Chinese tech stocks have taken a tumble.

The BATS trade — Baidu, Alibaba, Tencent and Sina — has come under pressure this quarter. Those losses have been so sharp for Baidu and Sina that they are on track to close out the second quarter with their worst loss since at least 2010.

Michael Binger, president of Gradient Investments, says there’s still hope yet for these Chinese stocks, an emerging-market alternative to the FANG stocks — Facebook, Amazon, Netflix and Google parent Alphabet.

“I don’t think the BATS stocks are untouchable. I think you need to tread lightly,” Binger said on CNBC’s “Trading Nation ” on Tuesday. “I think sentiment more than fundamentals is weighing on these stocks.”

Binger says while they all could rebound, just one of the BATS names looks best to break out.

“I would really go with Alibaba,” he said. “Alibaba is the leading e-commerce company in China. It’s one of the leading e-commerce companies in the world. I think over the next 10 years it’s going to be a neck-and-neck race between Amazon and Alibaba. They have 600 million-plus active users and it’s growing fast. Their sales growth is north of 30%. It’s at the lower end of its valuation range, so yeah, I think you could step in right here.”

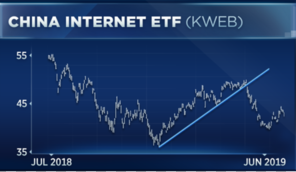

The whole Chinese internet trade could still be in for more downside, according to Mark Newton, technical analyst at Newton Advisors. He says the KWEB China internet ETF could mirror any weakness in the U.S. markets.

“It’s acted very similar to how the U.S. has acted over the last year. We bottomed right near Christmas Eve, rallied up until the beginning of May, we peaked — we bottomed out in early June, and now we’re starting to roll over again,” Newton said during the same segment. “My thinking is we do move lower short term to areas right near $39, which is June lows, or potentially a bit lower.”

The KWEB ETF, whose stocks include Alibaba, Baidu and JD.com, would need to decline by nearly 8% to reach Newton’s $39 target. It has not traded firmly below that level since early January.

“I see a bit more lagging to go for China. I do think this will be attractive potentially in a month or two on further weakness, but for now I think it’s an avoid,” said Newton.