Tech is stabilizing after wild swings in recent days.

TradingAnalysis.com founder Todd Gordon says the charts are pointing to an all-clear for tech.

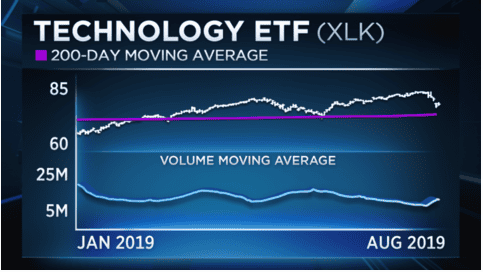

“We’re still above the upsloping 200-day moving average [in terms of volume], we need to be averaging 15 to 17 million shares a day in the XLK to really trigger some concern, ” he said Tuesday on “Trading Nation, ” referring to the tech ETF. “So everything we see here, everything aside, the motion is still intact.”

Gordon likes Microsoft in particular, a stock that he owns, and remains bullish on the stock given that it has held its uptrending 50-day moving average.

Erin Gibbs, chief investment officer of Gibbs Wealth Management, says that while “it’s a little early” to say that the tech dip is over, there is one stock in the XLK that she’s eyeing: Mastercard.

This is especially because Mastercard doesn’t have much exposure to the U.S.-China trade war.

“I think it could easily go up another 16 percent. Even if we faced a global slowdown, people are still going to be using their credit cards for purchases, even if the prices are higher,” she said on “Trading Nation.” “So I think this one is a little more insulated from some of the headline risks we may face over the next two weeks.”

Tech is still up 24 percent year to date despite the downturn in the last two weeks.