U.S. stocks closed near session highs Wednesday amid light trading as investors awaited new developments in the increasingly unpredictable Sino-American trade war. Ten-year Treasury yields held steady after hitting a three-year low, while the dollar edged higher.

The S&P 500 Index climbed for the second day in three as a rally in Texas crude pushed energy shares higher. With the exception of utilities, sectors across the benchmark registered increases, although trading volume was about 15% lower than average.

President Donald Trump’s recent pronouncements on trade have left investors jumpy as they await his next moves and as optimism for a resolution becomes more difficult to sustain. With the latest round of tariffs from both sides due to be staggered from Sept. 1, China appears to be bracing for the worst and the U.S. leader’s credibility is becoming a key impediment to a deal. In addition, traders have to contend with Trump’s attacks on the Federal Reserve, which have clouded the outlook for monetary policy.

“We’re one headline or one tweet away from triumph or tragedy almost every single day right now,” Arthur Hogan, chief market strategist at National Securities Corp., told Bloomberg TV. “We’re really on a knife’s edge. And that’s what makes trading really difficult.”

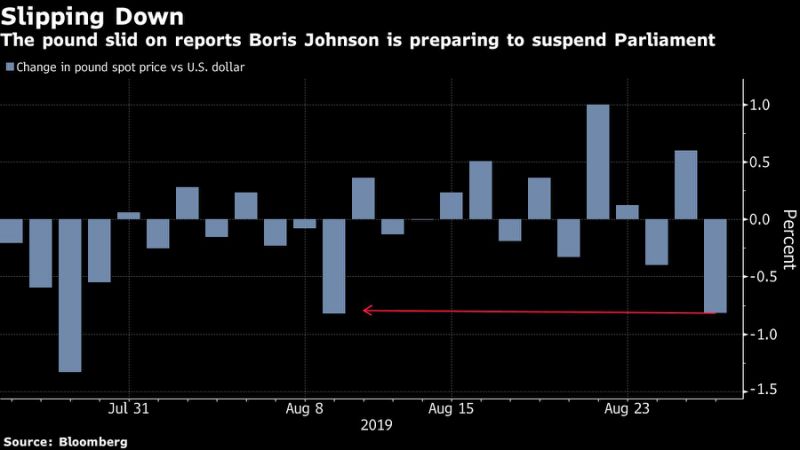

Technology companies and insurers led a decline on the Stoxx Europe 600 index. Benchmarks nudged higher in Sydney and Seoul, were little changed in Tokyo, and dropped in Shanghai and Hong Kong. The euro slipped, the pound weakened and gilts climbed after U.K. Prime Minister Boris Johnson said he will ask the Queen to suspend parliament from mid-September to mid-October, increasing the risk of a no-deal Brexit.

European bonds advanced, with Italian benchmark yields hitting record lows as talks to form a coalition government progressed. Crude oil extended gains after an industry report showed a bigger-than-expected drop in American crude inventories and as Iran all but ruled out a meeting with the U.S.

Events to keep an eye on this week:

The second reading of Q2 U.S. GDP Thursday is expected to refine estimates of slightly lower economic growth.Bank of Korea policy decision and briefing is on Friday.Euro-zone CPI data for August is also due Friday.

Here are the main moves in markets:

Stocks

The S&P 500 Index rose 0.7% as of 4 p.m. New York time.The Stoxx Europe 600 Index fell 0.2%.The U.K.’s FTSE 100 Index rose 0.4%.The MSCI Emerging Market Index rose 0.1%.

Currencies

The Bloomberg Dollar Spot Index gained 0.2% to a nine-month high.The euro dipped 0.1% to $1.1075, the weakest in more than two years.The British pound slid 0.6% to $1.2213.The Japanese yen fell 0.4% to 106.19 per dollar.

Bonds

The yield on 10-year Treasuries fell less than one basis point to 1.47%.The yield on two-year Treasuries declined three basis points to 1.50%.Britain’s 10-year yield fell six basis points to 0.44%.Germany’s 10-year yield fell two basis points to -0.71%.

Commodities

West Texas Intermediate crude gained 1.8% to $55.94 a barrel.Gold fell 0.2% to $1,538.99 an ounce.