It looks like it’s going to take a bit longer for the $22 trillion Treasury market to liven up again.

Ten-year yields barely budged this week after mixed jobs data –- disappointing payroll growth coupled with faster-than-projected wage increases –- lowered expectations that the Federal Reserve will rush to pare its asset purchases. The employment figures marked the end of a potentially momentous stretch that also featured a long-awaited speech by Fed Chair Jerome Powell, which also did little to sway yields. While bond-market veterans including Bill Gross have sounded the alarm about the risk of surging yields, the spread of the coronavirus’s delta variant is holding the Fed back on its plan to taper debt buying. The result is that the market has defied doomsday predictions and stuck to a narrow range.

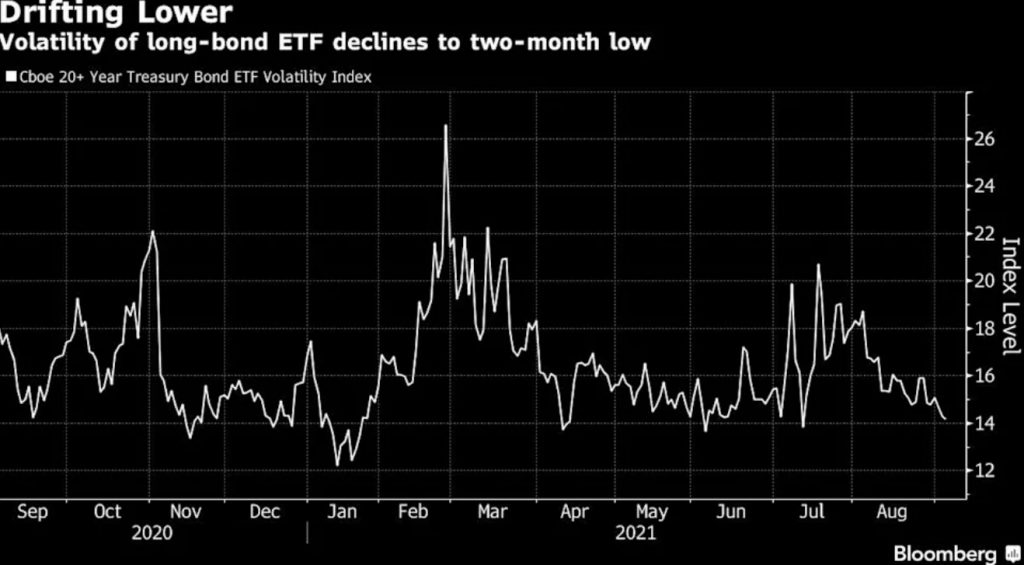

It’s been six months since 10-year rates posted a weekly move significantly greater than 10 basis points, and measures of volatility are tumbling. Short volatility wagers emerged this week in Treasury options, targeting 10-year yields to remain between 1.05% and 1.6% through late November.

“The Treasury market will remain in this sort of lull,” said Bill Herrmann, founder and managing partner at investment firm Wilshire Phoenix LLC. “The labor data points to fears of delta, which all may turn out to be just fears, but we can only go on the data that we are presented with. It’s looking really likely that the Fed is going to be handcuffed against normalizing policy at all until delta is contained.”

Friday had loomed as a potential day of reckoning for bond traders, should a robust jobs figure spark bets on a more hawkish Fed stance at policy makers’ next decision on Sept. 22. But the addition of 235,000 jobs last month was well short of forecasts, even as average hourly earnings rose twice the median estimate.

The report is all but certain to push the Fed to delay considering a move to scale back asset purchases until at least its November meeting, economists say. Ten-year yields rose Friday, reaching 1.33%, still only modestly higher on the week, while the yield curve steepened.

Next week’s slate of Treasury auctions, and yields’ tendency to drift higher in early September also helped drive the curve steeper, according to strategists at TD Securities. Even so, the gap between 5- and 30-year debt has remained in a quarter-point range since mid-June.

“For the bond market it’s likely to be an ongoing range trade,” said Chris Ahrens, a strategist at Stifel Nicolaus & Co. “There hasn’t been enough on the inflation data side for yields to break out of the range on the topside, nor enough evidence that the labor market is so weak that we can break out to the downside.”

What to Watch

The economic calendar:Sept. 8: MBA mortgage applications; JOLTS job openings; Fed Beige Book; consumer creditSept. 9: Jobless claims; Langer consumer comfortSept. 10: PPI; wholesale inventories/trade salesThe Fed calendar:Sept. 8: New York Fed’s John Williams; Beige Book; Dallas Fed’s Robert KaplanSept. 9: San Francisco Fed’s Mary Daly; Chicago Fed’s Charles Evans; Governor Michelle Bowman; Williams, Kaplan, Minneapolis Fed’s Neel Kashkari and Boston Fed’s Eric Rosengren in virtual event on racism and the economySept. 10: Cleveland Fed’s Loretta MesterThe auction calendar:Sept. 7: 13-, 26-. 52-week bills; 21-day CMB; 3-year notesSept. 8: 10-year notesSept. 9: 30-year bonds