Most millennials, 66%, don’t feel on track when it comes to saving for retirement. That’s according to a 2019 TD Ameritrade report, which surveyed 1,015 U.S. adults aged 23 and older with at least $10,000 in investable assets.

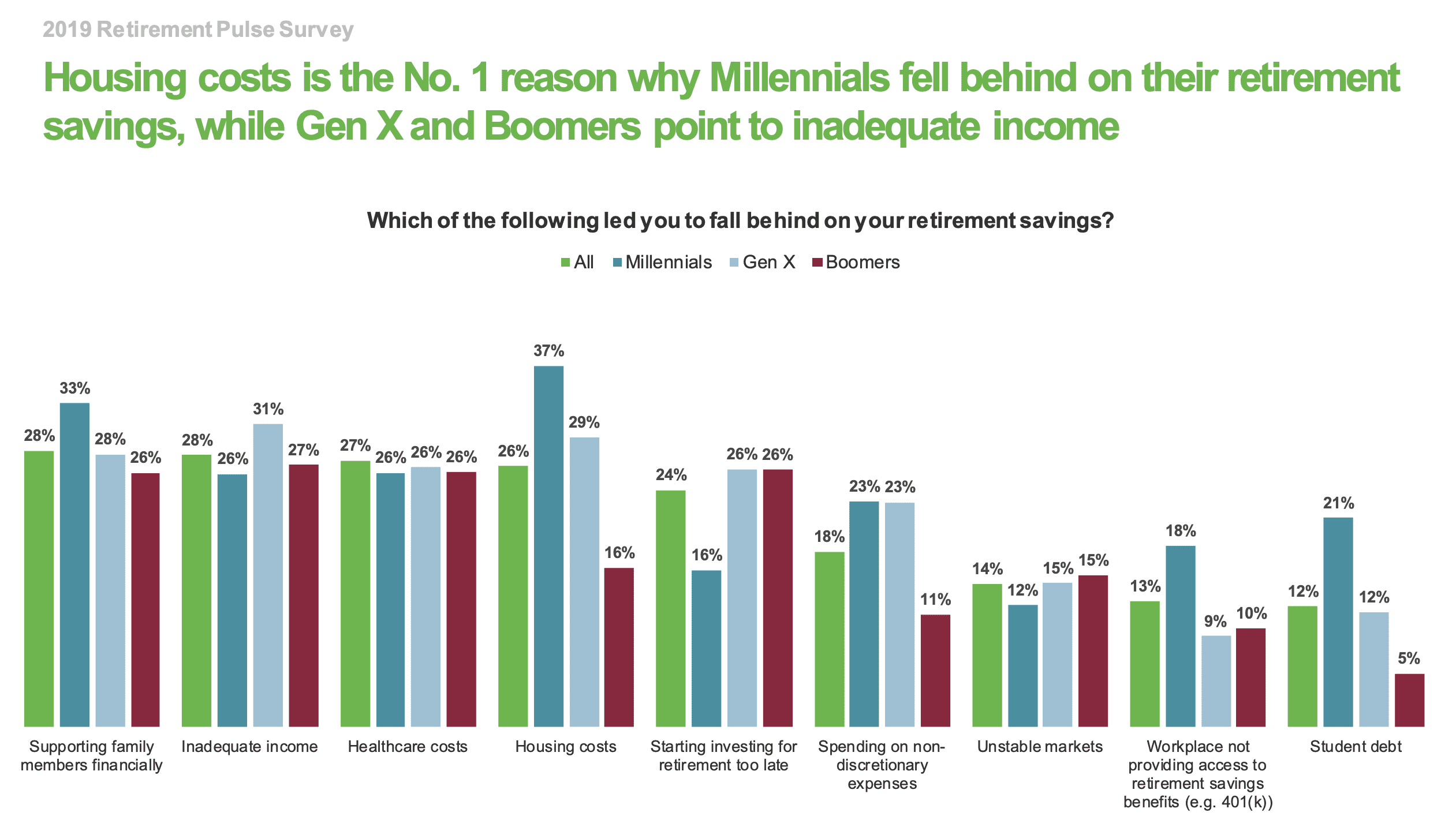

When asked why they’ve fallen behind on their retirement savings, the No. 1 response for millennials (ages 23 to 38), was housing costs: 37% cited it.

Partly because of rising rental prices, young people are spending big chunks of their income on housing. That’s especially true for families: 1 in 5 millennial parents reported spending 50-59% of their income on housing, according to a 2016 report from the National Endowment for Financial Education and Parents magazine. And 8% said they’re paying 60-74%.

It doesn’t leave much room for savings. As a rule of thumb, money experts recommend putting half of your take-home pay toward necessities, which includes things like housing, transportation, food, insurance and childcare. About 30% of your income can go toward “fun” and the remaining 20% should go toward savings for your future self.

Besides housing, 33% of millennials say that “supporting family members financially” has prevented them from saving enough for retirement. And 26% cite “inadequate income” for causing them to fall behind.

About one-fifth (21%) of millennials say that student debt is holding them back from saving for their future. This is a much more common answer among young people: Only 12% of Gen Xers and 5% of boomers feel this way.

The good news is, there are ways to save on housing and free up more room in your budget for retirement savings. Here are three strategies:

1. Split rent with roommates

Living with other people might not be your ideal scenario, but it can save you thousands of dollars, real estate website StreetEasy finds.

To stack on even more savings, you can double up in shared rooms, which is what more and more young people are opting to do in pricey cities like San Francisco or New York.

2. Stick to what you need

When shopping for a place, make sure you’re not getting more than what you need, recommends one millennial who saves more than 60% of his income by focusing on cutting back on “the big three” expenses: housing, transportation and food.

“If you’re renting, ask yourself whether stainless steel appliances will actually improve your life in any meaningful way,” says the Minneapolis-based millennial, who goes by the pen name Sean. “If you’re buying, take a long hard look at how much space you really need, and whether a mega huge yard with its mega huge maintenance is really something you want in your life.”

It’s important to be open-minded in general. If your dream neighborhood is going to break your budget, for example, consider other areas. The biggest mistake first-time home buyers make is not keeping an open mind, CPA Cathy Derus tells CNBC Make It.

3. Move to a different city

Another way to save on housing, which may not be feasible for everyone, is to move to a cheaper city. That’s what Sean did after living in Denver, Colorado, for two years: “Denver’s out-of-control home prices were certainly something I considered when I decided to pack up shop and head north to Minneapolis.”

Check out the most affordable cities for business professionals to live and work in 2019.

If you can’t leave your current city, consider living outside the city center. In general, the farther out you go, the cheaper the housing.