Western Alliance Bancorp spent much of this year ensnared in turmoil sparked by a series of regional bank collapses that spooked its investors and attracted short sellers.

But that hasn’t stopped the bank from becoming a favorite of Wall Street analysts. They’re more bullish on it than any other stock in the two-dozen strong KBW Bank Index, which tracks large publicly-traded US lenders.

With the company set to report results after market close on Tuesday, it’ll have a chance to win over skittish investors and to prove any naysayers wrong. But with a slew of headwinds against regional banks, the company could have its work cut out for it.

Wall Street Darling

Among the companies in the KBW Bank Index, Western Alliance has the highest consensus rating, according to data compiled by Bloomberg. Based on analysts’ 12-month price targets, the return potential for the stock was about 38% through Monday — meaning analysts think the stock should rise that much over the next 12 months, based on their price targets.

For comparison, the average return potential for stocks within the sector is about 16%, according to data through Monday’s close.

“If you come through 2Q and it’s a good report, not only will the stock go up, but now you have a lot more potential buyers,” said Hovde Group analyst Ben Gerlinger, whose rating for the stock is a buy-equivalent.

Despite the stock trading at discounted levels, many investors have stayed on the sidelines. But the second-quarter results offer a new point of reference, Gerlinger said.

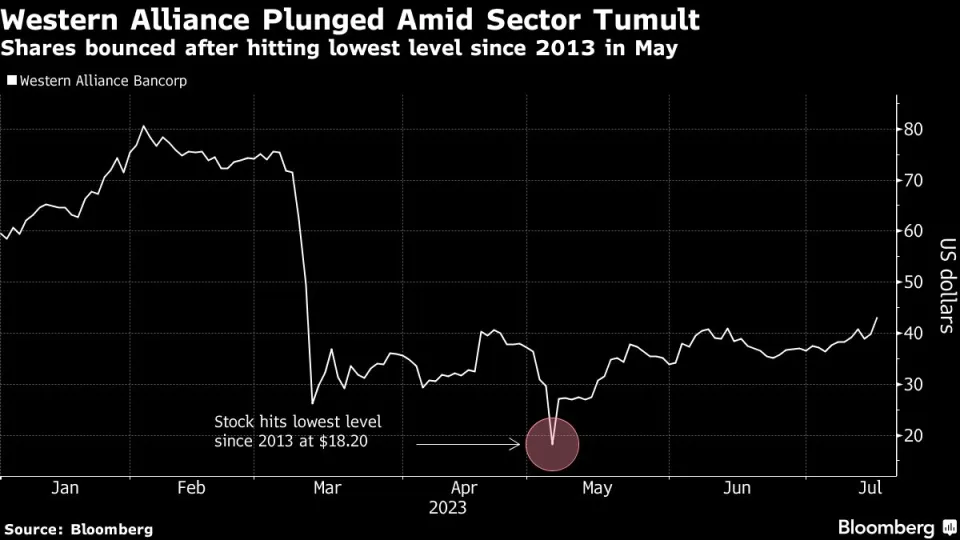

The rosy outlook is a stark departure from where the company stood just a few months ago. Investors swiftly soured on the stock following the failures of Silicon Valley Bank and Signature Bank. Like Western Alliance, both were commercial banks with exposure to the technology sector and relatively high levels of uninsured deposits compared to peers. In early May, shares in Western Alliance sank to as low as $18.20.

Shares in the bank rose 7.9% at 2:20 p.m. in New York on Tuesday amid a broader rally in bank stocks.

Analysts expect the company to report third-quarter profits of $1.97 per share, according to the average estimate from a survey conducted by Bloomberg. That figure represents nearly an 18% drop from the same time last year.

Analysts who favor the stock have touted its valuation and the steps management took to stabilize the business since the March tumult.

“Now that we’re past the anxiety, people are shifting their focus to banks that are inexpensive,” Wedbush’s David Chiaverini, who has a buy-equivalent rating on the stock, said. “All of the metrics are screening pretty well here.”

One area of caution for him will be around deposit costs. While the bank’s updates during the quarter have shown its deposits stabilizing, Chiaverini noted the rise in deposit costs across the banking sector, and said the net interest margin guidance will be a key focus.

“Growth is clearly better than outflows,” he said. “But the cost of those deposits will be front and center.”