Retirement is meant to be spent with family, enjoying life, pursuing passions, and seeking more profound connections with friends and loved ones. Shockingly, three-fourths of Americans are ill-equipped for retirement, with the average American couple having squirreled away roughly $5,000.

The general recommendation for retirement at age 65 is around $400,000—only about 80 times more than the average American couple’s savings. Forty-six percent of adults aged 25 to 34, which comprise the millennial generation, are entirely unwilling to invest in stocks, compared to a larger whole group of 34% of all Americans.

Maybe if they did, they’d see their retirement portfolio expand considering the historic bull run that the Dow Jones Industrial Average and S&P 500 are currently in.

HOW MANY AMERICANS OWN STOCKS?

A 2017 Gallup study showed that only 54% of Americans own stocks. The only area where stock ownership hasn’t fallen is in the $100,000+ income range. Perhaps more startlingly, only about half of millennials would even consider owning stocks—even with low-impact fiscal discipline and micro-investment apps like Acorns ready to pack in a few dollars and cents at a time as they spend money.

WHY DO MILLENNIALS HATE STOCKS?

Many sources seem to believe that the reasons for millennial hesitation center around the 2008 financial crisis—they don’t trust the market enough to let their retirement hinge on it. Other potential influences include lacking financial literacy and exposure to stocks. Of the millennials who were willing to invest, 32% of them would prefer to do so through with a financial advisor.

WHERE DO MILLENNIALS INVEST, IF NOT IN STOCKS?

Millennials prefer high-interest savings accounts to stocks. High-interest savings yield roughly 1% annual returns, compared to an average 8% yearly return on stocks. It just so happens that stocks are in the middle of the longest bull-run in U.S. history, with the Dow Jones Industrial Average already up 14% year-to-date and the S&P 500 headed for a record high.

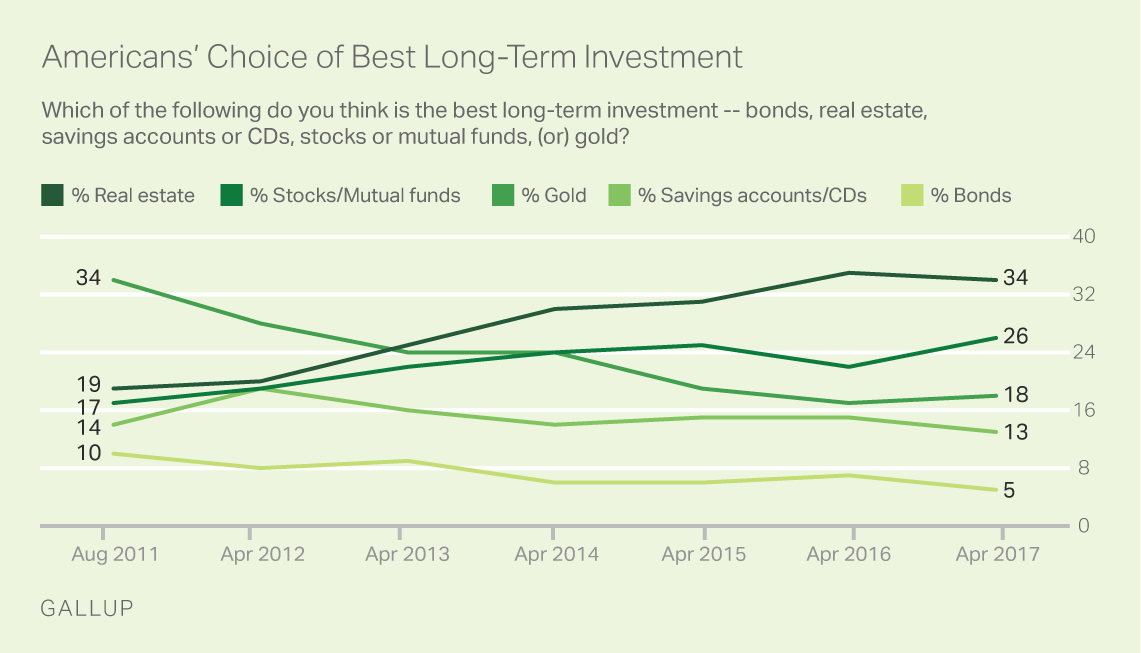

Real estate is the single largest investment class among millennials and middle-class Americans overall. Roughly one-in-three Americans believe that real estate is the best investment, up from 19% in 2011.

Financial investment, savings strategies, and fiscal discipline are all vital aspects of ensuring long-term monetary security through the golden years. Failing to save now could result in hard choices down the road. Yes, it is hard, but there are strategies and apps to help with saving small sums at a time. Laziness is no excuse to put your future self in a tight spot, much less your loved ones. Stocks may be a risky asset, but millennials have the most time to save for retirement. The Dow’s bull run won’t last forever, though.