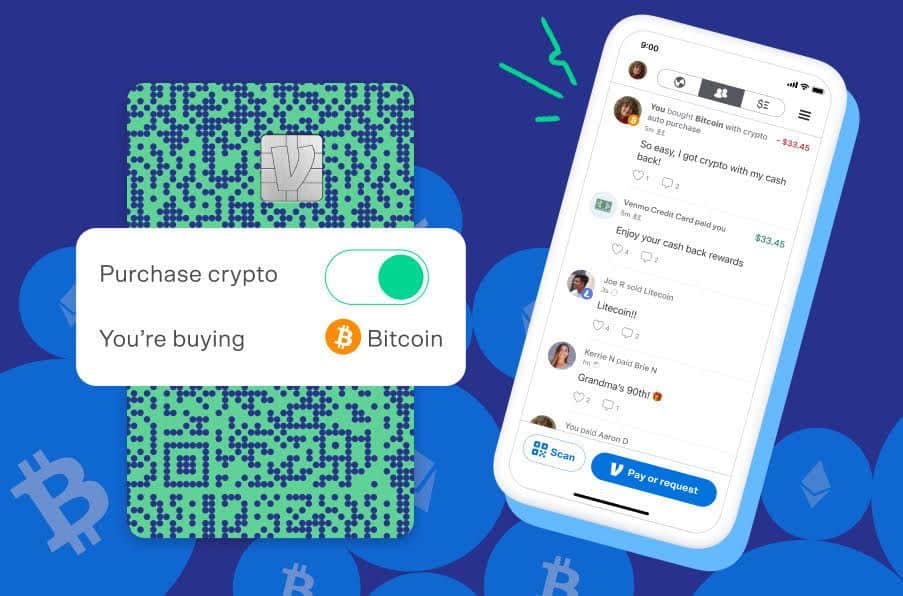

PayPal-owned Venmo is expanding its support for cryptocurrency with today’s launch of a new feature that will allow users to automatically buy cryptocurrency using the cash back they earned from their Venmo credit card purchases. Unlike when buying cryptocurrency directly, these automated purchases will have no transaction fees associated with them — a feature Venmo says is not a promotion, but how the system will work long term. Instead, a cryptocurrency conversion spread is built into each monthly transaction.

Cardholders will be able to purchase Bitcoin, Ethereum, Litecoin and Bitcoin Cash through the new “Cash Back to Crypto” option, rolling out now to the Venmo app.

Venmo had first introduced the ability for customers to buy, hold and sell cryptocurrency in April of this year, as part of a larger investment in cryptocurrency led by parent company, PayPal. In partnership with Paxos Trust Company, a regulated provider of cryptocurrency products and services, Venmo’s more than 76 million users are now able to access cryptocurrency from within the Venmo app.

The cash-back feature, meanwhile, could help drive sign-ups for the Venmo Credit Card, by interlinking it with the cryptocurrency functionality. Currently, Venmo cardholders can earn monthly cash back across eight different spending categories, with up to 3% back on their top eligible spending category, then 2% and 1% back on the second highest and all other purchases, respectively. The top two categories are adjusted monthly, based on where consumers are spending the most.

To enable Cash Back to Crypto, Venmo customers will navigate to the Venmo Credit Card home screen in the app, select the Rewards tab, then “Get Started.” From here, they’ll agree to the terms, select the crypto of their choice, and confirm their selection. Once enabled, when the cash-back funds hit the customer’s Venmo balance, the money is immediately used to make a crypto purchase — no interaction on the user’s part is required.

The feature will not include any transaction fees, as a cryptocurrency conversion spread is built into each monthly transaction. This is similar to how PayPal is handling Checkout with Crypto, which allows online shoppers to make purchases using their cryptocurrency. The cryptocurrency is converted to fiat, but there are no transaction fees.

The feature can also be turned on or off at any time, Venmo notes.

The company views Cash Back to Crypto as a way for newcomers to cryptocurrency to enter the market without having to worry about the process of making crypto purchases. It’s more of a set-it-and-forget-it type of feature. However, unless users make regular and frequent transactions with their Venmo Credit Card, these cash back-enabled crypto purchases will likely be fairly small.

The company has yet to offer details on how many Venmo credit card holders are active in the market. So far, PayPal CEO Dan Schulman has only said, during Q1 earnings, that the card “is outpacing our expectations for both new accounts and transactions.” This past quarter, the exec noted that the company was also seeing “strong adoption and trading of crypto on Venmo.”

“The introduction of the Cash Back to Crypto feature for the Venmo Credit Card offers customers a new way to start exploring the world of crypto, using their cash back earned each month to automatically and seamlessly purchase one of four cryptocurrencies on Venmo,” noted Darrell Esch, SVP and GM at Venmo, in a statement. “We’re excited to bring this new level of feature interconnectivity on the Venmo platform, linking our Venmo Credit Card and crypto experiences to provide another way for our customers to spend and manage their money with Venmo,” he added.

The new option will begin rolling out starting today to Venmo Credit Card holders.