HOW WILL THE ELECTION AFFECT THE STOCK MARKET? DOW JONES FORECAST

Global stock markets have been on a wild ride in 2020 thus far, juggling the coronavirus and the various monetary and fiscal decisions central banks and governments have made in response. If a global pandemic were not enough, the Dow Jones, Nasdaq 100 and S&P 500 will have to negotiate a looming Presidential election – an event that frequently dominates media and popular culture in the lead up. While it may feel like the election and its social implications can take over everyday life, what impact has it had on the stock market in the past?

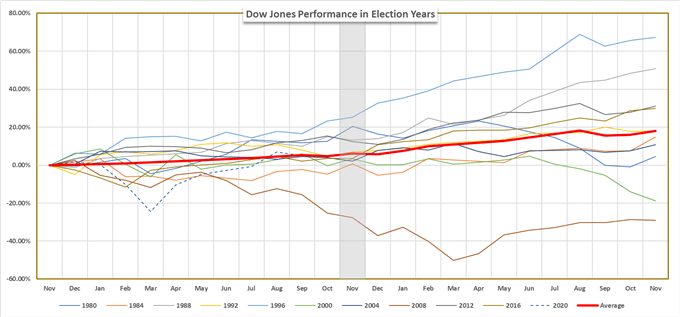

DOW JONES PERFORMANCE IN THE 12-MONTHS BEFORE AND AFTER A PRESIDENTIAL ELECTION

With the assistance of data from the last ten US Presidential elections, history reveals the stock market – more specifically the US benchmark Dow Jones index – typically rises on average before, during and after an election. That being said, there are a few caveats for which we must account. First and foremost, stocks generally rise over time in general, with the 30-year annualized return of the S&P 500 at roughly 8%. Similarly, the 30-year annualized return of the Dow Jones is slightly more than 5%.

With that in mind, seeing the Dow Jones rise modestly on average across ten presidential elections is not entirely surprising. To that end, drawing such conclusions from only a limited sample of data is presumptuous. Consequently, the saying that ‘past performance is not indicative of futures results’ is very apt for circumstances such as this where statistics cannot assure better equity performance than a non-election year.

As displayed in the graph above, some years are dominated by themes other than the Presidential election. 1996, 2008 and 2020 are just three instances whereby external influences like the ballooning of the Dot-Com Bubble, the Great Financial Crisis and coronavirus respectively have (or are currently) exerted as much or more influence than the changing of the guard in the Oval Office – although the coming election may surprise yet.

Suffice it to say, 2020 has proven to be anything but ordinary and external factors like trade wars, monetary policy and the pace of the pandemic recovery may all have varying degrees of influence over the stock market. Further still, the trajectory of these themes could be altered significantly after the election – possibly changing the shape and scope of an issue like US-China relations or technology regulation. Undoubtedly then, stocks will have their hands full in the coming months and it is difficult to say that Presidential elections are a positive development for equities.

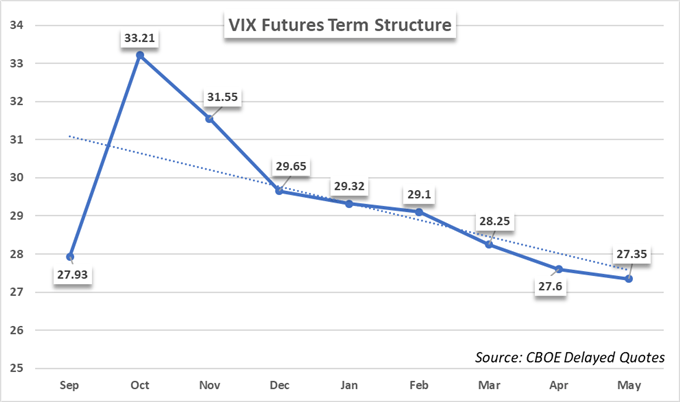

One theme we can attribute to an election with more confidence is an increase in volatility. Elections and their potential impact on government and fiscal policy can create uncertainty – a phenomenon most investors detest. With uncertainty often comes volatility and this volatility can be observed in the October VIX futures contract as it reflects the lead up to the election. In the subsequent months’ contracts, the assumption of volatility in VIX pricing steadily declines as the election impact fades into the rearview.

Thus, it can be surmised that an election’s impact on stock prices would inevitably fall with a general trend of strength, but expecting an increase in volatility may be the more likely outcome. As the election draws closer and potential policies are given more clarity, specific sectors may rise or fall depending on the forecasted outcomes. Healthcare, energy, technology and companies with sensitivities to US-China relations may all be subject to fundamental changes after the election.

Stocks like Amazon, AbbVie and Zoom are just a few examples of those with potentially heightened sensitivity to changes in the US administration, while corporations like Caterpillar, Boeing, Lulu and Walmart may be more closely aligned with the pace of economic recovery. Evidently, various themes to be negotiated around the election are already at play and divergent performances are likely.

With increased volatility to boot, these moves could see their magnitude increased regardless of direction, especially as trends in seasonality exacerbate election uncertainty. With the election drawing ever-closer, 2020 surely possesses the catalysts to differ from the typical election-year and trading opportunities are abound as a result. As the election nears, check back at DailyFX for election coverage from a macroeconomic perspective.