For all the risks of a year-end cooling-off period, emerging-market backers can’t complain about the lie of the land right now.

From the rollout of vaccination programs in some countries to rising commodity prices and the prospect of a breakthrough in U.S. stimulus talks, there are plenty of tailwinds to justify the buying spree that has sent gauges of developing-nation stocks, currencies and bonds to five straight weeks of gains. Inflows into emerging markets reached a monthly record in November, according to the Institute of International Finance.

“Low interest rates, increased conversation about stimulus and a ‘flight-to-quality’ unwind with progress on the Covid vaccine should keep the U.S. dollar dropping, which should be a boost to equities,” said Malcolm Dorson, a New York-based money manager at Mirae Asset Global Investments, whose $1.1 billion Mirae Asset Emerging Markets Great Consumer Fund, which Dorson helps oversee, has outperformed 91% of peers over the past three years, according to data compiled by Bloomberg.

The risks, as ever, are never far away. Aside from the continued spread of Covid-19, traders will be keeping an eye on any signs that the global recovery may be faltering, with many developing economies getting low on firepower to cushion the blow from another shock. Goldman Sachs Group Inc. says the tactical upside in emerging markets may be more muted from here, even as it turns more positive on the 2021 outlook for high-yielding currencies such as the South African rand, Mexican peso and Indian rupee.

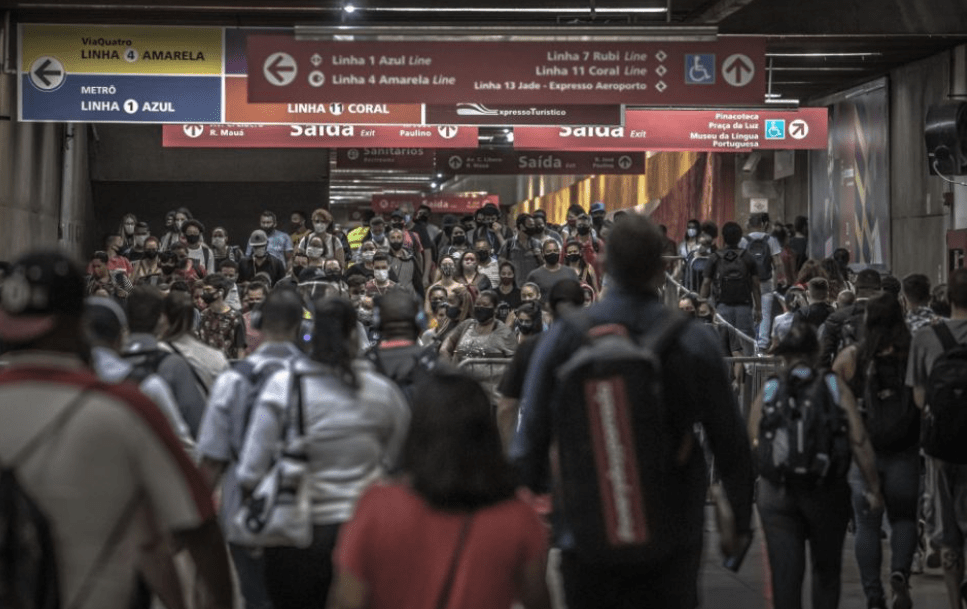

Still, the growing conviction that emerging markets are poised for further gains in 2021 will continue to sustain investor interest, according to Citigroup Inc. Central banks, too, may be less minded to cut interest rates as activity picks up in some of the hardest-hit economies. A report on Tuesday may show South Africa’s economy exited its longest recession in almost three decades in the third quarter. Policy makers in Brazil, Chile, Peru and Ukraine are forecast to keep rates on hold this week.

Central Banks in Focus

Brazil’s central bank will probably hold its key interest rate at a record low on Wednesday as the recovery in Latin America’s biggest economy slowsSmaller cash handouts could cause October retail sales figures released on Thursday to lose some steam. But as the economy remains weak, November inflation scheduled for Tuesday is expected to accelerate above 4% for the first time since FebruaryThe Brazilian real has been the best performer in emerging markets in the past monthChilean policy makers will also probably hold interest rates steady on Monday, though they may sound less dovish than in previous meetings, according to Bloomberg EconomicsAnnual inflation data for November, to be released on the same day, will likely show little change from the month beforePeru’s monetary authority is also likely to keep borrowing costs at an all-time low on Thursday and repeat its commitment to stay accommodative, according to Bloomberg EconomicsUkraine’s central bank will probably keep rates unchanged on Thursday amid a strained budget and uncertainty over IMF aid. The hryvnia, the world’s best performer last year, reached the weakest level since January 2018 in NovemberSerbia will also decide on monetary policy Thursday

U.S.-China Friction

The U.S. is preparing to sanction at least a dozen more Chinese officials over their role in the recent disqualification of Hong Kong legislators, according to two people familiar with the plansThe latest round of sanctions over Hong Kong could be rolled out as soon as Monday, said the people, who asked not to be identified because the measures haven’t been formally announcedRead: Markets Hit as U.S. Sanctions Remind China Tensions Here to Stay

Thailand Speaks

The Bank of Thailand plans to hold a briefing on Wednesday to explain foreign-exchange measures. Thai authorities are among the most vocal in Asia in expressing concern over the strength of their currencies and the impact on exportsThe baht has risen about 10% from this year’s low reached in April. The Thai central bank prefers to monitor speculation, especially in short-term bonds, and deregulate offshore investments and foreign-exchange transactions, rather than resort to capital controls, Nalin Chutchotitham, an economist at Citigroup Inc. in Bangkok, wrote in a note. Policy makers relaxed rules on capital outflows in NovemberCentral banks in South Korea and Taiwan are also taking steps to curb the appreciation of their currencies

Mideast Politics

Middle East stocks rallied on Sunday after Saudi Arabia and Qatar said they were making progress toward ending a three-year long rift, providing the latest spur to a region being buttressed by a jump in oil prices

Qatar’s Foreign Minister said on Friday his country is “hopeful that things will move in the right direction,” and his Saudi counterpart said he was looking forward to a successful outcome to talks mediated by the U.S. and KuwaitElsewhere, Kuwaiti voters replaced more than half of the sitting parliament, in a blow to pro-government forces, women and liberals. The election was held at a critical moment for an economy reeling from lower oil prices, the coronavirus pandemic and stalled reformsThe Premier Market index of the biggest and most liquid shares in Kuwait declined 0.4% on Sunday

Data and Events

China’s exports jumped in November by the most since early 2018 as year-end demand surged, pushing the trade surplus to a monthly record, official data showed Monday

Overseas shipments rose 21.1% in dollar terms in November from a year earlier, the most since February 2018, while imports gained 4.5%. That left a trade surplus of $75.4 billion for the month, which was the largest on record in data going back to at least 1990China is also due to release foreign reserves data on MondayRead: Asian Intervention in Focus, With EUR/USD Spill-Over LikelyChinese consumer and producer inflation data are due on Wednesday. The CPI could drop below zero in the coming months amid a slump in pork prices, while factory prices are already in deflationChina may also release a slew of data this week on money supply, credit and foreign direct investmentThe yuan is among emerging Asia’s best-performing currencies this yearTaiwan, an Asian export powerhouse, releases November trade data on MondayThe Philippines reports trade figures for October on Thursday. The peso, which is near a four-year high, is benefiting from a smaller trade deficit this year amid an import slumpIndia reports October industrial production on Friday. Factory output turned positive for the first time in seven months in September amid the easing of lockdown measures. The rupee is emerging Asia’s worst-performing currency this yearMalaysia is also due to release October industrial production data on Friday. Output turned positive since July but remains sluggish. The ringgit has risen more than 2% this quarterForeign-reserves data from Malaysia, Philippines and Thailand are also due this weekIndonesia’s November foreign reserves slightly fell to $133.56 billion due in part to the government’s payments on external debt, the central bank said MondaySouth Africa is set to report that GDP rebounded almost 55% in the third quarter, after shrinking 51% in the previous three months“South Africa’s lockdown was one of the most draconian in the world, resulting in a huge contraction in growth in the second quarter,” Bloomberg Economics said. “The easing of containment measures has since supported a recovery in output”The rand has been the top emerging-market gainer after South Korea’s won in the past three months

European Union heads of state will meet on Dec. 10 to discuss a multi-annual budget and emergency coronavirus stimulus measures that have been held back by a Hungarian and Polish veto over efforts to tie spending to upholding democratic standards

Implied volatility in the forint and the zloty has risen in the run-up to the meeting Bank of Russia holds a conference on the economy in the time of Covid-19 on Dec. 9-10, with Governor Elvira Nabiullina among speakers Russia said more than 2 million doses of its Sputnik V vaccine will be ready for use this week A reading of Mexico’s November consumer-price inflation on Wednesday is expected to flag a slowdown, consistent with central bank forecasts, according to Bloomberg Economics October industrial production figures, to be released on Friday, will probably add to signs that activity is recovering. The Mexican peso is the top performer in emerging markets this quarter