Bitcoin and other cryptocurrencies have been correcting hard in 2018 — but these three crypto-exposed stocks are in rally-mode.

It’s been a tough couple of weeks for cryptocurrency fans.

The biggest of the cryptos, bitcoin, has shed more than 30% of its market value since peaking earlier this month, unraveling billions of dollars of paper profits in the process. As I write, bitcoin prices are recovering from a brief dip below the $10,000 level for the first time since the beginning of December. Other, smaller, cryptocurrencies have dropped even harder.

But not all crypto trades are on defense right now.

In fact, some stocks with crypto exposure are actually primed to burst higher in this environment.

To figure out which ones are worth buying here, we’re turning to the charts for a technical look at three big stocks with bitcoin exposure that look ready to rally.

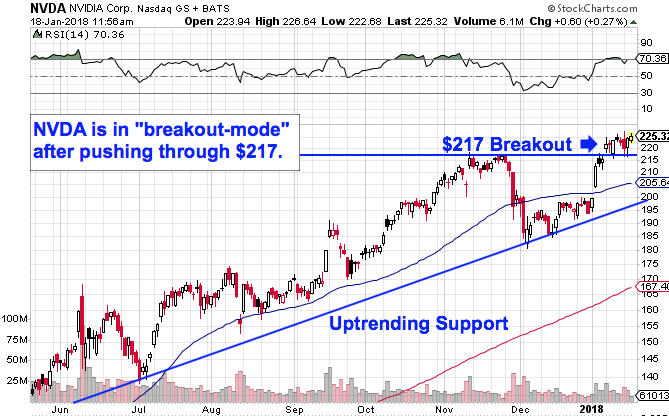

Leading things off is Nvidia Corp.

Nvidia’s graphics cards are used for cryptocurrency mining, an application that’s hugely driven demand for GPUs in recent years. That fact has also made Nvidia a favorite way for retail investors to play the crypto-boom. The price action is pretty unmistakable here:

After rallying more than 118% in the last year, Nvidia is back in breakout-mode this January. Shares of the $136 billion semiconductor stock broke out above prior resistance at the $217 level shortly after the calendar flipped to 2018, signaling that buyers are still clearly in control of the price action in this stock.

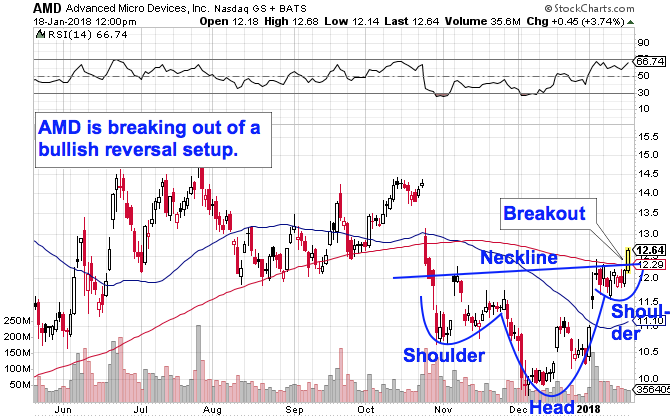

Meanwhile, another big GPU maker, Advanced Micro Devices Inc., is showing off a buy signal of its own:

AMD couldn’t look much more different from Nvidia in the last year. While the latter has been one of the best performers in the S&P 500, AMD has been a laggard. But that’s changing here – AMD is breaking out through the top of a bullish reversal pattern called an inverse head and shoulders Thursday, clearing the way for a re-test of prior highs around the $14.50 level.

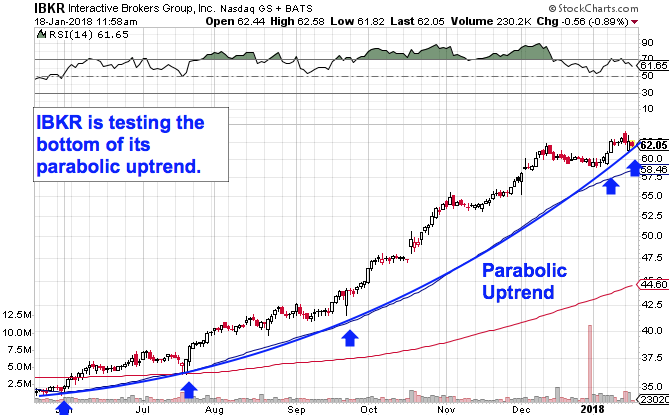

Interactive Brokers has been in a well-defined parabolic uptrend since last summer, bouncing higher on every successive test of trendline support. Simply put, it’s been a “buy the dips stock” during that entire timeframe.

Now, IBKR is showing off another buyable dip off of trendline support. The next bounce higher looks like a tradable buy signal in this big brokerage stock.