs. 4.46 million estimated, according to FactSet

Netflix is showing accelerating growth as the company expands. Streaming revenue increased 36 percent in the third quarter from a year earlier, though international revenue was down $90 million due to year-over-year impact from currency.

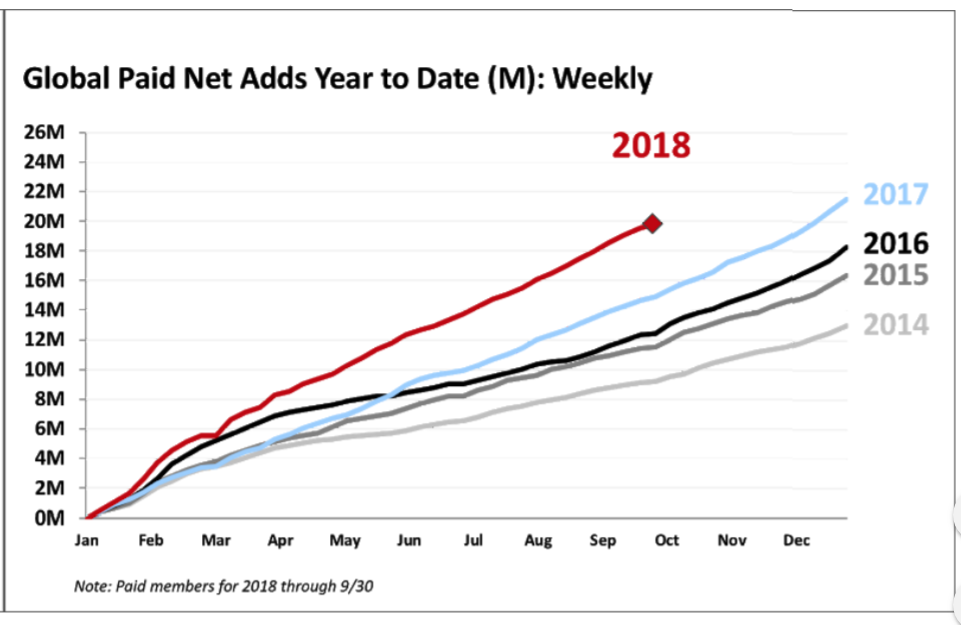

The company is projecting it will add 9.4 million net subscribers during the fourth quarter.

“We’re getting a little better on the forecasting,” CEO Reed Hastings said after the earnings report. “I think by focusing going forward on paid [net adds] we’ll be able to be a little more accurate and focus on the fundamentals.”

Netflix will also be relying on its TV and film studios to make more of its own content, rather than licensing content. Shows including “Stranger Things,” “Big Mouth,” “The Ranch,” “Bright,” “Godless,” “The Kissing Booth,” “3%,” “Dark,” “Sacred Games” and “Nailed It” were created by Netflix studios. It also licenses shows that may have appeared on TV or in theaters before like “Shameless” or “Friends,” as well as obtains first-window rights to shows like “Orange is the New Black” and “13 Reasons Why.”

“Our own original shows tend to be more valuable than licensing someone else’s shows in later windows,” Chief Content Officer Ted Sarandos told analysts. “So when we invest in an original show, we find, we’re having a better payback in terms of people watching and appreciating Netflix and valuing their subscription. So that’s why we’re leaning in that way.”

Netflix will only give guidance to paid membership subscription ads (not total, which includes people who may be using the free trial) starting with its earnings report in January 2019, and will include graphs like the ones above to show its growth trajectory. It will stop including end-of-quarter free trial subscriber numbers in its reports in 2020.

It’s also changing how it records some expenses to reflect the company’s move towards more of its own content.

“Next quarter, we expect to reclassify certain personnel costs from G&A to Content and Marketing, and from Technology & Development to Other Cost of Revenues,” the company wrote in a note to shareholders.

Analysts from Morgan Stanley, Goldman Sachs and Raymond James cut their price targets on Netflix ahead of its earnings report, due to a combination of the strength of the dollar, rising interest rates and increasing expenses for the company.

Still, Netflix shares are up more than 80 percent this year, as consumers continue to cut the cord with traditional TV providers. EMarketer projects more than 60 percent of the U.S. population will be using over-the-top services like YouTube, Netflix, Amazon, Hulu and HBO Now by the end of the year, an increase of 3 percent from a year earlier.