Blockchain and Ethereum transaction fees, also called ‘gas fees‘ can range and fluctuate wildly from moment to moment, costing anywhere from pennies to $200, and predicting them is challenging. Understanding what determines gas fees can be useful for saving money on any blockchain, especially Ethereum.

Most blockchains are designed for decentralization, and in order to achieve it they need an economic reward system to incentivize individuals across the world to participate in running the network. How these rewards are given out is different for mining versus staking, but most blockchain reward systems include fees and tips paid by the users. For blockchains that host smart contracts (especially Ethereum), these fees can vary widely depending on the smart contract being used. Fees are essential for preventing spam/DoS attacks, and tips are needed because each block has limited space and some transactions are more urgent than others.

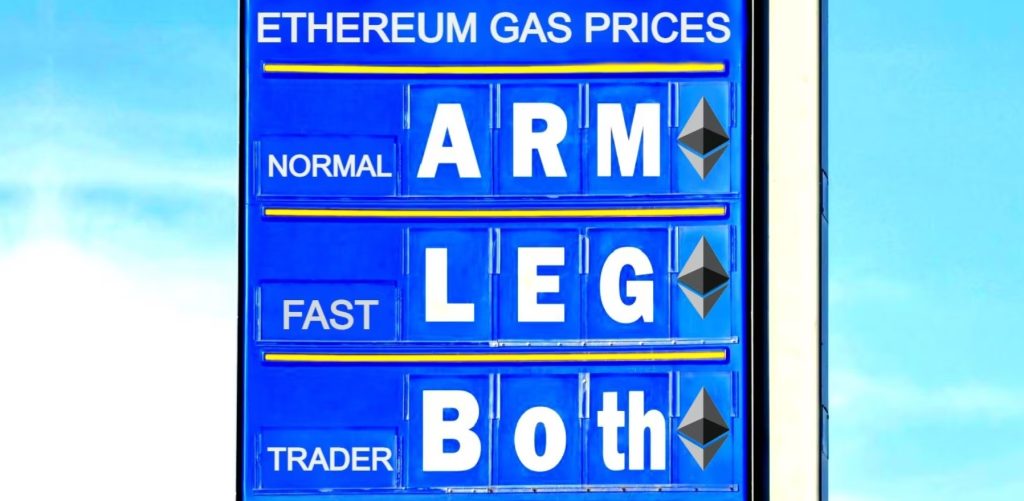

As NFT Now explains, a blockchain’s gas fee is the fee charged by the network to submit a transaction, and is based on the network’s activity and the size of the transaction. For smart contract blockchains, each machine-level operation in a smart contract accumulates an amount of “gas” units, which are added up and multiplied by the “base fee” (plus a “tip“) to create the final gas fee, often resulting in fees that vary widely in size. Users can accept the fee, or reject it and wait for a better one. On Ethereum, gas fees are valued in Ethereum’s native cryptocurrency, ether (or ETH), independently of its dollar value. If ETH’s price goes to the moon so will the dollar cost of using Ethereum, which is why Layer 2 scaling solutions like Polygon, Arbitrum, and Optimism exist. Ethereum’s infamous gas fees are also the reason why “Ethereum killers” like Binance Smart Chain, Fantom, Avalanche, and many more exist, as they offer similar smart contract functionality as Ethereum without the absurdly high gas fees, but they also lack the vast decentralized application (or dApp) ecosystem that makes Ethereum popular.

Minimize Gas Fees By Beating Rush Hour Traffic

Like real-world rush hours and congested highways, timing is crucial for getting the best service. According to EthereumPrice, weekends are the best time to be using Ethereum (and any blockchain), as light network traffic ensures low competition for block space, and thus lower fees, and within each day 6am – 12pm (PDT) are often the busiest hours.

For smart contract blockchains, a major part of the gas fee involves “gas units,” which are based on the computational complexity of the transaction. While retrieving data from the blockchain is free, modifying data charges a gas fee, and the gas units accumulated during the modification are factored into the final fee. For example, using a sophisticated dApp like the Uniswap decentralized exchange (DEX) on Ethereum involves many complex operations, resulting in a gas fee valued in the double or triple digits, but sending a token or NFT from one wallet to another can cost a few cents to a dollar on most days.

Blockchain gas fees are dependent upon network activity and the complexity of the smart contract being used (if applicable), and are charged in a blockchain’s native cryptocurrency, such as Ethereum’s ETH or Bitcoin’s BTC. Sending tokens or NFTs between accounts is relatively cheap, but interacting with complex decentralized finance (DeFi) dApps and other smart contracts is far more expensive. Users can always see the gas fee before it is charged and can choose to accept or reject it, and if the fee is unreasonably high then they can wait for lighter network activity. For Ethereum, Layer 2 scaling solutions like Polygon and Arbitrum can provide cheap gas fees for users, and should be used whenever possible, but competing blockchains may also provide useful services for even cheaper.