About three in five Americans live paycheck to paycheck but only one in four have a written plan to tackle their finances. And, according to Charles Schwab’s 2018 Modern Wealth Index, that’s because few people in the U.S. believe their level of wealth deserves a plan.

“The idea that financial planning and wealth management are just for millionaires is one of the biggest misconceptions among Americans, and one of the most damaging,” Joe Vietri, senior vice president and head of Schwab’s retail branch network, says in the study, adding that those who do have a written plan also tend to havegood financial habits.

The index tracked how 1,000 Americans aged 21-75 manage wealth across four categories: goal setting and financial planning; saving and investing; staying on track, financially; and having confidence in reaching financial goals. It then scored them on a scale of 1 to 100 based on how well they perform in these categories in their daily lives.

Having a written financial plan can lead to better daily money behaviors, Schwab finds, and those who have a plan are more likely to be regular savers, stay engaged with their investments, effectively manage debt and have a better outlook on reaching their goals.

“When we look at the top 10 percentile of overall performers, there’s a consistent theme that they’re diligent planners — three in four say they have a written financial plan,” Terri Kallsen, executive vice president and head of Schwab Investor Services, says in the study.

“Planning is critical to achieving any goal. It’s like establishing an exercise regimen to get in shape — we need to take the same approach to keep our finances in good health and on track.”

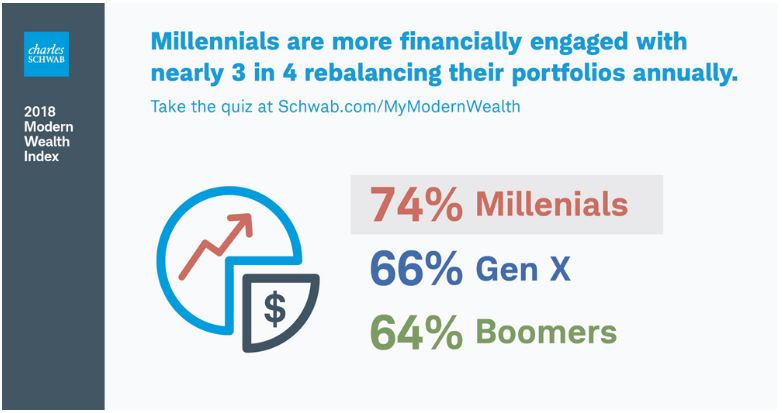

Overall, it appears millennials are on track with good financial habits. The index shows that young people, in many cases, are more focused on saving, investing and planning than their older peers: 31 percent have a written financial plan, compared to 20 percent of those in Generation X and 22 percent of Baby Boomers; 36 percent have specific savings goals, versus 25 percent of Gen X and 17 percent of Boomers; and 75 percent regularly rebalance their investment portfolios, compared to 66 percent of Gen X and 64 percent of Boomers.

That could even explain why 64 percent of millennials believe they will become wealthy in their lifetime.

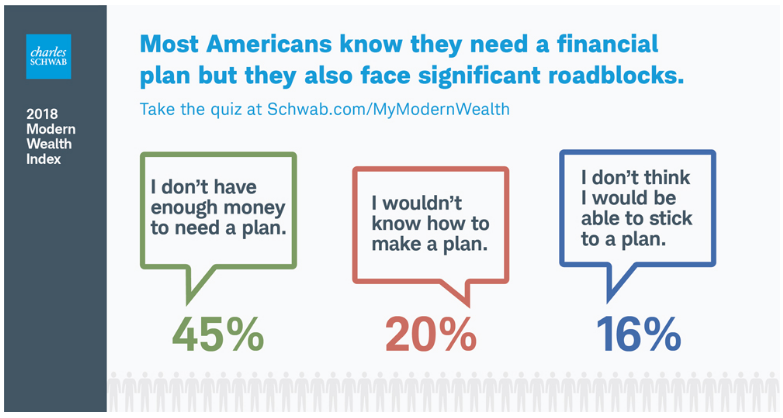

On the other end of the spectrum, among those without a written plan, 45 percent say they don’t think they have enough money to merit one, 20 percent say getting a plan never occurred to them and another 20 percent say they wouldn’t know how to go about getting a plan.

“When people think about creating a financial plan, they envision long, uncomfortable meetings in a stuffy office,” Vietri says. But “there’s no reason for planning to seem so difficult. Outside of financial services, there are so many examples of things that used to be burdensome or inaccessible now being much easier.”

For example, Schwab, among other institutions, offers digital options that make it easier for users to engage with their finances in real time. And mobile apps, like Mint, can help you track and budget your money.

If you’re looking to get more organized, best-selling author, award-winning financial advisor and former CNBC host Suze Orman suggests you start by prioritizing one thing at a time and then work your way up to achieving your bigger financial goals.

That could mean re-evaluating how you spend, like “stopping yourself before every purchase and asking, ‘Is this a need or a want?'” she points out. Or like “finding an extra $10 or $50 a week to put toward a goal,” such as an emergency savings fund, Orman writes. If you do that consistently, “it will put you on a path toward financial security.”

“Whether people think they don’t have enough money, believe it would be too expensive or just find the whole concept [of a financial plan] too complicated,” Vietri warns, “the longer they wait, the harder it is to achieve long-term success.”