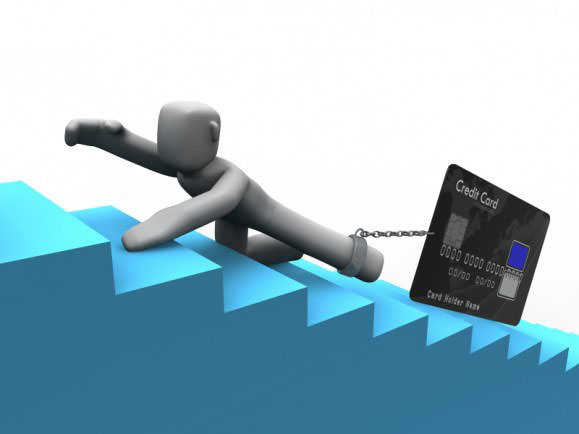

Most Americans are carrying around some amount of credit card debt.

In fact, credit card debt in the United States has hit an all-time high of nearly $1 trillion.

Additionally, more than half of us are living paycheck to paycheck, which makes paying that debt off seem nearly impossible.

However, digging yourself out of debt isn’t as unrealistic as it might seem.

Take Luke and Joy Turner, for example. When they got married, they owed $120,000 just in school loans.

Add credit card bills and car payments on top of that and their debt totaled more than $140,000.

“That was just really overwhelming, really overwhelming,” Luke said.

The Turners, like most of us, made only minimum payments on their loans, while trying to cover the costs of their growing family, until they realized they had to make a change.

“I said to my wife, ‘We are going to do this,’” Luke said.

Financial expert Nicole Middendorf has seen this situation many times before.

“We live in a society of having to have everything now,” Middendorf said.

However, Credit Counselor Matt Fellowes cautions for some people, it’s more than that.

“The reason why most people have credit card debt is not that they are going to Starbucks too much, or going to a department store and buying clothes. Credit card debt largely starts and is maintained because people don’t have emergency savings,” Fellowes said.

So, if you’re barely making ends meet, where do you begin to find the money to pay off debt, let alone put into savings?

There are a few obvious tips.

First, start by writing down everything you spend in a week’s time.

“After those seven days, take a step back and see if there’s an area that you spent money in that you really didn’t recognize, you didn’t remember or you felt bad about. Then, take all of that money you spend on those extra things and cut it in half, and give that to yourself as an allowance,” Middendorf said.

Next, if you’ve never built a budget, maybe now is the time.

“It’s figuring out where are you spending money, and what can you cut back, or what really is important to you,” Middendorf said.

“We’ve never been on a budget before, and it was just amazing the big difference it made,” Luke said.

The Turners stopped eating out and started to plan meals in advance. They also skipped vacations, which they admit wasn’t easy.

“We just knew that we had to stick to it,” Joy said.

Now, here are some tips maybe you’ve never heard, such as writing your credit card balance on a piece of paper and taping it to the front of your credit card.

“Just having the visual reminder every time you pull out your credit card is enough to stop using your credit card when you shouldn’t be using it,” Fellowes said.

Also, freeze your credit cards – literally freeze them in a glass of water.

If you have to wait for your card to thaw to get to it, chances are, the urge to buy will pass.

“You’re going to actually have to stop, and think, and wait before you actually spend that money,” Middendorf said.

One final tip, pay off credit cards with smaller balances first.

That goes against what we’ve been told in the past, but experts now say, psychologically, paying anything off can help you feel a sense of accomplishment, and also helps establish better behavior going forward.

As for the Turners, it took them five years and 11 months, but they finally paid off their entire $142,000 debt.

“I said, ‘We are debt-free,’ and it didn’t really sink in until I got that piece of paper in the mail that said, ‘Congratulations, you have paid off your loan,’” Luke said.