![]()

The last time semiconductor stocks were this high, the world was gripped by Y2K fears, Jim Carrey’s “The Grinch” was the top movie and Britney Spears was burning up the charts.

In other words, it’s been a long time and one technician sees the industry’s decades-long comeback as one of the most important stories on Wall Street.

“Forget about round numbers on the Dow. This is what we should be talking about,” Ari Wald, head of technical analysis at Oppenheimer, told CNBC’s “Trading Nation” on Monday.

The PHLX Semiconductor SOX ETF, which houses 30 chips stocks, has surpassed its record highs of March 2000 and is up nearly 16 percent in 2018. The group largely resisted a sell-off in February that wiped out broader market records, instead ending the month flat. The tech-heavy Nasdaq ended February nearly 2 percent lower.

A “multitude of tailwinds” for semiconductors has propelled the sector higher, Michael Binger, senior portfolio manager at Gradient Investments, said on Monday’s “Trading Nation” — high demand for electronics remains, the internet-of-things market is growing and all signs point to a sector in consolidation.

Though chips gains have been broad, Wald and Binger do see one stock that could race ahead of its peers.

“If I had to buy one today, it would be Micron,” said Binger.

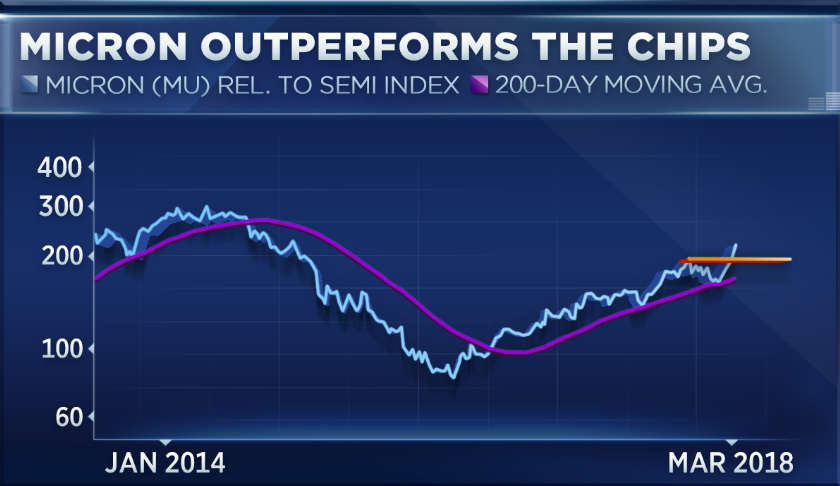

The upward trend for chipmakers over the past 18 months has helped Micron recapture levels not seen since October 2000. Its shares have not hit an intraday record high since August of that year.

Micron is “firing on all cylinders and it’s cheap right now,” Binger said.

The fifth largest chipmaker in the U.S. trades at a price-to-earnings ratio of six times forward earnings. The SOX ETF has a P-E ratio of 16 times forward earnings and the Nasdaq 23 times.

The charts back up the bullish case for Micron, says Wald. Micron fell below its 50-day moving average during the early February sell-offs that swept through broader markets but broke back above it in mid-February. Its shares have not fallen below its 200-day moving average since July 2016.

It’s “a little near-term overbought but our work suggests that this stock should just continue to do well looking out [at] the coming months and quarters,” added Wald.

Micron’s relative strength index, a measure of overbought conditions, sits at 81. The SOX ETF is at 70 and the Nasdaq at 67.

Micron shares rallied another 10 percent on Monday after Nomura analysts bumped up its price targets. Nomura increased its target to $100 from $55 on an expected increase in the pricing of processing chips and the potential for buybacks and dividends later this year.

Analysts have an average buy rating on Micron, according to data compiled by FactSet. An average price target of $61.89 implies a 12 percent upside from Friday’s close. Nomura has the highest price target on the Street.